Cashed-up MOD makes hay while sun shines in Botswana

Mining

Mining

With copper back in vogue, improving market sentiment and the significant blue sky potential of its tenements in a world-class copper belt, MOD Resources believes there is no time like the present to ramp up exploration and accelerate towards first production at its Botswana projects.

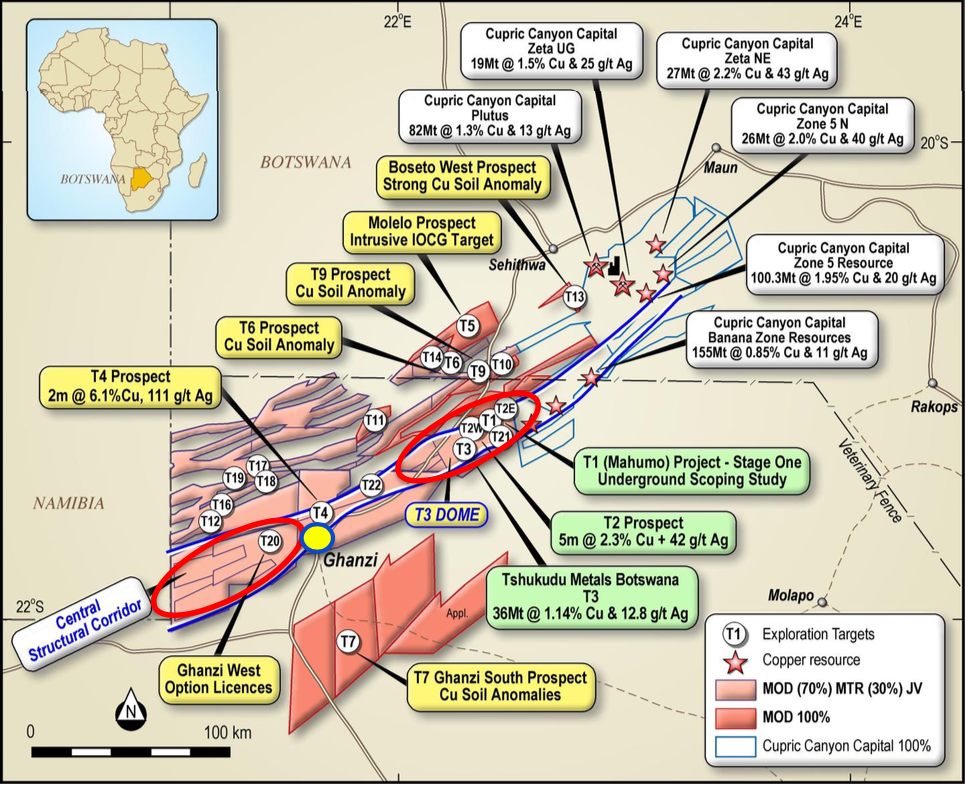

The emerging Perth-based copper play (ASX:MOD) owns 24 prospecting licences covering close to 12,000 square kilometres in mainly unexplored central and western Kalahari copper belt, Botswana.

“We have a major holding in the Kalahari copper belt,” MOD managing director Julian Hannah told delegates at the Mining 2017 Resources Convention last week.

“I am told we have a larger holding than Rio Tinto does in the iron ore province in Western Australia.”

MOD’s granted licences in the Kalahari copper belt.

The jewel in the crown for MOD is the T3 deposit where the company is currently carrying out a 70-hole drill campaign.

Discovered in March 2016 in the Ghanzi district in western Botswana, Mr Hannah said there was no evidence of any previous exploration or mining at T3.

“We had immediate success [at T3],” said Hannah. “Within six weeks of acquiring licences in Botswana we made a major copper discovery so we are currently looking to develop our first mine.

“It’s a huge prospective region,” he added. We have got six rigs going today. We have got a Pre-feasibility study for a 10-year open pit mine well advanced. We’re hoping to wrap that up by the end of this year and hopefully reach a decision to mine by the end of 2018.”

T3 is part of a joint venture between MOD and AIM listed Metal Tiger. Tshukudu Metals Botswana the in-country operating company and is owned 70 per cent by MOD with Metal Tiger owning the balance.

According to Hannah, Tshukudu has a wealth of in-country experience with its Chairman, Boikobo Paya, a well-regarded geologist in Botswana and former Permanent Secretary for Ministry of Minerals Energy and Water Resources.

Mr Hannah needs no introduction, he was one of the founders of nickel miner Western Areas and oversaw its transition from an explorer to a miner. He was there for 12 years before jumping ship to join MOD in 2013.

It seems MOD isn’t the only one that likes its Botswana story. Leading financial services firm Canaccord Genuity recently published their first independent research report on the company.

Canaccord initiated coverage with a Speculative Buy and a 10c target price based on the lack of quality ASX-listed copper developers to capitalise on the strong copper price and attractive upside to its Botswana projects.

Putting the money in the ground

While its focus in on brining T3 into production, MOD hasn’t taken its eye off exploration in the region.

MOD likes the prospectivity of the ground so much that it recently doubled its exploration budget to $10 million fast track drilling of regional targets around T3.

“We need to scale up exploration now, Hannah said.

“While MOD’s first major discovery, T3, has substantial upside and will remain our primary focus to bring into production, it may just be the beginning of a much larger story.

“Numerous other targets hold excellent potential, particularly along the same structural corridor which hosts T3 and other substantial resources already defined within the eastern Kalahari copper belt.”

The revised exploration program will include more than 200 drill holes with most the focus on a 150km prospective corridor which hosts T3 and MOD’s T1 resource.

The company is cashed-up with $15.8 million in the bank. In the past twelve months, its a raised $25 million to fund exploration.

Back in 2016, MOD was one of the better performers on the ASX going from nothing to 6c more or less overnight on the back of T3 discovery.

Since then its traded as high as 9c in March this year but has cooled slightly since then to be trading yesterday at 6.6c, valuing the company at $123 million.

A bit about Botswana

Compared to other countries in Africa, Botswana has low sovereign risk and boasts infrastructure that is in better condition than several of its neighbours, which has assisted in boosting international mining investment.

Botswana is one of the world’s biggest diamond producers. Besides diamonds, other important minerals in Botswana include copper, coal, and nickel.