You might be interested in

News

Closing Bell: ASX goes missing as new premiums lift health stocks; Bitcoin at US$68k

Mining

Magnis closes in on $320m funding via Singapore-based PEY Capital for Nachu graphite project

ESG

Lithium-ion will be the major battery technology for the next few years.

But plenty of challengers are on the horizon and battery metal investors are watching closely to see which technology could be next to benefit from electric vehicle and energy storage demand.

So what are the future options?

In terms of electric vehicle batteries, at the moment it’s more about refining the chemical make-up of a lithium-ion battery rather than moving to another type of battery.

“The immediate progress you are likely to see in battery technology is towards advanced lithium-ion technologies which are maximising the performance of existing chemistries,” Benchmark Mineral Intelligence senior analyst Andrew Miller told Stockhead.

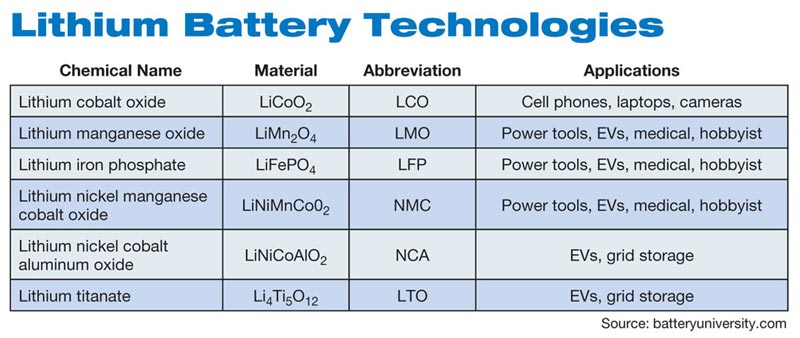

Electric car makers are focusing on two chemistries: nickel-cobalt-aluminium (NCA) and nickel-cobalt-manganese (NCM or NMC).

American car giant Tesla prefers NCA, while the NCM chemistry is more popular among its rivals.

Car and battery makers are reducing the amount of cobalt they use because it is one of the most expensive parts of a battery and there is a shortage of the commodity.

Cobalt is mainly used to make the cathode in lithium-ion batteries.

Benchmark Mineral Intelligence predicts that by 2026, NCM batteries will account for about 70 per cent of the total lithium-ion battery market.

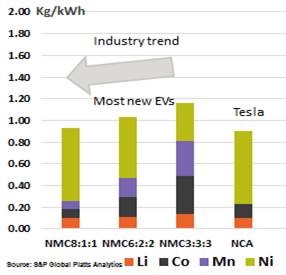

Right now most EVs use the NMC622 battery technology, which stands for six parts of nickel to one part each of manganese and cobalt, but there’s a drive towards the NMC811 battery technology.

“NCM811 and NCA are very similar cathode chemistries and the battery market is already pushing towards these technologies,” Mr Miller said.

“Tesla have already successfully commercialised NCA and a number of other companies are looking to follow in their footsteps.

“NCM chemistries are more widely used today and there is already a shift towards 811, but this is posing a challenge to producers in terms of lifecycle, so the shift will be more gradual with 622 the target for most in the near-term and gradually working towards 811 over the next one to three years.”

China’s biggest lithium battery maker – the $150 billion Contemporary Amperex Technology – is already making plans to switch to NMC811.

More nickel makes batteries cheaper and longer lasting because it can store and produce more energy.

At the moment CATL produces batteries containing 50 per cent nickel, 20 per cent cobalt and 30 per cent manganese – or NCM523.

CATL supplies batteries to electric car makers SAIC Motor Corp, Geely, BMW and Volkswagen.

Marcel Goldenberg, a battery metals specialist for S&P Global Platts, sees the NMC811 technology becoming commercially viable in the next three to five years.

New contenders

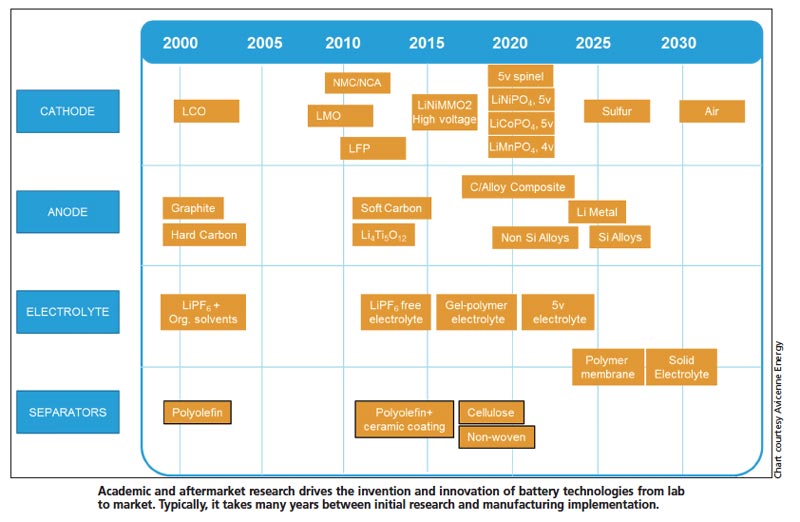

Benchmark’s Mr Miller says the natural successor to lithium-ion technologies looks set to be solid-state batteries which is where a lot of companies are focusing their investments for EV applications.

