Eye on Lithium: From paper to batteries, this makeover highlights how fast lithium is growing

Mining

Mining

All your ASX lithium news for Tuesday, March 1.

The lithium market is showing no signs of slowing down just yet with Swedish battery developer Northvolt AB announcing its plans to repurpose a closed paper mill – founded in 1990 – into a battery materials factory.

The Kvarnsveden Mill in Borlänge, Sweden produced pulp and paper for over 120 years until its closure in 2021 but soon it will have the production capacity of more than 100 GWh of cathode material, which will enable cell assembly and production at multiple Northvolt facilities.

Northvolt says the move puts it in good stead to deliver the world’s greenest lithium-ion battery and establish a sustainable supply of batteries to facilitate the decarbonisation of society.

The factory will play a key role in fulfilling more than $50 billion in orders from key customers and joins a wider European production network of facilities being developed together with partners in Sweden, Norway, Poland, Germany, and Portugal.

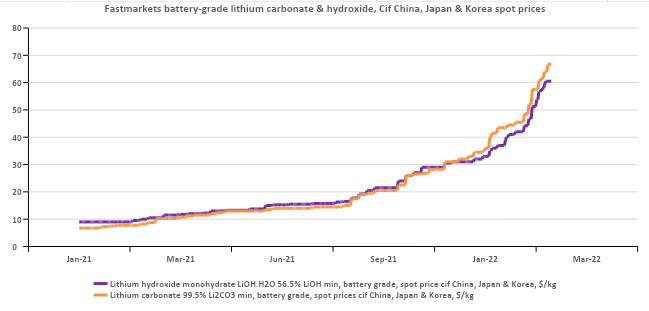

Fastmarkets index manager Peter Hannah told Stockhead spot prices for lithium carbonate and lithium hydroxide (the two key lithium compounds for the battery supply chain) have just seen their largest ever monthly gains – which is particularly impressive when you consider that February is the year’s shortest month.

Fastmarkets’ CIF China, Japan & Korea assessments – seen as the market’s seaborne benchmarks – stood at $67 per kg for lithium carbonate and $60.5 per kg for lithium hydroxide, he said, while both started February in the low $40s.

“The spot market for lithium chemicals remains extremely tight, and, with anticipated supply increases still some way off, prices show little sign of easing in the near term.”

Intelligence from Fastmarkets’ research analysts also suggests that many smaller-size cathode and battery producers have been de-stocking their inventories amid these high prices, indicating that we could expect greater ‘apparent demand’ going forward even if the market starts to rebalance owing to restocking needs.

“As industry exposure to these high current prices increases it’s possible that we could start to see some hints of demand destruction,” Hannah said.

“The risk for lithium prices would be if this begins to happen just as supply starts to respond more meaningfully over the next couple of years.

“Having said that, the unprecedented long-term tailwind in demand for lithium from the battery sector should mean that the extent and duration of any down-cycles could be somewhat limited.”

