You might be interested in

Mining

EVs are using less nickel and cobalt as carmakers aim for budget prices, and that might actually be good for these Aussie miners

News

Rise and Shine: Everything you need to know before the ASX opens

News

Mining

Duketon Mining (ASX:DKM) does things a little bit differently.

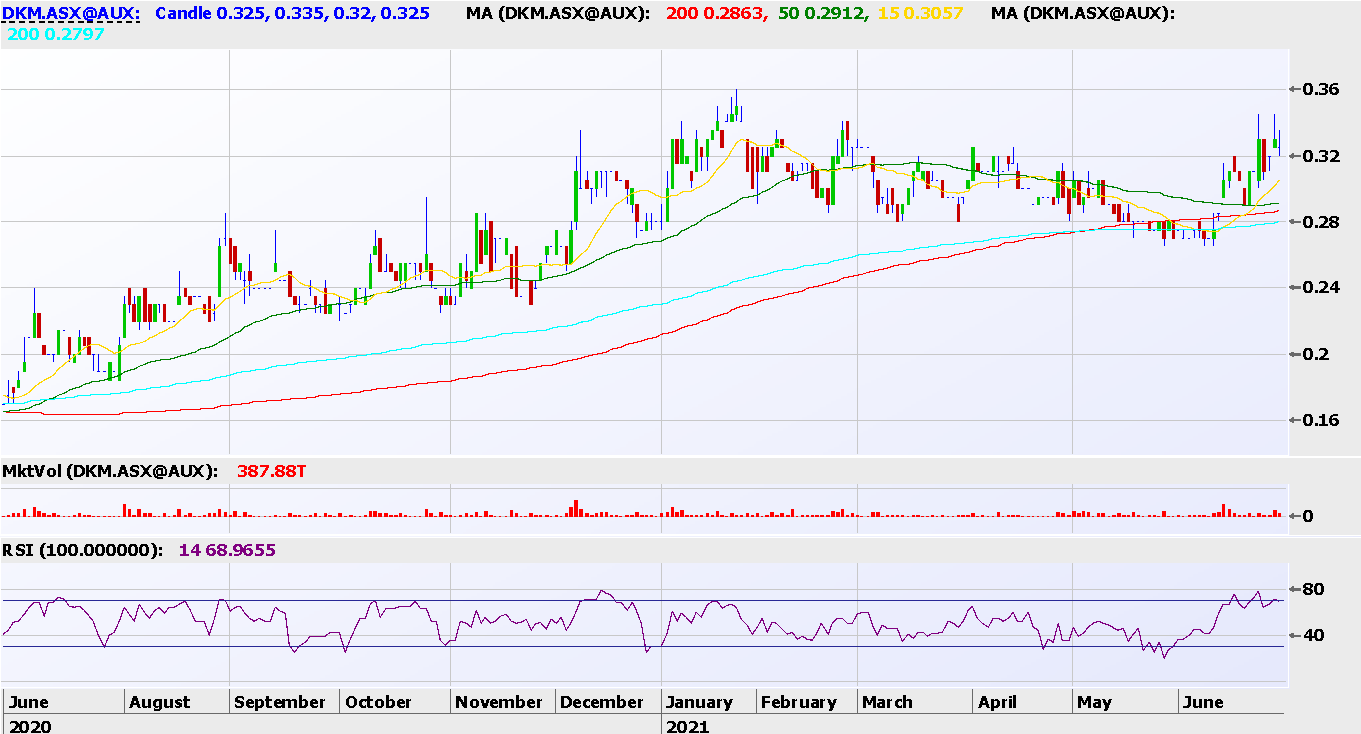

Let’s start with the technicals.

We’ve used a two-year chart to give some context, and a very favourable medium-term uptrend can be observed.

That time frame gives context to the recent selldown – a moderate one at best – as some of the acute froth came out of what was a very hot resource sector at the margins.

Price action took a look at the 200-day simple moving average – as can be observed in red – in late May and early June – but pleasingly this ultimately provided support as the uptrend resumed.

More recently, the stock moved higher to have a look at recent highs around the 35c mark.

All the moving averages in fact can be seen to be converging, which can set the table for a more significant move in either direction.

The stock is prone to gaps given a lack of relative liquidity, however that can be a positive also should the underlying bullish thesis prove correct.

The register appears to be tight.

Provided the gap level down to 28.5c from 11th June can hold in coming weeks, DKM looks every chance to move new highs as we move into the new financial year.

The current drilling campaign may well prove the catalyst for the above.

The investor preso of early May spoke to $32m in ‘cash and liquids’ ( liquids in this case being a holding in another listed company on the ASX ), $20m of which was cash as at the end of March quarter, against a current market cap of only $40m basis today’s close.

That’s a seriously low EV, and as we are fond of saying, ‘you can’t eat value’.

Duketon Mining is now one of the largest positions in the IMA.

Steve Collette of Collette Capital Pty Ltd (ABN 56645766507) is a Corporate Authorised Representative (No. 1284431) of Sanlam Private Wealth (AFS License No. 337927), which only provides general advice.

Collette Capital only makes services available to professional and sophisticated investors as defined by the Corporations Act, Section (s)708(8)C and 761G(7)C.

The Collette Capital Wholesale IMA Strategy has returned +24.57% p.a. net of all fees as at the end of February 2021 since inception in January 2015 (using the Time Weighted Return method of calculating returns).

Learn more at www.collette.capital