Blackstone’s off to a flier in Vietnam

Mining

Special Report: Blackstone Minerals is off and drilling in Vietnam, and its early results appear to validate the company’s decision to switch gears.

In case you missed it, Blackstone Minerals (ASX:BSX) took an option to acquire a 90 per cent stake in the Ta Khoa nickel project in Vietnam— its reasoning being that Asia is expected to become an electric battery powerhouse.

So, what better place to produce a material expected to play an increasing role in battery technology than Asia itself?

The drilling has now matched the strategy, with it hitting some good grades on its first round of exploration drilling.

Intersections included:

In fact, there was even a peak assay figure of 3.4 per cent nickel.

The first round of drilling is now done, with the first phase of Induced Polarisation also done and dusted.

The results will now be processed again to try and firm up deeper targets for the second round of drilling.

The exploration front is important for Blackstone, as it has 25 targets to follow up on within a 150km2 area.

Any new mineralisation found will be processed at the Ban Phuc mine processing centre — which is currently in care and maintenance mode.

That processing centre served the Ban Phuc mine, which was based on just one target and was mined out within three years by the previous operator.

Should Blackstone be able to convert a decent chunk of its 25 exploration targets into resources, the processing centre looms as a no-brainer outlet for its nickel.

At the time of writing, nickel is on somewhat of a bull run.

Since the start of 2018, it’s up over 42 per cent for the year. It’s having an even better year than gold, which has predictably gotten all the headlines.

But nickel has emerged, particularly this year, as vital to the future of electric vehicle battery viability.

The Chinese government is now demanding that EVs manufactured in the country have a range of more than 400km — and the demand for a higher range is good for nickel.

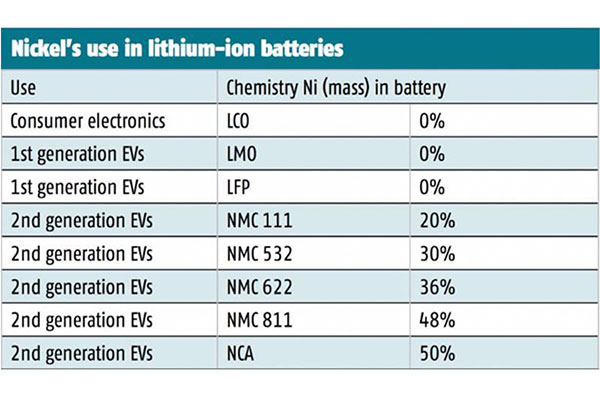

To get the 400km, you need a lithium-ion battery with great power and heft, and that means a battery with greater nickel content.

Battery makers have found batteries with a greater nickel mix have a higher energy density, so manufacturers have started to put more and more nickel into their batteries.

So, the macro makes sense for Blackstone.

By acquiring a project with a processing facility already on site, it will save time and money and be able to get nickel to market sooner to take advantage of the bullish trade.

But what Blackstone has done (or is in the very early stages of doing, more accurately) is prove up the exploration side.

If it can do that, it can quickly begin sending new sources of nickel to market and set up a longer-term sustainable project there.