Castillo Copper unearths high-grade targets in copper-rich Mt Isa

Mining

Special Report: Castillo Copper was undertaking due diligence for its planned secondary London Stock Exchange (LSE) listing when it uncovered some very high-grade copper targets in Queensland.

Castillo Copper (ASX:CCZ) has dusted off some historic, JORC-compliant drill data showing high grades of up to 28.4 per cent copper — less than 50m from surface — at its Mt Oxide project in the mineral-rich Mt Isa region of northwest Queensland.

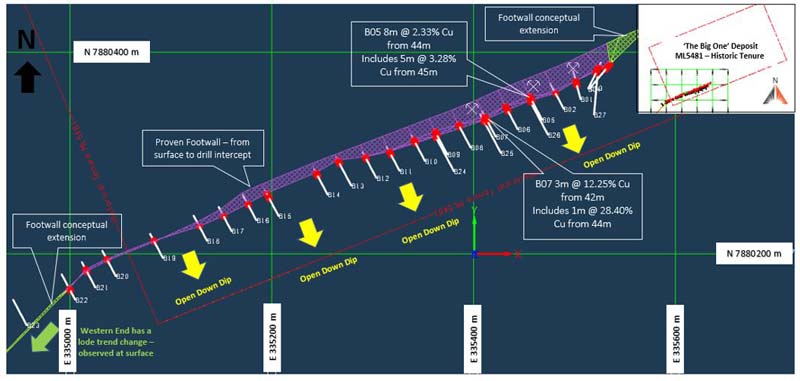

Castillo got its hands on the original logs and assay results from formerly listed West Australian Metals’ 27-hole, 1673m reverse circulation (RC) drilling campaign at the ‘Big One’ deposit in 1993.

That data included hits of 3m at 12.25 per cent copper from 42m, including 2m at 17.87 per cent from 43m and 1m at 28.4 per cent from 44m.

To put that in perspective, anything above 6 per cent copper is generally considered high grade.

In 1997, about 4,400 tonnes of supergene (shallow) ore was mined from the Big One deposit within the historic mining lease (ML5481), with the grade averaging about 3.5 per cent copper.

On top of that, historic production records from 1944-74 for the Boomerang mine confirmed that 4,211.2 tonnes of oxide ore grading about 6 per cent copper was mined to produce 250.9 tonnes of copper metal.

“We painstakingly tracked down the original mining lease owner in Brisbane, who then scoured through his attic to find relevant historic records that confirmed the veracity of percentages we announced were QA/QC compliant,” managing director Simon Paull told Stockhead.

“Through this historic data review process, we’ve managed to identify some priority targets that are beyond exciting.”

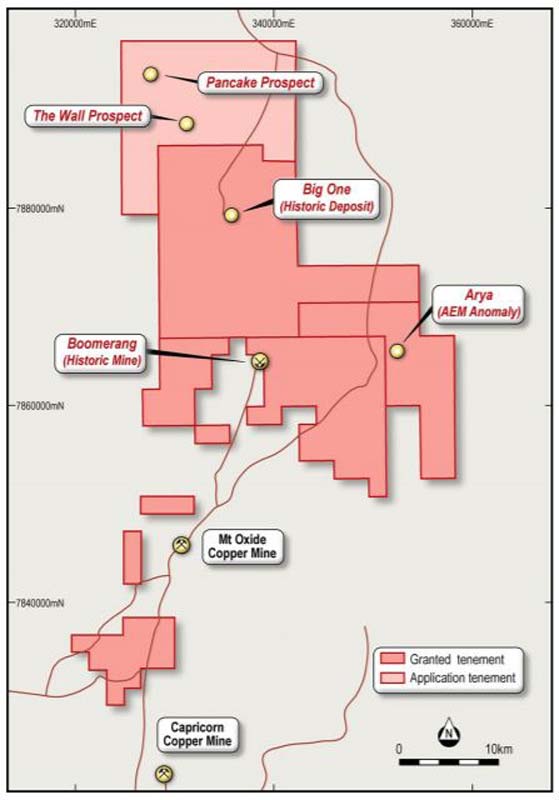

“Locating this historic drilling, assay and production data for the Big One deposit and Boomerang mine within the 961sqkm Mt Oxide pillar project, which is in the heart of the Mt Isa copper-belt, is a tremendous windfall.”

This potentially lucrative find has prompted Castillo to add the Big One deposit to its upcoming drill program, which is presently being formulated by the geology team.

“As a starting point, our geology team now have ample data points to start formulating a drilling campaign to re-test and potentially expand the known ore body at the Big One deposit then focus on the Boomerang mine and Arya prospect,” Paull said.

“This would be a great start to developing the high-priority Mt Oxide pillar and creating incremental value for shareholders.”

Paull told Stockhead that once key targets are finalised, then Castillo will move ahead with drilling once all necessary regulatory approvals are secured.