| CODE | COMPANY | PRICE | % TODAY | 1 WEEK RETURN % | 1 MONTH RETURN % | MARKETCAP |

|---|---|---|---|---|---|---|

| BNR | Bulletin Res Ltd | 0.15 | 25.0% | 3.4% | 50.0% | $34,267,189 |

| RLC | Reedy Lagoon Corp. | 0.029 | 20.8% | 3.6% | -12.1% | $13,148,574 |

| QXR | Qx Resources Limited | 0.049 | 19.5% | 28.9% | 25.6% | $29,350,355 |

| SHH | Shree Minerals Ltd | 0.0175 | 16.7% | -2.8% | 45.8% | $15,948,553 |

| SYA | Sayona Mining Ltd | 0.13 | 15.6% | 8.3% | 8.3% | $798,403,637 |

| QPM | Queensland Pacific | 0.15 | 15.4% | -3.2% | -9.1% | $200,604,707 |

| ASN | Anson Resources Ltd | 0.125 | 13.6% | 4.2% | 0.0% | $112,353,921 |

| LEL | Lithenergy | 0.93 | 12.7% | -0.5% | -8.4% | $37,125,000 |

| CXO | Core Lithium | 0.865 | 12.3% | 10.2% | 17.7% | $1,304,633,522 |

| 1MC | Morella Corporation | 0.021 | 10.5% | 0.0% | -30.0% | $98,348,066 |

| AVW | Avira Resources Ltd | 0.0055 | 10.0% | -8.3% | 10.0% | $10,593,950 |

| ESS | Essential Metals Ltd | 0.355 | 9.2% | -4.1% | -28.3% | $79,380,266 |

| ESS | Essential Metals Ltd | 0.355 | 9.2% | -4.1% | -28.3% | $79,380,266 |

| PNN | PepinNini Minerals | 0.43 | 8.9% | -5.5% | -6.5% | $24,181,234 |

| NMT | Neometals Ltd | 1.455 | 8.6% | 11.5% | 7.4% | $734,824,371 |

| AVZ | AVZ Minerals Ltd | 0.8575 | 8.5% | 7.9% | 28.0% | $2,727,129,833 |

| AKE | Allkem Limited | 9.83 | 8.4% | 4.6% | 8.7% | $5,782,357,065 |

| LPD | Lepidico Ltd | 0.0325 | 8.3% | 1.6% | -12.2% | $187,170,910 |

| PAM | Pan Asia Metals | 0.52 | 8.3% | -3.7% | -9.6% | $35,356,149 |

| WCN | White Cliff Min Ltd | 0.026 | 8.3% | -7.1% | 18.2% | $14,415,034 |

| AZL | Arizona Lithium Ltd | 0.13 | 8.3% | -3.7% | -3.7% | $239,731,975 |

| IGO | IGO Limited | 11.78 | 7.8% | 2.7% | -0.6% | $8,276,937,196 |

| MLS | Metals Australia | 0.056 | 7.7% | 21.7% | 40.0% | $13,620,261 |

| WR1 | Winsome Resources | 0.355 | 7.6% | -7.8% | -11.3% | $44,371,798 |

| EUR | European Lithium Ltd | 0.097 | 6.6% | -7.6% | -15.7% | $104,821,480 |

| LPI | Lithium Pwr Int Ltd | 0.585 | 6.4% | -2.5% | -7.1% | $191,823,416 |

| GSM | Golden State Mining | 0.084 | 6.3% | -2.3% | -6.7% | $6,563,951 |

| RMX | Red Mount Min Ltd | 0.0085 | 6.3% | -5.6% | -5.6% | $13,138,911 |

| GLN | Galan Lithium Ltd | 1.435 | 5.9% | 3.2% | -5.6% | $402,244,418 |

| WML | Woomera Mining Ltd | 0.018 | 5.9% | 0.0% | -10.0% | $11,591,162 |

| CHR | Charger Metals | 0.64 | 5.8% | -7.2% | -17.4% | $19,701,443 |

| JRL | Jindalee Resources | 2.75 | 5.8% | -2.8% | 7.8% | $140,670,312 |

| LRS | Latin Resources Ltd | 0.038 | 5.6% | 0.0% | 18.8% | $51,937,818 |

| VUL | Vulcan Energy | 9.06 | 5.5% | 2.7% | 2.6% | $1,130,831,323 |

| FFX | Firefinch Ltd | 0.685 | 5.4% | 5.4% | 6.2% | $765,788,530 |

| MRR | Minrex Resources Ltd | 0.059 | 5.4% | -7.8% | 3.5% | $49,423,789 |

| INR | Ioneer Ltd | 0.5525 | 5.2% | -5.6% | -16.9% | $1,076,537,909 |

| GL1 | Globallith | 1.45 | 5.1% | -2.7% | -6.5% | $187,846,392 |

| AGY | Argosy Minerals Ltd | 0.315 | 5.0% | -3.1% | -4.5% | $393,889,977 |

| MQR | Marquee Resource Ltd | 0.105 | 5.0% | -8.7% | -16.0% | $21,446,510 |

| LTR | Liontown Resources | 1.505 | 4.9% | 1.3% | 7.9% | $3,145,843,159 |

| LIT | Lithium Australia NL | 0.11 | 4.8% | 0.0% | -4.3% | $108,419,913 |

| TMB | Tambourahmetals | 0.23 | 4.5% | -2.1% | -2.1% | $9,062,372 |

| LKE | Lake Resources | 0.945 | 4.4% | 4.4% | 7.4% | $1,106,363,855 |