“In terms of solid-state, this continues to offer the light-weight benefits of lithium-ion and can also provide increased energy density which is a crucial target for EV applications,” he explained.

Solid state technology is harder to engineer — but promises a lower-cost battery that is higher capacity, higher density, higher performance and quicker to charge.

Mr Miller doesn’t expect solid-state batteries to be a “significant part of the market until post-2025”.

But battery makers say solid-state batteries are much closer to becoming a reality.

Graphite miner Magnis Resources (ASX:MNS) revealed earlier in October that its partner, battery maker C4V, had developed one of the world’s first solid-state batteries.

The new battery, which was unveiled at a conference in New York, replaces more than 80 per cent of the usual liquid electrolyte with a solid electrolyte. C4V’s battery also does not require cobalt.

C4V reckons it could be producing prototypes for customers by as early as the second quarter of next year.

Meanwhile, other potential choices are lithium sulphur and lithium air batteries.

The International Energy Agency sees both Li-Air and Li-Sulphur becoming available from 2030.

But French market researcher Avicenne Energy predicts Li-Sulphur could be available before 2025.

Scientists from the Drexel University College of Engineering in Philadelphia recently made a breakthrough in stabilising a Li-Sulphur battery.

They think they have found a way to make a Li-Sulphur battery with four times the capacity of a similarly sized lithium-ion battery.

“Our Li-S electrodes provide the right architecture and chemistry to minimise capacity fade during battery cycling, a key impediment in commercialisation of Li-S batteries,” said Vibha Kalra, an associate professor in the College of Engineering who led the research.

“Our research shows that these electrodes exhibit a sustained effective capacity that is four-times higher than the current Li-ion batteries. And our novel, low-cost method for sulphurising the cathode in just seconds removes a significant impediment for manufacturing.”

What about energy storage?

While the EV space is firmly dominated by lithium-ion for the moment, stationary storage is more diverse.

Stationary storage systems are big batteries designed to store excess power from the power grid — including from renewable sources — for use during expensive peak demand periods.

There are a couple of battery technologies vying for top spot, but the spotlight is largely on vanadium redox flow batteries (VRFBs).

“The area where you are likely to see far more variation in battery technologies is stationary storage applications where you don’t need the light-weight benefits of a lithium-based technology,” Mr Miller said.

“While we still expect lithium-ion to play a big role in this market there will be several other technologies that compete for market share in this space.

“In particular vanadium flow seems a strong contender for stationary storage but there are several steps the industry has to overcome before it can reach wide-spread commercialisation.”

VRFBs are regarded as a safer alternative to lithium-ion and better suited to large-scale applications.

They come at a higher upfront cost but have a far longer life compared to lithium-ion batteries.

“For stationary storage, vanadium flow is very interesting because of the life-cycle advantages and the fact that the input raw materials can be reused,” Mr Miller said.

China leans towards vanadium

While lithium-ion is now the favoured technology in China, the Asian powerhouse is looking at several types of batteries as it works out the best option for grid-scale energy storage.

David Gillam, the boss of Mastermines – a specialist company that has strong ties to China and helps Australian miners with marketing and securing off-take deals, says Chinese players are looking in every direction.

“We sort of have an idea that they may be moving more towards vanadium for big installations but there’s not enough proof yet that that’s the case,” he told Stockhead earlier in October.

“It’s very early days and it’s typical of China, they’re going to test everything.”

Other battery technologies that are being advanced include the zinc air battery – a tech that was developed by researchers from the University of Sydney.

Although a zinc air battery is cheaper than a lithium-ion battery it is not as efficient and is probably better suited to domestic energy storage than large-scale energy storage.

US scientists, meanwhile, have discovered a way to stop sodium batteries from exploding and make them hold a charge more effectively.

Sodium is a very cheap and abundant alternative to lithium.

Sodium-ion batteries would be physically heavier than lithium-ion, which makes them an unlikely replacement in electric car batteries.

But researchers have been investigating the alternative because they could store energy for large solar and wind power facilities at a lower cost.