You might be interested in

Mining

Monster or Mouse: Only 8 miners and explorers have joined the $500 million club in 2022, 14 have dropped out

Experts

Three megatrends to benefit from Chalmers' first Federal Government budget

News

Mining

A successful exploration campaign has given Firefinch a boost in its bid to return the historic Morila mine to full production, with major resource upgrades at its Viper and N’Tiola satellite deposits.

Firefinch (ASX:FFX) produced 46,000oz of gold at the Morila mine in Mali in its first full year of operations in 2021.

But it has plans to hit a 100,000ozpa-plus run rate in 2022 before scaling up to 200,000ozpa by 2024.

The centrepiece of those plans is the ongoing revival of the mine’s main Morila Super Pit, a deposit whose grade and scale once saw it coined ‘Morila the Gorilla’ by previous owners.

Mining began at the Morila Pit in December with first ore expected to present itself in the June quarter.

But the addition of substantial resources at Viper and N’Tiola is an added bonus that will help them remain significant contributors to the mine’s success between 2022 and 2023.

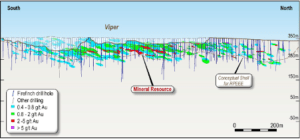

At Viper, which is already in production, Firefinch has increased its mineral resource estimate by 128% to 3.27Mt at 1.15g/t for 119,000oz of contained gold even after 8000oz of depletion.

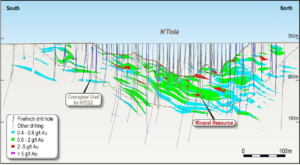

At N’Tiola, which is next up to be mined, FFX has boosted its mineral resource by 18% to 2.9Mt at 1.03g/t for 96,000oz of the precious metal.

The satellite deposits have enabled FFX to bridge the gap between the tailings retreatment operation being run by former owners AngloGold and Barrick and the revival of the massive Morila pit.

Significantly, the resource upgrades at Viper and N’Tiola have taken its overall bounty to a major milestone of 2.5Moz.

“We set out to develop the satellite pits into a solid and confident source of ore to bridge between the tailings treatment operation that we inherited to full production form the Morila Super Pit,” FFX managing director Dr Michael Anderson said.

“This investment in drilling has delivered that with now over 200,000 ounces of resource in these two deposits alone and we expect a solid increase in Reserves at these pits to follow.

“We are already delivering ore from Viper as we start to ramp up to full production from Morila.”

Firefinch has developed a reputation for leaving no stone unturned in its bid to uncover additional value at Morila since its purchase for around US$29 million in late 2020.

It is not resting on its laurels at Viper and N’Tiola after the resource upgrade either.

Located 26km from Morila, more drilling is planned at Viper which is expected to make a substantial contribution to ore feed over the next two years.

The upgrade includes an 80% lift in measured and indicated resources by 41,000oz to 92,000oz compared to May 21 estimates. That’s significant since resources of that confidence level can be incorporated into ore reserves.

Mineralisation at Viper has been defined over 1.5km of strike and to depths of 200m, but mineralisation remains open at depth with further drilling to test the extents of mineralisation there planned for 2022.

Firefinch says there has been little systematic testing for repeats of the Viper orebody or parallel structures with exploration planned for the coming years.

Over at N’Tiola, around 25km from the Morila mill, around 39,000oz was mined by previous owners, with Firefinch looking to restart mining in the second half of 2022.

FFX has drilled 179 holes for 12,025m since taking over Morila on top of 38,652m of drilling previously completed.

2021 drilling defined near-surface mineralisation at the northern and southern extremes of the deposit, with near surface gold at the southern end to enable bringing forward the planned start of ore mining.

Drilling this year will test for extensions to high-grade zones and test parallel zones inferred in geological interpretation.

This article was developed in collaboration with Firefinch, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.