Carawine is putting pedal to the metal for its 2020 exploration

Mining

Mining

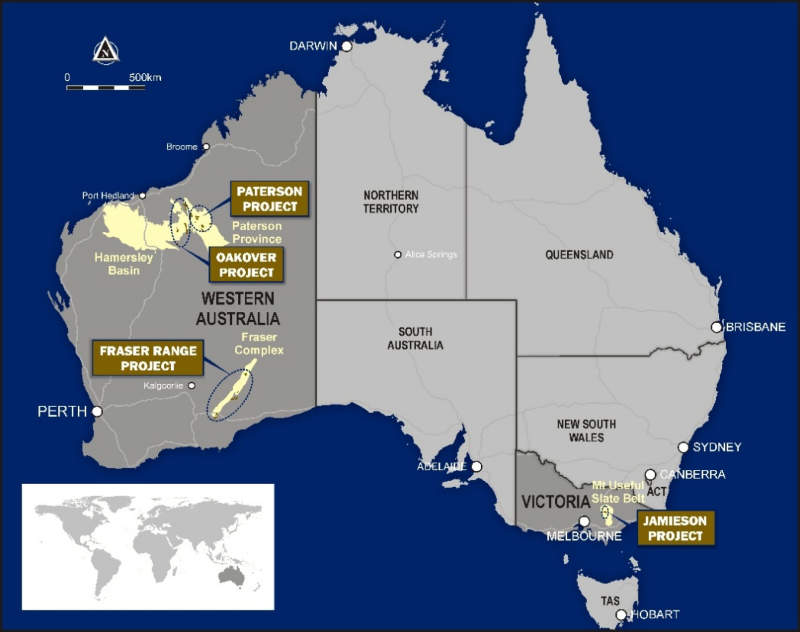

Special Report: Carawine has dived straight into its busy 2020 schedule with drilling already underway at its Jamieson gold and copper project in Victoria.

The company has already completed the first of up to six holes that are targeting extensions of porphyry-related gold and copper mineralisation at the Hill 800 deposit. First assays are expected towards the end of February.

Carawine Resources (ASX:CWX) had a successful exploration run at Hill 800 in 2019 with appealing intersections such as 5m grading 24.1 grams per tonne (g/t) gold from 203m within a broader 43m zone at 4.24g/t gold from 177m.

This work established the continuity of high copper and gold grades, discovered a porphyry source to its mineralisation and identified the potential for large porphyry systems at the broader Jamieson project.

Once drilling at Hill 800 is completed, the campaign will continue with four to six holes targeting potential porphyry-related magnetic targets that Carawine has modelled at and around Hill 800.

“The 3D model of the heli-mag data suggests there is a large, deep magnetic body just to the south of Hill 800 with numerous secondary bodies extending from it towards the surface, including into areas where we have identified near-surface mineralisation,” managing director David Boyd said earlier this week.

“Each of these bodies represents an exciting drill target, and we will take a deliberate and systematic approach to properly test each of them. The first of these holes is planned to commence in February.”

The current drilling campaign at Jamieson will wrap up with two holes to follow up on known mineralisation and potential porphyry-related magnetic targets at Rhyolite Creek.

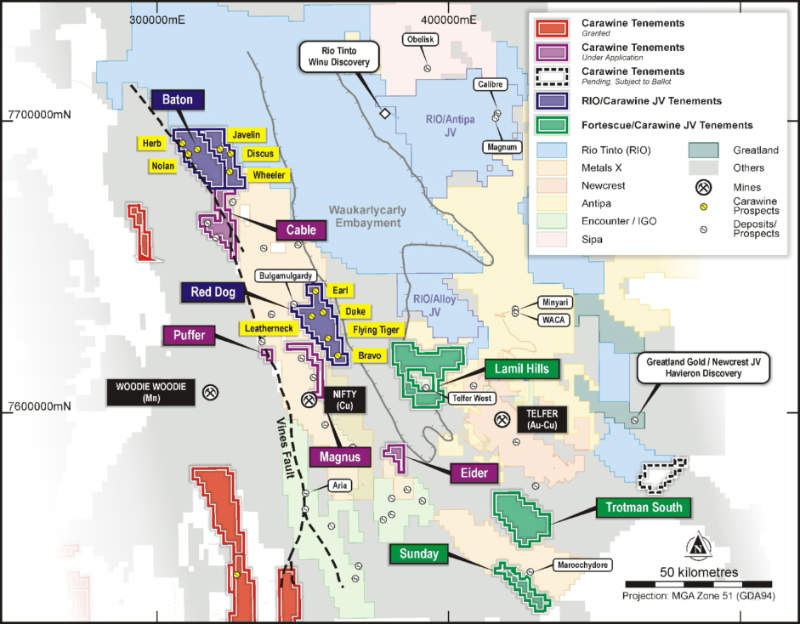

While the Jamieson project certainly holds centre stage for the company, Carawine is also in joint ventures with two of Australia’s largest miners for its projects in Western Australia’s hot Paterson Province.

