You might be interested in

Mining

Brightstar Resources’ drilling returns intriguing gold hits below current Cork Tree Well deposit

Mining

Emerging Brightstar Resources continues to build gold inventory with maiden 70,000oz resource at Aspacia

Mining

Mining

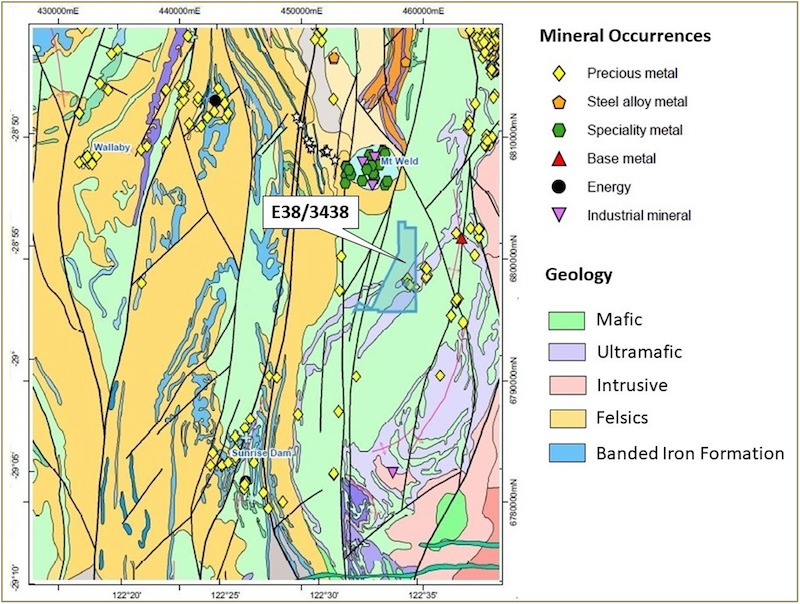

Brightstar Resources has consolidated ground around its namesake project in WA’s world-class Laverton gold region, completing the acquisition of a new tenement.

The addition of the tenement to the Brightstar (ASX:BTR) portfolio adds prospective brownfields gold ground just 15km from the project’s Brightstar plant, and land adjacent to a number of the company’s existing prospecting and exploration licences.

The land is dominated by a north-east striking, steeply dipping contact between a komatiitic talc sheared ultramafic unit to the west, and basalts and coarser basaltic facies of quartz dolerites to the east.

The area has been the subject of extensive historical exploration, including detailed geological mapping, airborne geophysical surveys, geochemistry and drilling.

The most extensive of these was carried out by Acacia Resources during the mid-1990s through its Keringal East joint venture. Data is being collated from historical reports and will inform plans for future exploration once reviews are completed.

Historical workings and drilling indicate shallow dipping, massive thin quartz veins hosted by possibly fault controlled, sub-horizontal, weathered, strongly foliated mafic and metasediment chlorite schists.

These veins and adjacent strongly preferentially weathered shear/fault zones appear to be the main target of historical workings onsite.

The tenement is located in an extremely prospective area near major gold mines such as AngloGold Ashanti’s Sunrise Dam and Gold Fields’ Wallaby. Brightstar said anomalous nickel mineralisation has also been delineated through geochemical sampling at the tenement.

Under the terms of the deal, the project’s previous owners – Mining Equities – have been issued the following in exchange for the tenement.

The previous owners will also receive a 1% net smelter royalty on the tenement.

The acquisition is the latest in a series of moves by Brightstar, which was reborn in December having recapitalised and cleared the debt which hung over its previous iteration, Stone Resources.

The company holds a compelling portfolio, including:

Managing director Bill Hobba told Stockhead at the time of the rename that the company planned to aggressively pursue a path of planning and development.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.