You might be interested in

Mining

Gold Digger: Don't expect a rally soon but H2 could be golden, agree top analysts

Mining

Gold Digger: Scientific research, and Metals Focus analysis, tells us gold will shine in 2024

Mining

Mining

Special Report: Metalicity (ASX:MCT) is a sub $3m market cap gold explorer with enormous ‘re-rating’ potential. Results from an imminent drill program at the unloved Kookynie project in WA’s Eastern Goldfields “will speak for themselves”, managing director Jason Livingstone says.

The historic Penny West and Bellevue gold mines are two old high-grade WA projects which were not given the respect they deserved, until very recently.

In late 2018, ~$5m market cap Spectrum Metals (ASX:SPX) acquired the historic Penny West gold project in the Youanmi region.

The tiny explorer immediately struck ‘bonanza’ grade gold about 150m north of the historic high-grade open pit.

A year of ongoing exploration success culminated in a lucrative ~$208m takeover from miner Ramelius (ASX:RMS) earlier this year.

Bellevue Gold’s (ASX:BGL) success has been even more impressive. Since January 2017, the company’s share price has rocketed from 2.5c to +60c per share, driven by success at its namesake historic project.

Metalicity believes Kookynie can be WA’s next historic, high-grade success story.

In May 2019, the explorer entered into a farm-in agreement with Nex Metals (ASX:NME) over the project.

Around the same time, recently installed exploration manager Jason Livingstone took the reins as managing director. Kookynie is a historic gold mining area he had an eye on for years, he says.

“I kicked around the goldfields for the first few years of my career, and as a young geologist you get sent to many different, sometimes wild places. I had been to Kookynie many times,” Livingstone says.

“Our chairman [and fellow geologist] Mat Longworth has also known about the area for a very long time.

“Nex Metals could see that we were two geologists who saw potential in this project and were about doing the work – not just riding hype around gold in general.”

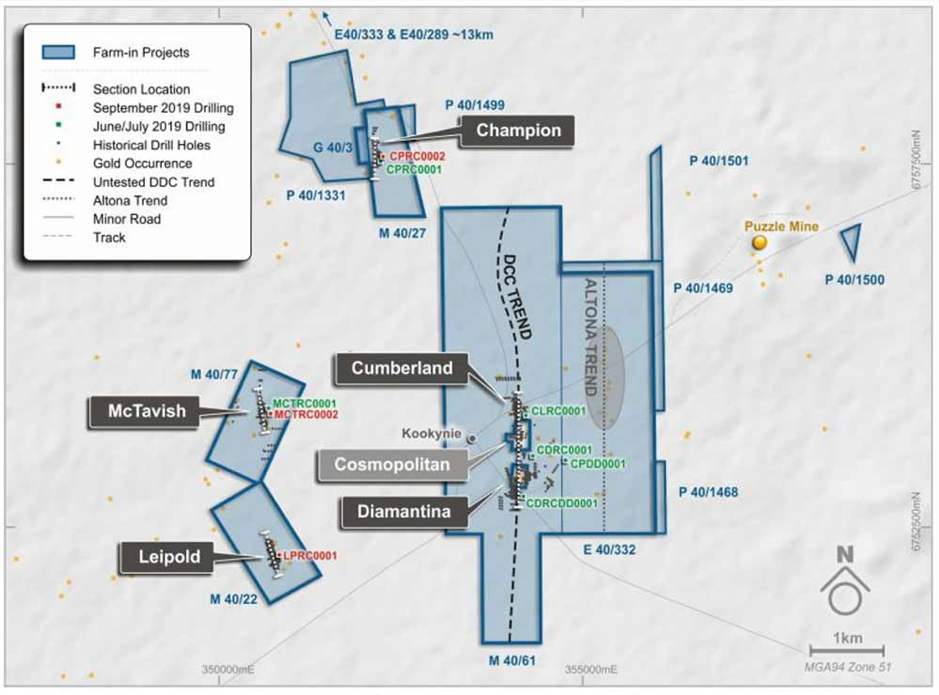

Kookynie, about 50km south of Leonora, is host to six historical mines: Champion, McTavish, Leipold, Diamantina, Cosmopolitan and Cumberland.

Between 1896 and 1922 Cosmopolitan was one of Australia’s largest gold mines, producing 360,000oz at an average head grade of 15 grams per tonne (g/t).

“It was a prolific gold mine during its day, and a brilliant ‘canvas’ for us to start redeveloping this area,” Livingstone says.