Over in the West Paterson JV, Rio Tinto (ASX:RIO) expects to receive final data from an airborne survey flown in December 2019 to improve understanding of mineralising systems in the area.

Access planning has already started and depending on heritage clearance, drilling of the Javelin, Discus and Wheeler anomalies could begin during the second quarter of 2020.

Rio is also scoping an appropriate methodology for induced polarisation or ground electromagnetic (EM) surveys to screen airborne EM targets on the Red Dog tenement, with test surveys currently planned for the third quarter.

The major miner has the right to take up to a 70 per cent stake in the Baton and Red Dog tenements that make up the West Paterson JV by spending $5.5m in six years.

It can earn a further 10 per cent by sole funding exploration through to a discovery milestone, or completion of a scoping-level study on any discovery.

Meanwhile, Fortescue Metals Group (ASX:FMG) is compiling existing data over the Lamil Hills, Trotman South and Sunday tenements that make up the Coolbro JV, ahead of planning field work programs for 2020.

Fortescue can earn up to 75 per cent in the three tenements by spending $6m over seven years.

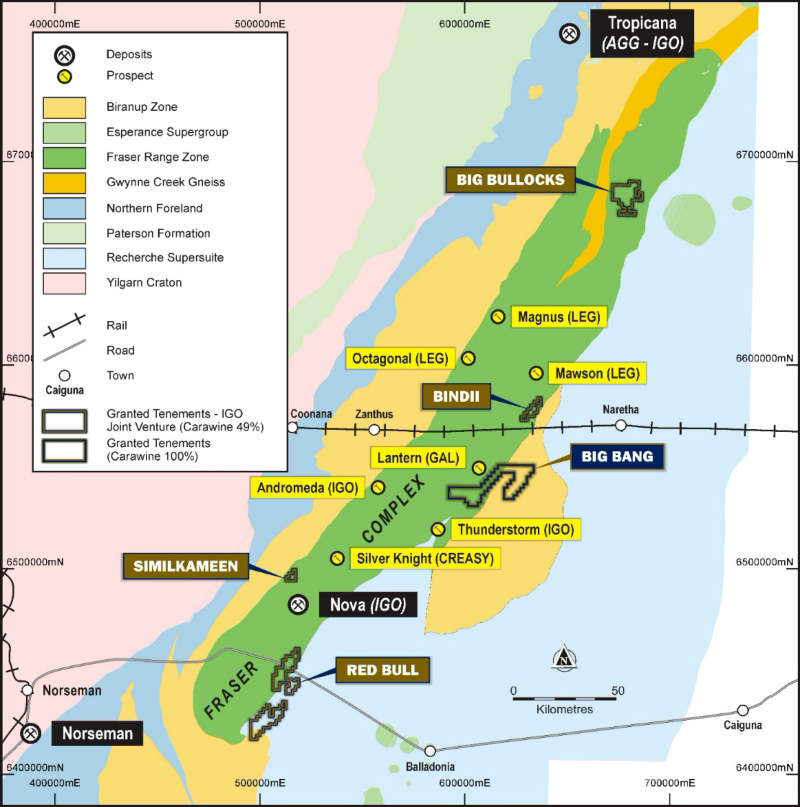

Over in the Fraser Range, JV partner Independence Group (ASX:IGO) is planning to carry out several surveys to test for basement conductors within the Big Bullock 1 and surrounding prospects during the second quarter.

Carawine will focus its Paterson activity on compiling and reviewing historic exploration on its four exploration licence applications that are not subject to farm-in or JV agreements.

The results will be used to prioritise and plan exploration programs for the tenements upon grant.

It will also review historic results at its wholly owned Big Bang tenement in the Fraser Range to identify targets for further work.

Should this return positive results, the company expects to kick off exploration work in the third quarter of 2020.