Castillo’s Broken Hill shows early signs it could be a substantial cobalt deposit

Mining

Mining

Special report: Castillo Copper’s Broken Hill landholding is emerging as a substantial cobalt project with evidence it could host mineralisation similar to other big projects in the western NSW region.

The geology team has identified structures “nearly identical” to the ones that are known to host cobalt mineralisation at Cobalt Blue Holdings’ (ASX:COB) nearby Thackaringa project – which already has a proven cobalt resource of 72 million tonnes at 852 parts per million (ppm).

At the high priority “Area 1” target, pyrite – a lead indicator for cobalt mineralisation – identical to occurrences at Cobalt Blue’s Big Hill deposit was confirmed and validated by laboratory results.

The Big Hill deposit has a resource of 10 million tonnes at 697ppm containing 6700 tonnes of cobalt.

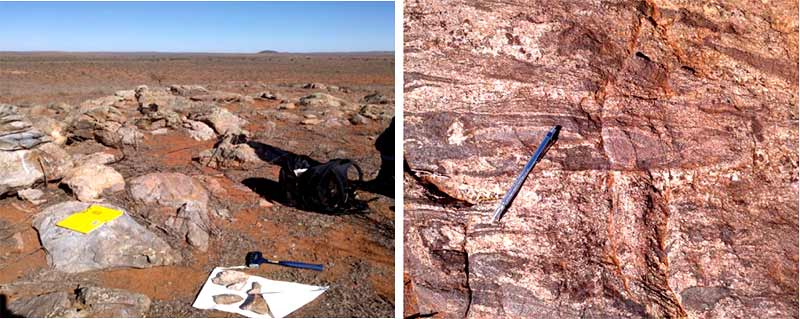

The findings line up with historic test results that prove elevated cobalt exists within the Himalaya Formation across Castillo’s (ASX:CCZ) landholding (see image below).

Rock chip samples taken over the formation were also positive for cobalt mineralisation.

Castillo also determined that there is a high degree of similarity between samples taken from its ground and samples taken from another neighbouring project owned by Australian Mines (ASX:AUZ).

Upside potential for cobalt

The company says this further highlights the upside potential for Broken Hill hosting cobalt mineralisation.

Broken Hill is a highly prospective region in New South Wales that has been largely underexplored for cobalt.

There is an extensive database of past sampling and drilling information, but past explorers did not test for cobalt.

“Up until recently cobalt was only ever mined as a by-product,” executive director Alan Armstrong told Stockhead.

“No one really looked for it and in effect a lot of the time people didn’t even assay for it because assay costs were much more expensive than they are now.”

While Cobalt Blue currently only owns 51 per cent of the cobalt rights within the Thackaringa project and is earning in to increase its stake, Castillo Copper already fully owns its Broken Hill project.

And the Broken Hill project is not just prospective for cobalt – it also has a lot of zinc potential.

“Having access to all the minerals rather than just cobalt, there’s a lot of benefits to the way we can explore it,” Mr Armstrong said.

“Obviously cobalt is our main focus, but if we come across some really interesting zinc results for example then we can leverage off that as well.”

Asia looks to Australia to shore up supply

Interest in Australian cobalt miners is ramping up, with companies like Korean technology giant LG recently striking a “major strategic partnership” with Cobalt Blue and its partner in the Thackaringa project, Broken Hill Prospecting (ASX:BPL).

LGI is interested in securing more cobalt, nickel and lithium, key components of lithium-ion batteries, and is working with LG Chem – a developer of next generation batteries for fixed storage and electric vehicles.

LG Chem is the fourth largest electric vehicle battery maker globally.

Battery storage for renewable energy generation is also going to boom, according to Bloomberg New Energy Finance (BNEF).

Wind and solar installations are projected to hit 50 per cent of global power generation by 2050.

“We see $548 billion being invested in battery capacity by 2050, two thirds of that at the grid level and one third installed behind-the-meter by households and businesses,” said Seb Henbest, head of Europe, Middle East and Africa for BNEF.

Castillo is expediting exploration and now plans to undertake a soil sampling program over the prospective areas of its Broken Hill project.

“This is just one string to the bow at Broken Hill,” Mr Armstrong said.

“We’re building up this war chest of information to really identify the best areas so that when we go to drill it we’ve got a much better chance of defining a JORC resource from a successful drilling program.”

JORC refers to the mining industry’s official code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

This special report is brought to you by Castillo Copper.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.