Dateline geared for growth after transformative month

Mining

Mining

When Dateline Resources announced the acquisition of the Colosseum gold project in California this month, it added to its books a valuable relic of an empire long gone.

It was the late Alan Bond’s Bond International Gold which first developed and took Colosseum into production in the late 1980s, selling the project as things got shaky to LAC Minerals which would later be acquired by Barrick Gold.

Between 1988 and 1993, Colosseum produced around 344,000 ounces of a 700,000-ounce proven reserve initially defined by BP based on a 1 gram per tonne cut-off grade and a 2.5g/t gold head grade.

Those numbers are significant for a few reasons. The first means there’s a significant amount of gold reserve still sitting in the ground at Colosseum. The latter two are high cut-offs at the current gold price.

“Even at US$1350 gold, those are remarkably high,” Dateline (ASX:DTR) managing director Stephen Baghdadi told Stockhead.

Dateline is in the process of analysing BP Mineral’s resource model but has reason to believe there’s a resource at Colosseum much larger than the leftover reserve.

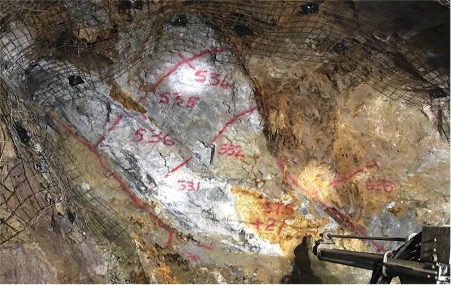

The project comprises two wide gold-bearing breccia pipes – hinting at the presence of something larger at depth.

“These pipes often have a feeder system at depth, and in this particular instance they come to surface as two prominent peaks, which means they can extend to great depth ,” Baghdadi said.

“It’s only been drilled down to 1000ft, if you drill another 1000ft and define an additional 700,000 ounce reserve you’re talking about a serious project.

“It’s got so much potential.”

Once the data is assessed, the company intends to put together a JORC compliant mineral resource for the project – one it is hopeful will deliver on the potential it sees at Colosseum.

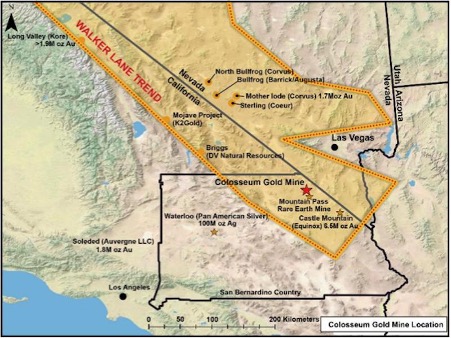

Colosseum sits in a fertile area, just 10km from the Mountain Pass rare earths mine – the only mine of its kind in the US.

Colosseum is a serious pick-up, but it may not even be the biggest piece of news to come from Dateline in the month of March.

The company announced within a week of Colosseum acquisition a US$6.8 million working capital facility which will allow the company to bring its Gold Links gold project in Colorado into production.

The facility was a huge coup, giving the company access to the cash it needs to take the project into production while further growing the resource.

At Gold Links, Dateline holds a swarm of high-grade, narrow vein gold over an area of more than a kilometre across strike and 5km of strike length.

The project is the amalgamation of four historic projects and a nearby mill, which combined have already demonstrated huge potential through drilling conducted at the 2150 and Sacramento veins by the company between 2017 and 2019.

Dateline’s drilling showed that the mineralisation extended below the valley floor at the project – a challenge within the means of historic mining processes but one freed up with modern mining techniques.

The section above 2150 also hosts gold, with an indicated JORC resource of 9033 tons for a total 3879 ounces of gold at 14.73 grams per tonne, and an inferred resource of 4134 tones for a total of 882 ounces at 7.32g/t.

The company believes that gap between the grade on indicated and inferred resources is promising, as it supports the theory that potential exists to increase the inferred grade by closer spaced drilling

The section below 2150 has an inferred resource of 21,026 tons for a total 6453 ounces of gold at 10.52g/t, and the Sacramento vein has an inferred resource of 110,780 tons for 10,379 ounces at a grade of 3.21g/t.

“What’s attractive to me about what we have in Colorado is that it’s a massive project – when it’s amalgamated it’s massive,” Baghdadi said.

“We’re talking 5km of strike with multiple veins, and that shouldn’t be underestimated.

“This thing has the potential to go for a long time and produce high grade gold for a long time. It gives us a long-term prospect for income and dividends.”

Owing to the presence of an existing mill at Lucky Strike, Gold Links doesn’t require a great deal of expenditure on infrastructure to get it up and running, and Dateline anticipates processing of ore to begin in Q4.

Permitting is all lined up too – Gold Links has seven mining permits and a permit to mill, a great source of pride for Dateline having acquired the project with just one mining permit in place.

With cash in hand, a steady program of work lined up to bring Gold Links into production and a project with blue sky potential at Colosseum, 2021 looms as a transformative year for Dateline Resources.

This article was developed in collaboration with Dateline Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.