Ex-vanadium player Titanium Sands reborn as mineral sands explorer

Mining

Mining

Explorer Titanium Sands (ASX:TSL) will end a 21-month hiatus and finally be reinstated to the ASX on Tuesday morning, after raising $6 million to focus on its Sri Lankan mineral sands project.

The explorer raised $6m under its prospectus dated 29 March 2018, its supplementary prospectus dated 21 June 2018, and its second supplementary prospectus dated 19 September 2018 by issuing 300 million shares at 2c per share.

The explorer has now officially completed the transition from Western Australian vanadium miner and explorer to heavy mineral sands exploration company.

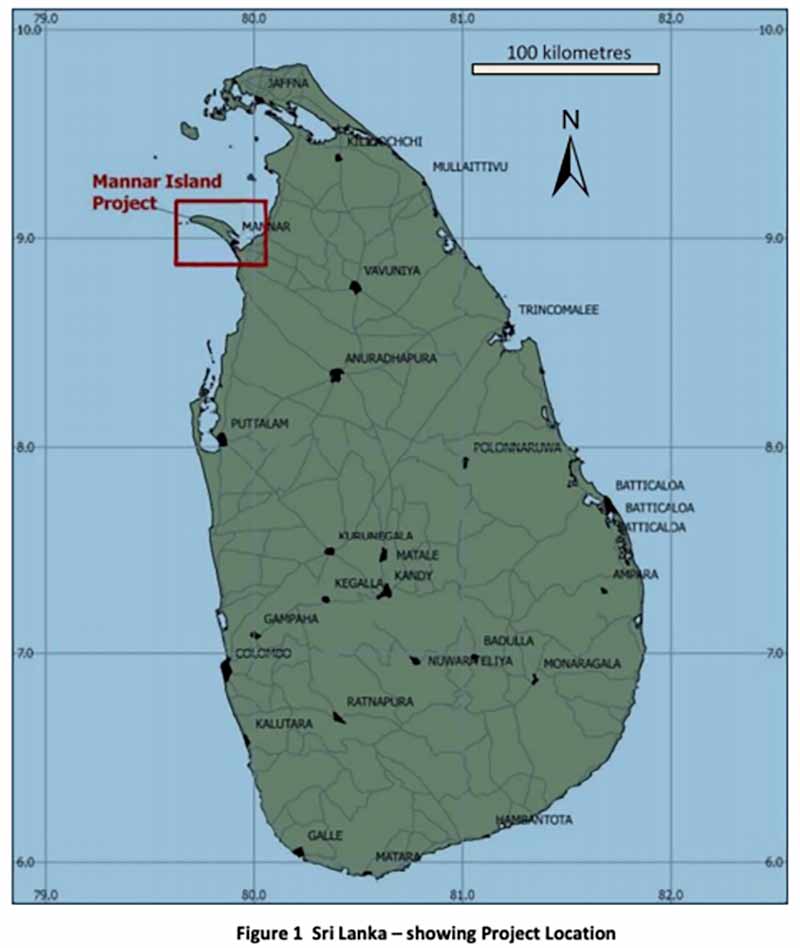

In January, Titanium Sands shareholders approved the acquisition of private company Srinel, which holds the highly prospective Mannar Island heavy mineral sands project in Sri Lanka.

Previous exploration at Mannar defined a Joint Ore Reserves Committee (JORC) inferred resource of 10.3 million tonnes with total heavy mineral (THM) of 11.7 per cent.

The explorer will use its cash to boost the resources at Mannar, which will provide the basis for a scoping study to “evaluate development scenarios”, the company told investors.

An independent geological report concluded that the tenements were highly prospective for economic heavy mineral mineralisation.

“The mineral assemblage is high value, the resources having an estimated ilmenite equivalent grade of 13.7 per cent,” consultants Continental Resource Management said.

“As there is a significant probability that the heavy minerals extend below the water table and, as drilling has shown that heavy mineral mineralisation extends inland from the island’s north coast for at least 2.5km, it is likely that the resource tonnage will be able to be significantly upgraded by deeper and more extensive drilling within the granted tenements.”

The company has no other material assets.

First listing on the ASX in 1988, Titanium Sands has reskinned itself a number of times.

As Precious Metals Australia, it was part owner of the ill-fated Windimurra vanadium mine in Western Australia with former global miner Xstrata, between 2000 and 2003.

When production was suspended in February 2003 due to low prices and production problems, Metal Bulletin’s price per pound for vanadium pentoxide was approximately $US1.90. (The vanadium price is currently over $US35 per pound).

The company then rebadged itself as Windimurra Vanadium, spending more than $100 million rebuilding the operation before collapsing into administration just prior to first production in 2009.

Its share price prior to collapse in 2009 reached highs of more than $23.50, according to Commsec data.

It officially changed its name to Titanium Sands in December 2016 to focus on the Sri Lankan mineral sands assets.