You might be interested in

News

Closing Bell: Geopolitical tensions, China's economy roil the ASX as Aussie dollar trades below US65c

News

Market Highlights: Markets rattled on war tensions, and how investors should play this out

News

Mining

Like all EU-based battery metals developers, vertically integrated Talga Resources (ASX:TLG) benefits from its location amongst the ‘wakening beast’ that is Europe’s electric vehicle manufacturing sector.

That’s because there’s a coordinated push to establish internal EV supply chains to feed the 16 (and growing) large-scale lithium-ion battery cell plants confirmed or likely to come online in Europe by 2023.

These internal supply chains mean less exposure to China, as well as unstable jurisdictions like the Democratic Republic of Congo, for raw battery materials.

Today, Talga unveiled a maiden 27,000-tonne copper-cobalt resource estimate for its Kiskama deposit in northern Sweden.

It’s not its main game by stretch; Talga’s focus is still the high-grade, high-margin Vittangi graphite anode project, so development partners are being sought.

Still, Talga believes the timing is right if growing EU demand for “conflict free” cobalt is to be met, managing director Mark Thompson says.

“From here, Talga will seek partners to further explore and develop this copper-cobalt project in north Sweden,” he says.

“The potential is to build larger scale on this core estimate, with growth-targeted exploration along strike and down dip, including the newly identified large geophysical conductor ‘K2’ located just 600m to the east.”

READ: An ‘avalanche’ is laying waste to lithium prices, as predicted

Vanadium developer Technology Metals Australia (ASX:TMT) just released its definitive feasibility study (DFS) for the large, long life Gabanintha project in WA.

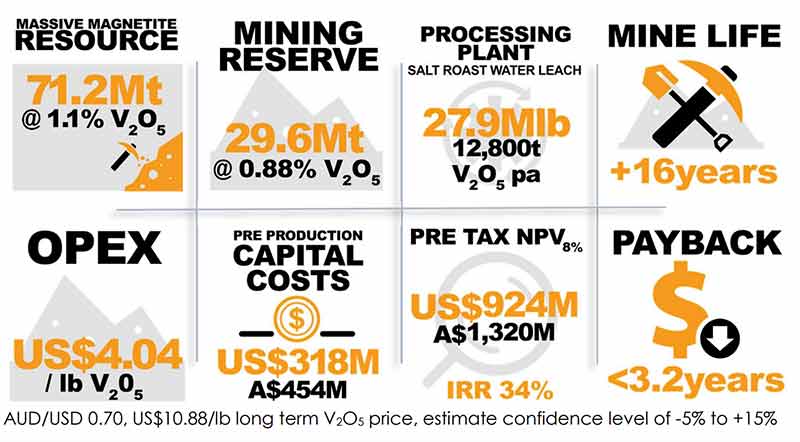

Here’s some of the highlights:

Based on average all in sustaining costs of $US5.75/lb ($8.48/lb) and a long term V2O5 price of $US10.88/lb, pre-production capex of $US318m ($454m) could be paid back within 3.2 years, it says.

TMT estimates the 16-year project will make average annual EBITDA of $268m during steady state production.

“The very high-quality Gabanintha vanadium project DFS has generated an outstanding result delivering lowest quartile operating costs over a long initial mine life at a scale that will make the project the largest single primary vanadium producer in the world,” TMT’s Ian Prentice says.

“Delivery of this study is a key milestone in progression of discussions with prospective development partners that the company has engaged with over the past 12 to 18 months.”