Blackstone reckons Ta Khoa will be a ‘cycle proof’ green nickel asset

Mining

Mining

Blackstone Minerals (ASX:BSX) has just released the pre-feasibility study for the development of a Ta Khoa downstream refinery project in Northern Vietnam and the numbers are looking good.

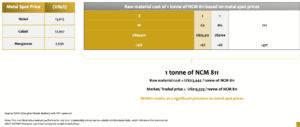

Managing director Scott Williamson said the refinery would process up to 400ktpa (base case) of nickel concentrate to produce battery grade NCM811 precursor for the lithium-ion battery industry which will be trading at a premium to metal spot prices.

“It’s a fairly new product and in the study we’ve shown how it’s been trading since it became a commercial tradable product which has always traded between 20-40% premium to the underlying nickel cobalt manganese prices,” he said.

“So, we’re confident that those premiums will prevail and potentially they will fluctuate between 20-40% range.

“We’ve used 20% in our study as our base case and we’ve also put in that variational spot case/price, which is at today’s premiums – around 40% – but we’re happy with the base case which is the lowest ever recorded premium for the product.

“We’re confident that we’ll hang around because of the demand that’s coming for the product because of the lithium-ion battery and the EV revolution.”

The base case physicals for the refinery include:

Over the next 12 months the company will move into the definitive feasibility study phase, targeting a final investment decision (FID) in CY2022.

Then comes the pilot plant phase, with plans to start construction through 2023 and 2024 – targeting first production in 2024 and a ramp up to steady state operations by 2026.

Williamson said that the company is not leveraged to the nickel price.

“When we buy concentrate, we buy concentrate at a percentage of the nickel price and then we sell it at a percentage or a premium to the nickel price – so the margin will always be there, regardless of what the nickel price is,” he said.

“Even if the nickel price goes down, there will still be demand for this product because of EVs.

“It’s basically an industrial company in that sense – it’s not relying on the underlying commodity price to make it economic.”

And the base case economics certainly seem to support this pricing outlook.

They include:

“Because of the hydro power, our power cost are much lower than our peers, and our labour costs are much lower than our peers – so we’ve got very strong margins,” Williamson said.

“Also, because of the premium of the product, we can pay a little bit extra for our concentrate, we can actually pay a little bit more than our competitors.

“That’s why we’re confident we’ll be able to source third party feed.”

Another arrow in Blackstone’s quiver is its ESG credentials, with Williamson certain that customers will pay a premium for green as-close-to-zero-carbon-as-possible nickel.

“We’ll be focused on moving towards a zero carbon product because we’ve got renewable power sources, we’ve got hydroelectric power, and we’re also looking at electric mining equipment which will be then hooked into that hydro power.

“We’re aiming for a zero carbon mining operation.

“A lot of the nickel in the industry is already set up on coal and diesel powered infrastructure and it’s set up with a pyrometallurgical technology, whereas we’re looking at this hydrometallurgical technology, which is much cleaner and greener, with lower emissions.

“We’ve already got the renewable power, we’ve got two of the largest hydropower plants in Southeast Asia which we’re already hooked into, so that puts us at the front of the industry for green credentials.”