Elephants on Parade: This nickel explorer is hitting sulphides down the road from the world’s largest undeveloped nickel resource

Mining

Mining

A 195m package of sulphide veins hit is nothing to sneeze at for any nickel explorer, but when that hit is within kilometres of the world’s largest undeveloped nickel sulphide resource its worth standing up and taking notice.

That is exactly the case for Adavale Resources (ASX:ADD), which has started drilling at its Kabanga Jirani nickel project in Tanzania.

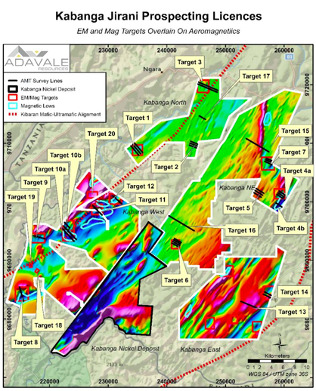

The tenements lie adjacent, and due north-east, from the giant Kabanga nickel deposit owned by the private British company of the same name(see figure 1).

Outlined after 600km of drilling by previous owners Barrick and Glencore, the Kabanga mine hosts a resource of 58Mt at 2.62% nickel with one of the two orebodies to a depth of 1.2km.

But like the Nova nickel mine in Australia’s Fraser Range, one of the world’s great prospective “nearology” domains, few believe that’s where the bounty stops.

Adavale is confident its turf has the potential to host another Kabanga, and hitting nickel mineralisation within its first 600m of drilling is providing plenty of confidence that it is in the right spot.

“Looking at the recent drilling data we announced from our first hole, we’re excited,” Adavale CEO Allan Ritchie said.

“This is fantastic on a first drill hole to come up with mineralisation like 0.86% nickel, 4.44% copper and you may have noted a nice cobalt number at 0.44%, these are outstanding numbers.”

Those readings came from a portable XRF, and while assays to confirm grade and mineralisation are still to come, just the visual presence of sulphide veins of almost 200m had given Ritchie reason for optimism.

“What we found was 195m package of sulphide veins in that hole with those kinds of elevated readings in there,” he said.

“We’re coming back to this hole at Target 1, we’re going to run some downhole EM.

“We are confident we’re next to a substantial sulphide source and we hope to find massive sulphides with elevated nickel and copper mineralisation.”

Kabanga is located along the Karagwe-Ankolean belt, and while that name may not hold the allure of Australia’s Fraser Range or Kambalda Dome or Canada’s Ring of Fire, it has plenty of regional scale potential.

“It’s a Mesoproterozoic sedimentary package containing 1.4 to 1.6 billion year old mafic-ultramafic sills formed by magma intruding into sulphur rich sediments enabling the process of sulphide saturation to take place. This has resulted in nickel, copper, cobalt, chrome and PGErich resources to form along the belt including Kabanga and others.,” Ritchie said.

Analogues include the Fraser Range, where IGO’s Nova-Bollinger mine hosts the same type of large, flat, predictable and deep intrusive ultramafic as the massive sulphide rich Kabanga deposit.

“It’s an analogue to that, same age, same host rock, same style of intrusions,” Ritchie said.

“You find a big discovery like Nova and then a follow up like Legend (Mining) has and others along the Fraser belt.

“It’s the classic mobile belt abutting a fixed part of the continent, a craton, over here at the Fraser Range it’s the Yilgarn Craton.

“In Tanzania the highly prospective mobile belt, hosting the Kabanga deposit is located between the Congo and the Tanzanian cratons, which is the nickel precinct where we’re drilling right now.”

The prospectivity across the 1,145km2 locked up by Adavale at Kabanga Jirani and nearby tenements is not just a nearology play.

In fact research on the ground goes all the way back to the 1970s, when the United Nations Development Programme funded surveys and drilling across prospective ground in the mineral rich country.

It was later subjected to a major GEOTEM Airborne survey by BHP, which held the ground up to the late 1990’s.

Since taking on the project in September last year Adavale has collated an enormous amount of private and public data to outline priority targets for drilling, going beyond just the maps on record at the local geological survey.

By correlating that data with learnings from their giant neighbour, Adavale’s geologists have been able to get a clearer picture of where nickel and copper bearing sulphides may be located on their tenements.

“Initially they found coincident nickel and copper anomalies in soil samples, that is a great vector for nickel,” Ritchie said.

“When it got better was when the soil anomalies were sitting on the mag lows.

“So we took that kind of knowledge and that’s how we embarked on our expedited exploration studies. We performed our first broad sampling in December 2020 and within 6 short months we were drilling.”

Geo-chemical samples along with geophysical surveys have helped Adavale identify initially 15 and now 22 high priority targets.

Target 1, where the nickel and copper XRF readings were recorded, was just the first 455m hole of an 8 hole, 3000m program.

The second diamond drill hole into Target 11 has just begun too.

“Our first hole was nearly 455m. our licences are about 1,500m above sea level and there’s great drainage, we can manage some good depth,” Ritchie said.

“Our neighbour next door, Kabanga Nickel, they’ve got two fantastic orebodies the first one extending down 1.2km.

“So we’re pretty pleased to be finding some of the mineralisation from about 260m in the first hole.

“In the second hole, if the exploration gods are kind, hopefully we’ll get to see sulphides start a little earlier and we’re hoping to see the an intrusion at a shallower depth.”

Part of the US$664 million Kabanga development will be a class I “green” nickel and PGE refinery, located approx 100km from Adavale’s licences.

Should Adavale prove up a significant resource Ritchie is confident it will fit comfortably into the ESG-friendly narrative developing in Tanzania and of course around nickel sulphides for EV batteries.

“There’s going to be a refiner/smelter 100km up the road that’s a class I “green” nickel and PGE refinery,”

“There’s a hydropower renewable energy source nearby and Tanzanian President Hassan has obtained further funding to expand the hydro project.

“A “green” sources of energy too, the ESG tick is significant with regards to the Tanzanian environmental platform and President Hassan has several important social and good governance platforms too .”

While the mining environment in Tanzania has improved from about 4 or 5 years ago, Ritchie said that had turned around even more so under the current administration.

“Nickel is definitely an exciting metal, it’s in important part of the battery metals thematic, the price of nickel was riding high at over US$19500/t in this last little period, there is a Nickel Sulphide supply deficit that’s forthcoming,” he said.

Ritchie added “ It’s been a solid 6 months fast-tracking from initial exploration to drilling and in particular this last quarter has seen the team perform an enormous load of methodical and expeditious exploration, on such a low cost too. We have a great team who are excited from the first hole with excellent values of Nickel and Copper, and very much looking forward to our 2nd hole results too”

This article was developed in collaboration with Adavale Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.