Cox’s Find produced 77,000oz gold at 21g/t … but that’s just the tip of the iceberg

Mining

Mining

Special Report: The shallow, high-grade Cox’s Find gold mine historically produced 77,000oz at eye-watering grades above 21g/t. Great Southern Mining believes there’s a lot more where that came from, but the prize could be even bigger outside the existing mine footprint.

There’s no shortage of potential company making projects in the Great Southern (ASX:GSN) portfolio.

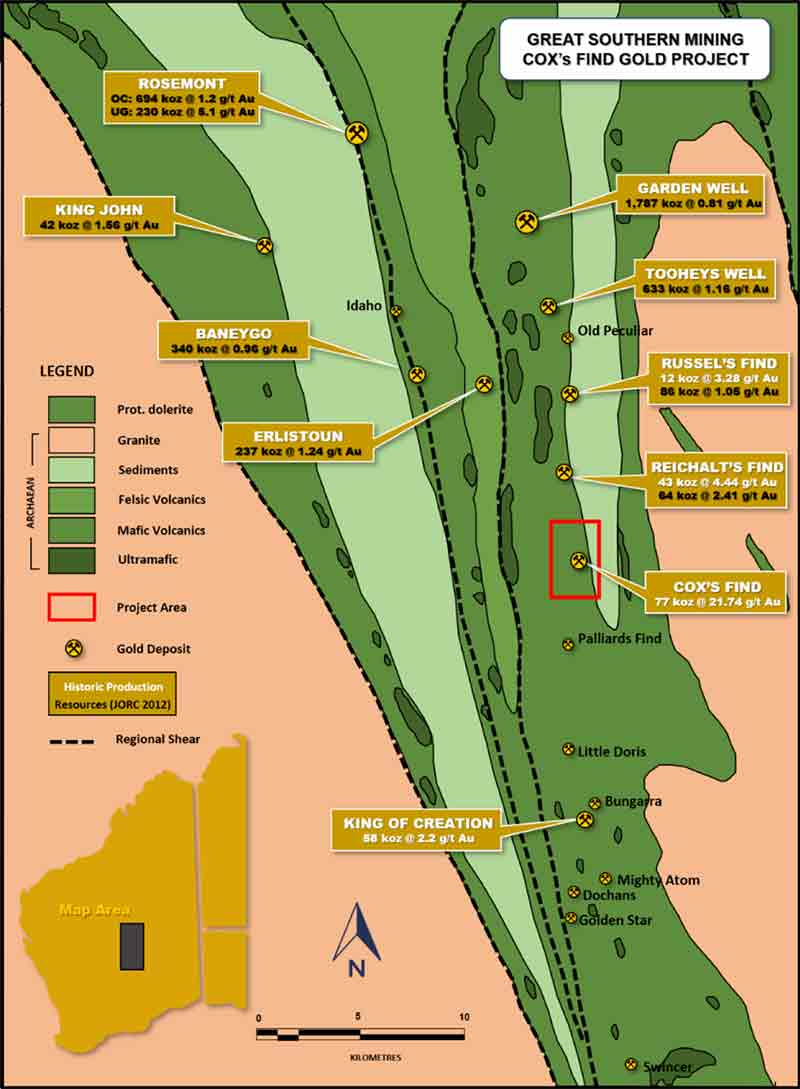

The new Cox’s Find acquisition, about 70km from the gold mining hub of Laverton in WA, is exciting because it represents low risk exploration, early cash flow and genuine company-making upside.

>> Learn more about Great Southern Mining

The mine, which produced 77,000 ounces at more than 21 g/t between 1935 and 1942, was Western Mining Corporation’s (WMC) first foray into Australian gold production.

In today’s terms — when +5g/t is generally considered high grade — that would make Cox’s Find one of the highest-grade gold mines in Australia.

But WMC didn’t stop mining because they exhausted the resource. To be economic at equivalent gold prices of between $US300 to $US500/oz, production cut-off grades at the time were ~15g/t.

That meant any ore grading under ~15g/t was ignored.

The cut-off grade got higher and higher as WMC went deeper until, in 1942, the mine became uneconomic and was mothballed at a depth of 158m.

Since then, exploration has been sporadic at best. Over the past 30 years, the mine has been completely dormant under private ownership.

