Cazaly has another crack at getting into Namibian cobalt

Mining

Mining

Cazaly Resources is determined to pick up a cobalt project in Namibia.

The company (ASX:CAZ) has acquired an option to earn a 95 per cent stake in the Kaoko Kobalt project, which it says is primarily prospective for copper and cobalt mineralisation.

The latest news comes a few months after it announced it was not going ahead with the acquisition of the Tsumkwe project in Namibia after a review of historic data failed to produce any evidence of cobalt.

Until recently, Perth-based Cazaly has primarily focused on the exploration of gold, iron ore, nickel and graphite in Australia.

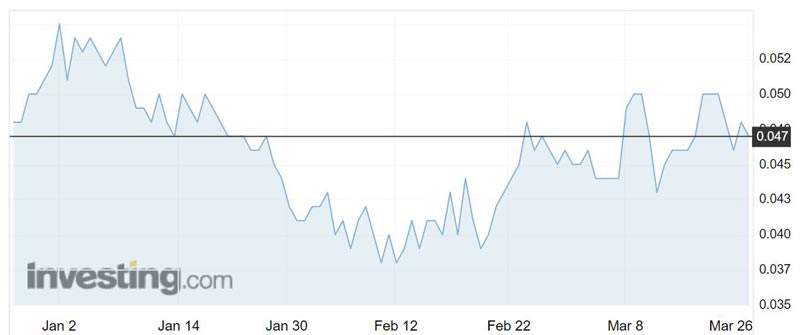

Investors appeared wary of the news, pushing the shares down 6 per cent to 4.5c on Monday.

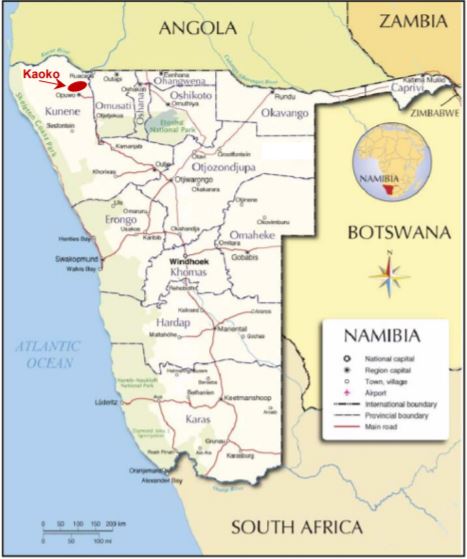

This potential new project is located in northern Namibia, about 800km by road from the capital of Windhoek and roughly 750km from the port of Walvis Bay.

“The Kaoko Kobalt project ticks all the boxes,” managing director Clive Jones said.

“It is located close to excellent infrastructure and adjoins Celsius Resources’ rapidly growing Opuwo cobalt-copper project within what appears to be a significant emerging cobalt-bearing belt in Namibia.”

Celsius began exploring nearby in early 2017 and expects to release a maiden resource for its project very soon.

Mr Jones is confident the Kaoko Kobalt project is a much better option than the Tsumkwe project.

“The problem with the previous project was that the assaying (testing) was only done by XRF not chemical assaying, which is problematic for cobalt,” he told Stockhead.

XRF (X-ray fluorescence) is a non-destructive analytical technique used to determine the elemental composition of materials.

Chemical assaying has already been done on the Kaoko project and has returned “encouraging” results, Mr Jones said.

Cazaly told investors the Opuwo cobalt-copper bearing Dolomite Ore Formation (DOF) horizon on Celsius’ landholding may continue into the Kaoko Kobalt project.

The project contains around 27km of prospective potential DOF equivalent in three areas and numerous widespread copper occurrences with grades of up to 38 per cent copper from grab samples, the company noted.

Anything over 1.5 per cent copper is considered high grade.

Cazaly expects to make a decision on whether or not it will go ahead with the acquisition in “just a matter of a few weeks”, Mr Jones said.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

Investors are going nuts over cobalt stocks because of the anticipated growth in supply needed to satisfy demand from electric vehicle makers.

According to BMO Capital Markets, even without the battery market the market for cobalt is tight and the forecast is for an increase of 60 per cent in cobalt demand to 2025.

Last week the LME cobalt price hit a decade long high and closed the week out at US$94,500 ($122,398) per tonne, up 26 per cent since the start of the year.

Canaccord Genuity recently revised its long-term (from 2025) forecast for cobalt pricing upwards by 32 per cent to around $US108,000 per tonne.