DMC gets the band back together to IPO as a nickel explorer

Mining

Mining

DMC Mining is returning to the ASX and gearing up for a $5 million IPO at $0.20 per share in December to explore its nickel tenements in the Fraser Range and Ravensthorpe in WA.

Ten years ago, the previous iteration of the company was focused on iron ore and was taken over by Cape Lambert Resource for $55 million.

Executive chairman David Sumich said the three original directors – himself, Bruce Franzen and William Witham – have returned with nickel tenements under their belt and aiming to recreate DMC’s (ASX:DMM) previous success story.

“We think we’re one of the most exciting nickel juniors that’s going to list,” he said.

“We’ve got a very large strategic position in the Fraser Range, so we’ve got one very high priority tenement there which is quite close to the Nova mine with drill targets.

“And then an equally high priority is our ground at Ravensthorpe which is adjacent to the RAV8 and First Quantum Minerals Nickel mines. This Project also with drill ready targets is very prospective and located in an active nickel region.”

Sumich said one of the things that sets DMC apart from other nickel explorers is its 880 square kilometre footprint in the Fraser Range.

“That makes us the largest junior. After IGO (ASX:IGO), then you’ve got Legend (ASX:LEG), Galileo (ASX:GAL) and then will come DMC,” he said.

“We’re really happy with the way we’ve been able to amalgamate, from two different vendors, that large strategic position and then the additional landholding in Ravensthorpe.”

Not to mention the nickel infrastructure already in place in WA, with BHP (ASX:BHP) a potential offtaker, the Kambalda concentrator and the Kalgoorlie nickel smelter.

“WA is the only place to be in terms of nickel,” Sumich said.

“All the infrastructure is there for any junior should they get to the development stage.”

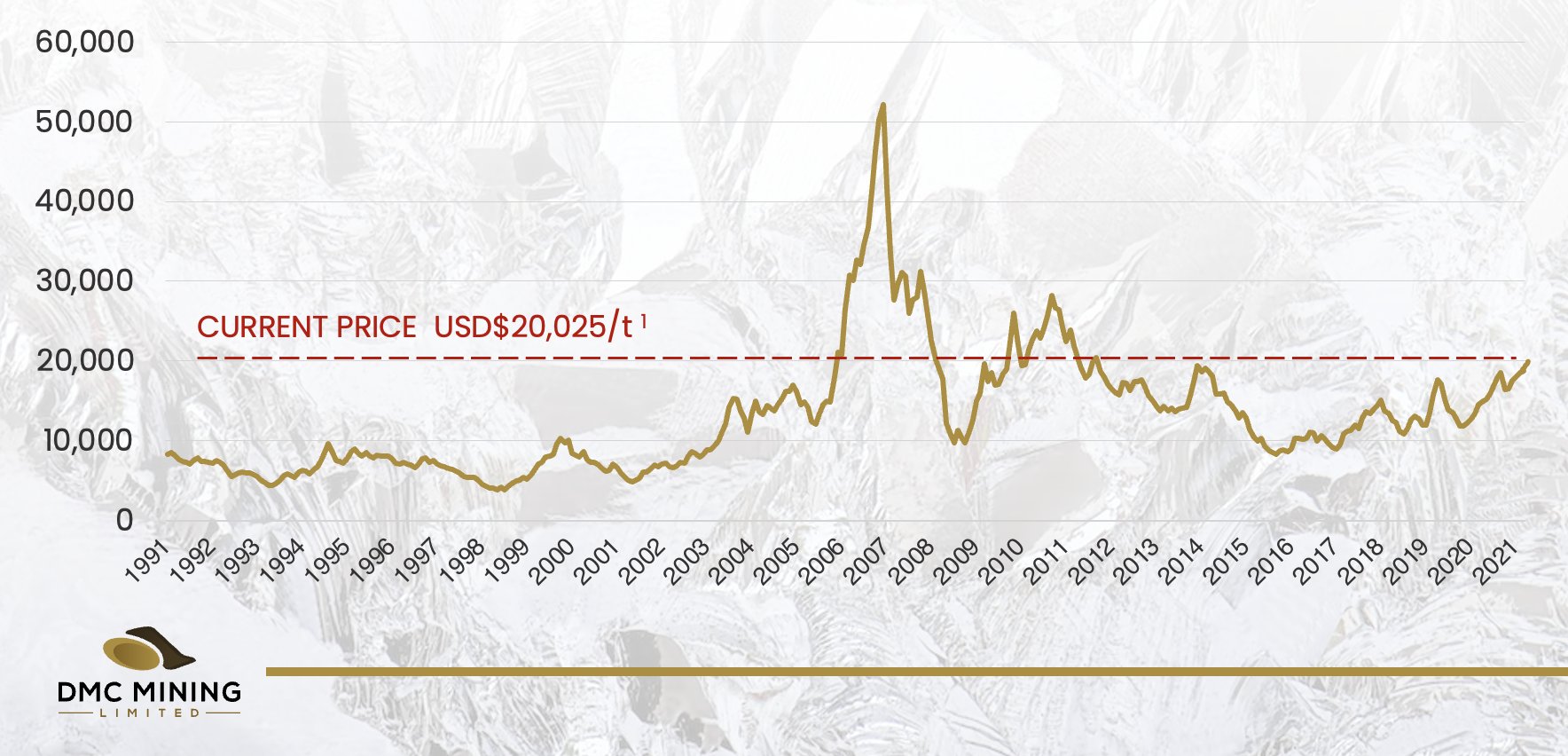

And Sumich says nickel is the commodity to be in, especially with the need for nickel sulphide in electric vehicles.

“We believe that nickel is going to be the stand out winner out of the EV boom,” he said.

“The vast majority of any car battery is nickel and no matter what the combination – if it’s nickel and managese or other – most people are predicting that there’s going to be higher and higher amounts of nickel required.

“We think it’s the right commodity to be in.”

And the price looks set to stay strong in the near-term.

“As well as the projects, I think what sets us apart is how we’re priced,” Sumich said.

“Our enterprise value at $4 million, it offers the investor a lot of leverage. We haven’t moved yet.

“Whereas most of the other nickel players are fully priced, even explorers who don’t have a JORC resource, so I think the combination of project quality and prospectivity combined with our valuation is what sets us apart.”

Sumich said the company has a full six months ahead of it post-IPO in terms of drilling.

“All our tenements have been granted, they’re all 100% DMC and there’s no JVs or royalties or anything, and we’ll be drilling starting in January,” he said.

“And our directors have a track record of delivering funds back to shareholders.

“We have a following as a team and our three directors are looking to replicate what we achieved the first time, 10 years ago.”

This article was developed in collaboration with DMC Mining Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.