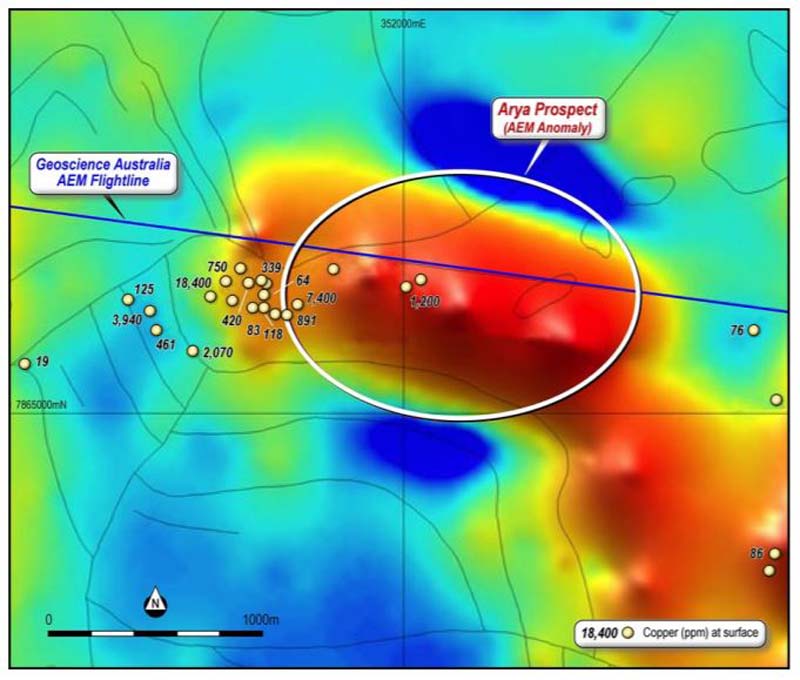

“Arya Prospect, which is one of key jewels in the crown for the Mt Oxide project, is pretty well established — we’ve got the targets for that already largely mapped out.” he said.

“We need to put some RC holes down into the anomaly, but probably won’t need too many because it is such a large system. We will find out pretty quickly if it’s a massive sulphide copper-bearing orebody.”

“Now we’ve got this other prospect at Big One it just makes so much sense to bolt on some extra holes to the drilling campaign to attack the both.”

Bundling the Big One and Boomerang prospects with the large massive sulphide target at the Arya prospect delivers a significant pipeline of future development work.

The exploration upside for the Big One Deposit is to primarily define the extent and grade of the supergene zone that could be mined by open pit methods.

Further, selected drill-holes could potentially act as scout drilling to target and characterise the extent and grade of the sulphide ore underpinning the supergene enrichment.

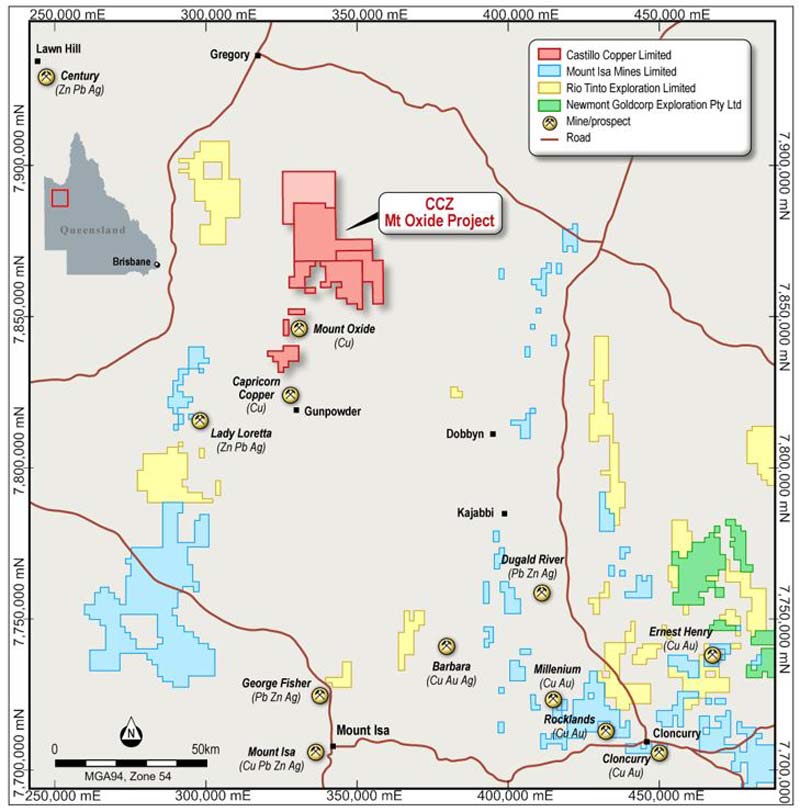

Castillo’s landholding is located in prime copper territory, surrounded by several producing mines including the Ernest Henry, Cloncurry and Mt Isa operations.

Over the past 12 months, there has been a resurgence of interest in Mt Isa’s copper belt, with the likes of Rio Tinto (ASX:RIO) applying for more ground in the region.

Other larger players with significant footprints include Mt Isa Mines and Newmont Goldcorp.

Castillo originally pegged the Mt Oxide ground about two years ago and, realising it was sitting on something pretty special, pegged further ground late last year which is in the process of being approved by regulators.

According to historic reports, the mineralisation underpinning the significant drilling intercepts from the Big One deposit is supergene copper ore.

Castillo noted that these hits are all associated with a northeast trending fault that was intruded by a porphyry dyke.

Porphyry-style mines can be economic from copper concentrations as low as 0.15 per cent and are usually very large, meaning they can be mined for a very long time.

“The copper grades found at the Big One Deposit are excellent and clearly highlight the potential upside apparent from developing the Mt Oxide pillar,” Castillo’s London-based director Ged Hall said.

“More significantly, the timing is near text-book as we work towards securing regulatory approval to dual list CCZ on the Standard Board of the London Stock Exchange.”

Castillo is anticipating it will start trading on the LSE in mid to late February.