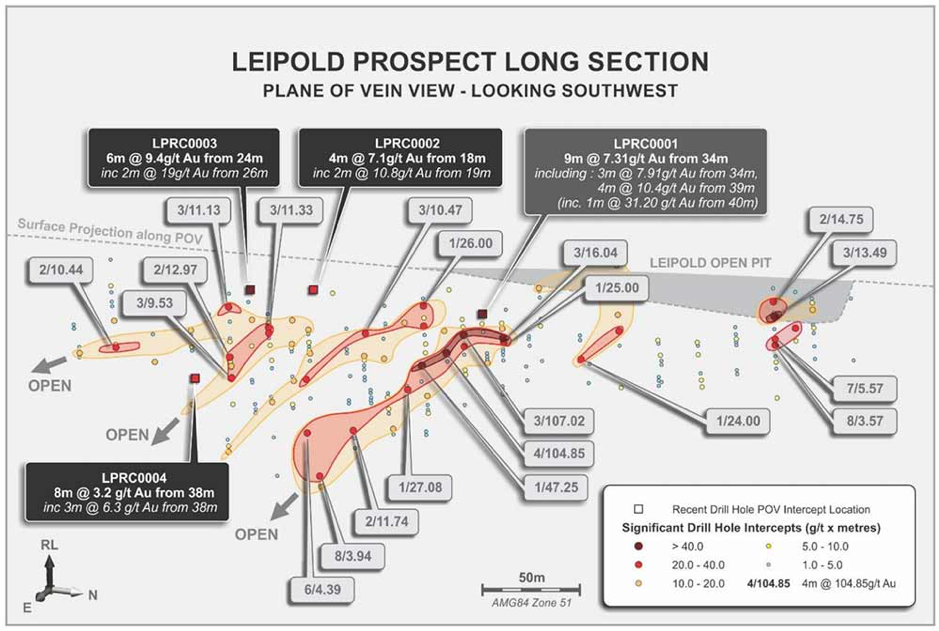

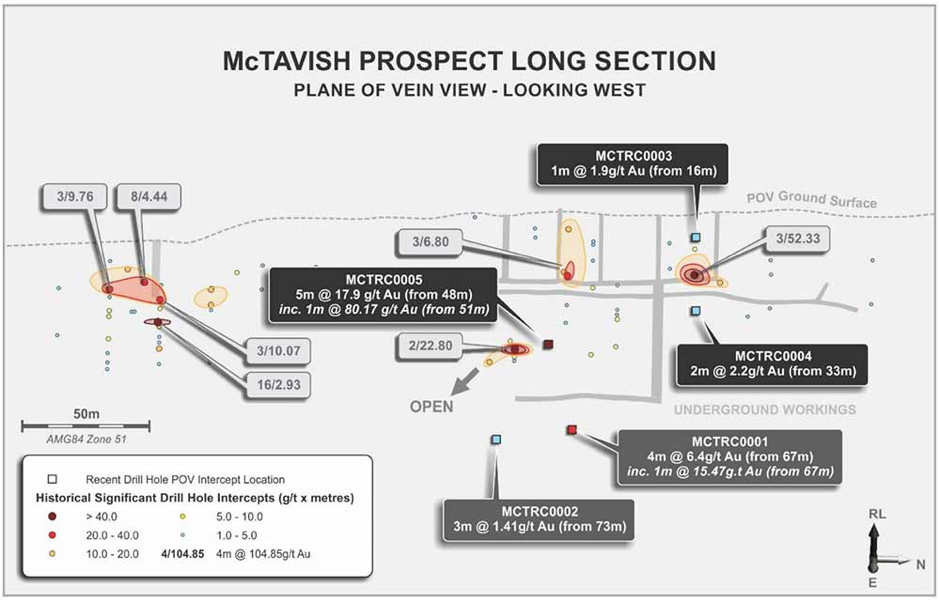

Metalicity’s initial focus has been the prolific Leipold-McTavish trend, about 3km west of Cosmopolitan. The company has successfully completed three drilling campaigns here to date, and a fourth is due to start very soon.

Like Penny West and Bellevue, these targets are ‘signposted’ by old high-grade workings.

Incredibly, every single hole drilled by Metalicity so far has hit the mineralised structure, reinforcing historical drilling from the 80s and 90s around these small but high-grade mining operations.

Assays released in January include 5m at 17.9g/t from 48m at McTavish, and 6m at 9.4g/t from 26m at Leipold.

That’s the trifecta — shallow, thick, and high grade.

And further to all of this, the company already has a good initial feel of the amount of gold at Kookynie.

Metalicity recently released a JORC exploration target of between 294,000oz and 967,000oz.

To put that in perspective, Spectrum Metals had a resource of 355,000oz when it was taken over by Ramelius for $208m.

“These are phenomenal drill intercepts but there’s still a lot of gaps, a lot of strike to find out where the limits of these things actually are,” Livingstone says.

“That what’s exciting about these prospects; none of them are closed off, they all remain open in any which direction you see fit.”

The next drilling program, due to kick off in late May, will comprise initially of 3,000m around the Leipold-McTavish area.

This is a prelude to a much larger program that will see further work at the Leipold-McTavish areas, but also the Champion and the Diamantina-Cosmopolitan-Cumberland areas which have shown to be exceptionally prospective.

“Now it is about really stepping out, doing that methodical exploration and letting the projects speak for themselves,” Livingstone says.

“I want to put up new cross sections of these targets and have people go ‘wow! What is this?’”

Metalicity has moved to control as much of this unloved goldfield as it can. Since the initial deal with Nex was inked, Metalicity has been able to triple its landholding to just shy of 8,000 hectares.

“We aren’t just dealing with a fantastic gold project, but an actual gold province,” Livingstone says.

“It’s a province that has been unloved for many, many decades – unjustly so.”

Livingstone is particularly excited about the tenure that has never been drilled.

There’s about 8km of unexplored ‘strike’ underneath a very thin 5-10m layer of sedimentary cover, which may have masked potential deposits from the old-time explorers.

“This is 8km that doesn’t have a single drill hole into it,” Livingstone says.

“As an exploration geologist that’s what gets me excited – the possibility of a significant discovery along strike from areas that have produced some significant gold”.