Hydro-power fits with new govt energy policy, says Genex

Energy

Energy

Genex Power starts generating power from its first solar farm this year, but it now faces questions about the impact of the government’s new energy policy.

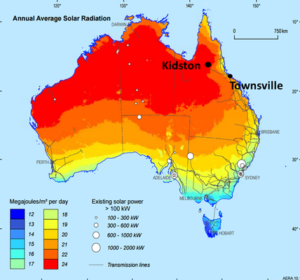

Genex (ASX:GNX) created its Kidston solar project in Northern Queensland because of the then-prospective impact of Liquified Natural Gas exports, exec director Simon Kidston told Stockhead.

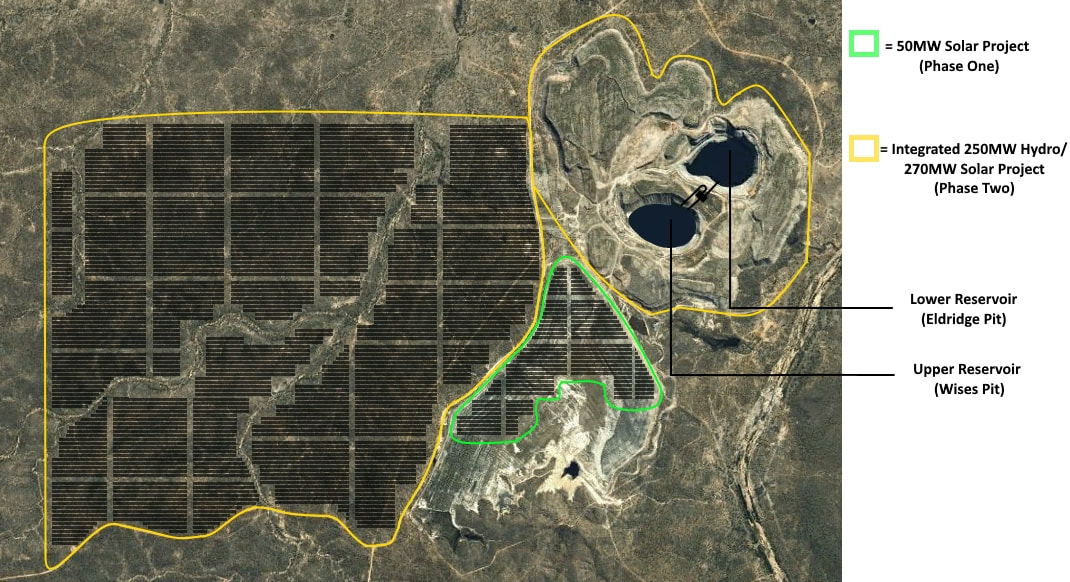

Two massive open pits at the old Kidston gold mine were a perfect location for a solar-powered, pumped hydro project, a process where water is pumped from a lower reservoir to a higher one using off-peak electricity and reversed to supply power at peak energy periods.

“LNG was the sole reason why we started that business,” he said, based on forecasts that local gas prices would move closer to higher, international ones — as they have done.

“Traditionally in Queensland the peaking power requirement has been supplied by gas.”

At the gas prices of $2-3 a gigajoule two years ago the Kidston proposition was comparable with gas-powered electricity.

Today it’s a third cheaper to run — notwithstanding the $100 million Genex has borrowed to build stage one of the Kidston project.

Winning each way

Mr Kidston says this kind of cheap, on-demand energy fits exactly into the government’s new plan to require electricity retailers to buy a certain amount of ‘dispatchable’ power: the kind that can be switched on or off at a moment’s notice.

The Federal Government announced yesterday a new energy policy that will replace the Renewable Energy Target (RET) with a Nation Energy Guarantee (NEG).

It’s very light on details as yet, but what is known is that it will require energy retailers to buy a quota of dispatchable power such as gas or storage, and there will be an emissions guarantee where retailers will have to buy or generate electricity that has a certain emissions intensity, a level which will be reduced each year.

However, there’s a chance storage could be a loser under the new plan, says Australian National University expert Dr Matthew Stocks.

“The [government’s] statements made a requirement for a certain amount of dispatchable supply, that can turned on and off as the system needs,” he told Stockhead.

“Pumped hydro certainly fits within that brief. What’s less clear is if it’s needed if solar and wind isn’t there.

“If there’s not a lot of wind and [solar photovoltaics] in the system, there’s not a lot of need for storage [to mitigate their intermittent supply].”

Notwithstanding the fuel supply issues last summer, the country doesn’t need more electricity generation capacity as much as a change in the energy mix to lower emissions, he says.

And since it’s still unclear what level of emissions reductions the government wants, it will stymie investment in wind and solar, and therefore storage.

RET certificates, a system which encouraged investment in new clean energy generation, will be phased out after 2020.

Ready to go

Genex’s stage one solar project, a 50 megawatt (MW) solar farm, is fully funded and will start before the end of the year.

It’s ready to go with long-term power purchase agreements locked in. Mr Kidston says it won’t be affected by any federal policy changes.

Financially, stage one is set for two decades because the Queensland government has signed a 20-year price guarantee.

The arrangement comes with a price floor that guarantees Genex gets an annual minimum EBITDA of $15 million.

If power prices fall through the floor the Queensland government will top up Genex’s earnings. If they don’t, Genex still gets to keep everything above that floor.

For what that will mean to Genex’s bottom line, it posted an $11 million loss and net assets of $15 million.

Mr Kidston says they’re looking for a similar funding arrangement for stage two, a 250MW hydro project powered by a 270MW solar farm.

Financing arrangements for stage two should be finished next year.

Genex closed on Tuesday up 2 per cent at 23.5c.