| PLL | Piedmont Lithium Inc | 0.72 | 4.3% | 6.7% | 11.6% | $365,343,891 |

| ADV | Ardiden Ltd | 0.0125 | 4.2% | -3.8% | -10.7% | $31,927,708 |

| CRR | Critical Resources | 0.077 | 4.1% | -19.8% | -26.7% | $109,326,601 |

| SRZ | Stellar Resources | 0.026 | 4.0% | -3.7% | 18.2% | $20,932,566 |

| STM | Sunstone Metals Ltd | 0.079 | 3.9% | 0.0% | 3.9% | $170,203,594 |

| GT1 | Greentechnology | 0.79 | 3.9% | 3.3% | -6.5% | $80,560,000 |

| EFE | Eastern Resources | 0.053 | 3.9% | -5.4% | -3.6% | $50,194,678 |

| INF | Infinity Lithium | 0.135 | 3.8% | -15.6% | -20.6% | $53,927,827 |

| BMM | Balkanminingandmin | 0.29 | 3.6% | -17.1% | -15.9% | $9,170,000 |

| AAJ | Aruma Resources Ltd | 0.09 | 3.4% | -10.0% | 9.8% | $13,655,651 |

| PLS | Pilbara Min Ltd | 2.8 | 3.3% | -4.4% | -13.0% | $8,067,118,561 |

| LRV | Larvottoresources | 0.19 | 2.7% | -26.9% | 8.6% | $7,470,763 |

| AM7 | Arcadia Minerals | 0.22 | 2.3% | -13.7% | -8.3% | $7,523,388 |

| A8G | Australasian Metals | 0.46 | 2.2% | -8.0% | -11.5% | $18,076,722 |

| AML | Aeon Metals Ltd. | 0.049 | 2.1% | 1.0% | 14.0% | $41,558,827 |

| PSC | Prospect Res Ltd | 0.855 | 1.2% | 1.2% | 3.0% | $362,844,893 |

| MIN | Mineral Resources. | 45.54 | 0.6% | -3.8% | -15.4% | $8,545,472,048 |

| EMH | European Metals Hldg | 1.2 | 0.4% | -5.1% | -16.4% | $167,750,473 |

| GXY | Galaxy Resources | 0 | 0.0% | -100.0% | -100.0% | $2,715,139,305 |

| TKL | Traka Resources | 0.011 | 0.0% | -8.3% | -35.3% | $7,576,520 |

| TON | Triton Min Ltd | 0.03 | 0.0% | -6.3% | -14.3% | $37,283,525 |

| AS2 | Askarimetalslimited | 0.345 | 0.0% | -6.8% | -2.8% | $13,154,859 |

| BYH | Bryah Resources Ltd | 0.047 | 0.0% | -6.0% | -13.0% | $10,631,737 |

| EMS | Eastern Metals | 0.195 | 0.0% | -11.4% | -22.0% | $6,942,000 |

| FG1 | Flynngold | 0.165 | 0.0% | 3.1% | 8.2% | $10,570,073 |

| FRS | Forrestaniaresources | 0.31 | 0.0% | -6.1% | -17.3% | $8,710,629 |

| RAG | Ragnar Metals Ltd | 0.028 | 0.0% | -20.0% | -30.0% | $10,435,177 |

| TEM | Tempest Minerals | 0.023 | 0.0% | -4.2% | 4.5% | $9,151,721 |

| TSC | Twenty Seven Co. Ltd | 0.004 | 0.0% | 0.0% | 0.0% | $10,643,256 |

| KGD | Kula Gold Limited | 0.046 | 0.0% | -8.0% | 21.1% | $9,898,079 |

| KZR | Kalamazoo Resources | 0.29 | 0.0% | -12.8% | -10.8% | $42,106,368 |

| MTM | Mtmongerresources | 0.165 | 0.0% | -2.9% | 26.9% | $4,671,155 |

| ENT | Enterprise Metals | 0.014 | 0.0% | -6.7% | -6.0% | $8,022,282 |

| PGD | Peregrine Gold | 0.49 | 0.0% | -16.9% | -2.0% | $18,677,883 |

| CAI | Calidus Resources | 0.77 | -0.6% | 7.7% | 10.8% | $310,205,386 |

| NVA | Nova Minerals Ltd | 0.605 | -0.8% | -33.1% | -32.4% | $109,923,394 |

| RDT | Red Dirt Metals Ltd | 0.555 | -0.9% | -5.9% | -14.6% | $142,887,116 |

| ARN | Aldoro Resources | 0.365 | -1.4% | -12.0% | 9.0% | $33,166,278 |

| AZI | Altamin Limited | 0.063 | -1.6% | -12.5% | -1.6% | $24,887,805 |

| DTM | Dart Mining NL | 0.098 | -2.0% | 8.9% | 17.4% | $12,449,093 |

| AX8 | Accelerate Resources | 0.041 | -2.4% | -12.8% | 5.1% | $10,645,274 |

| IMI | Infinitymining | 0.17 | -2.9% | -5.6% | 6.3% | $10,062,500 |

| SCN | Scorpion Minerals | 0.068 | -2.9% | -4.2% | -4.2% | $18,865,433 |

| KAI | Kairos Minerals Ltd | 0.021 | -4.5% | -16.0% | -22.2% | $43,166,057 |

| MMC | Mitremining | 0.18 | -10.0% | -12.2% | 0.0% | $5,417,020 |