Great Southern spent six intensive months finalising this acquisition. After poring over 80 years of historical production, exploration and technical data the explorer knows the potential prize is huge.

“One only has to look at the depths of extraction and of modern-day mining (and subsequent resource cut-off’s) to know that this wouldn’t be the first historic gold mine to be resurrected on significant ounces discovered at depth,” Great Southern chairman John Terpu says.

There’s an obvious analogue to Spectrum Metals (ASX:SPX) wildly successful Penny West project – but unlike Penny West, Cox’s Find neighbours some very large gold mills.

Most mills are hungry for higher grade feed, given their head grades are getting lower and lower, Terpu says.

“The ability to transport high-grade feed places Great Southern in a strong position to seek toll treatment options, if pursuing a fast turnaround production scenario.”

The current site — covered by three mining leases – hosts a shallow 15m open pit, underground mining stopes, untreated stockpiles of ore on the surface, and remnant tailings from the underground operation.

For starters, using a third-party mill, those existing ore stockpiles represent significant near-term cash for Great Southern at today’s +$2200/oz gold price. But that’s just a bonus.

Great Southern will be the first company to apply modern exploration and development techniques to this poorly understood, and ultimately underexplored, high-grade deposit.

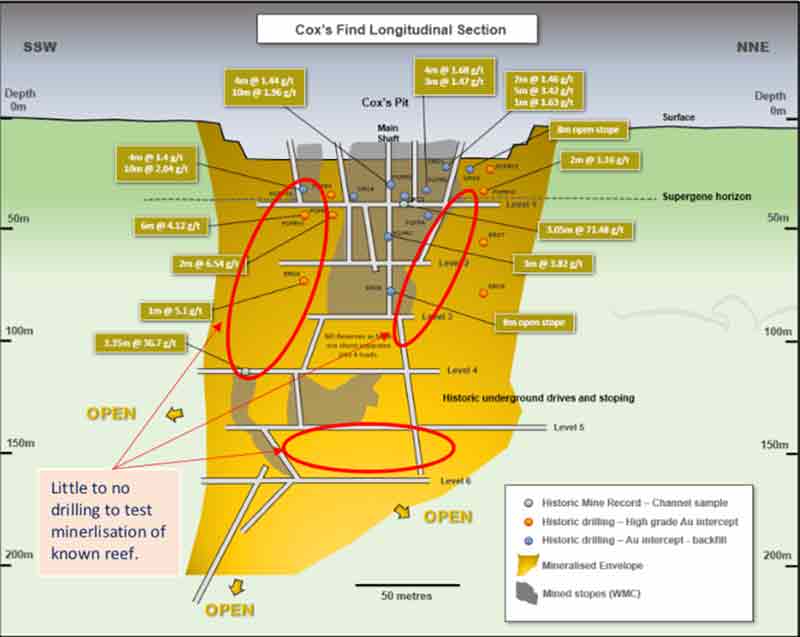

Great Southern’s first job will be to redefine the underground orebody, because the current outline was based on ‘marginal’ historic economics around 12 g/t.

Previous exploratory surface drilling to define the reef structure was limited to ~60m vertical depth.

There is real potential that each reef (circled in red, below) hosts in the order of 150,000oz of high-grade gold, Terpu says.

Then Great Southern will test the depth extensions beyond 150m depth where no drilling has been done to date.

‘Open’ (shown above) just means that no one knows where the gold ends.

On top of that, Great Southern also believes that the base of the old pit is close to a gold-enriched ‘supergene zone’ at about 30m depth.

If established, this very shallow, lower grade mineralisation could have a material impact on the size of a potential resource at Cox’s Find.

Outside the existing mine footprint, the upside is enormous. Great Southern will also test a number of promising structural/geochemical targets with the aim discovering new high-grade gold lodes.

The explorer believes that that the tenement contains multiple parallel ‘stacked’ gold reefs – basically repeats of the existing mine.

“There is already good evidence of parallel gold-bearing structural trends to the east and south of the currently defined ore deposit that have not been drill tested,” Terpu says.

“It is noteworthy that these targets are significantly larger than that which defines the current mine footprint and given the extremely high-grade of the Cox Find reef, additional targets could amount to considerable ounces.”