Around 61% of total works are now complete for the development of AGY’s modular 2,000tpa lithium carbonate production operation at the Rincon project in Salta Province, Argentina.

In mid-2022, the company expects to achieve its first production of >99.5% battery quality lithium carbonate product at the project where major works across three main phases – design, construction, and commissioning remains on schedule.

Up to 99% of earthworks and land movement have been ticked off, 87% of site works are completed, and 57% of process plant works have been wrapped up.

AGY managing director Jerko Zuvela said record-level lithium carbonate prices are providing great interest in the Rincon project.

“Argosy’s transformation into a cashflow generator is nearing, whilst also progressing toward the next stage 12,000tpa scale operations,” he said.

A large-scale lithium drill campaign at ZNC’s Split Rocks Project in Western Australia is underway across four main pegmatite targets – Rio, Dulcie West, Estrela, and British Hills East.

The company says an expansion of this program is likely as geo-chemical screening programs take off alongside drilling with one auger and two soil crews working towards sampling all prospective portions of the 660km land package.

In its exploration for gold, VKA has stumbled upon multiple pegmatite intervals in 58 of the 71 holes drilled at its First Hit Project.

VKA says “the lilac colour indicative of the lithium bearing mineral lepidolite” has been identified by petrographic thin section microscope analysis and now a comprehensive review is underway.

“It is encouraging to identify the lithium mineral species in hole VKRC0030 as it confirms that we are in an area with exploration potential for lithium bearing pegmatites,” VKA managing director Julian Woodcock said.

A reconnaissance exploration site visit has been completed at the Yarrie Lithium Project in Western Australia’s Pilbara region.

The Yarri lithium project is considered highly prospective for hard rock lithium-tin-tantalum mineralisation in pegmatites and covers some 1,711km bordering Kalamazoo’s (ASX:KZR) Marble Bar Lithium Project.

AS2 managing director Joan Lambrechts said the purpose of the site visit was to investigate the type of granitic exposures and to ascertain the age and minerology of both the granites and pegmatites.

Diversified developer of lithium resources, PLL has announced two senior management changes – chief operating officer David Klanecky has accped the role of CEO while chief development officer Patrick Brindle will assume the role of chief operating officer.

The company aims to advance permits and approvals at its flagship Carolina Lithium Project in North Carolina, US and expand its business to produce 60,000t per year of lithium hydroxide.

PLL is in joint venture with Sayona Mining (ASX:SYA) at the North American Lithium mine where it hopes to bring the mine back into production.

Emerging lithium producer SYA has doubled its lithium resource base across two flagship projects in Québec, Canada – the North American Lithium and Authier Lithium projects – amid surging demand for the commodity.

Total JORC combined measured, indicated, and inferred mineral resources for the two projects now totals 119.1Mt at 1.05% lithium.

SAY managing director Brett Lynch said this expansion is a “major achievement” for the company as it continues to enlarge its lithium footprint.