You might be interested in

Mining

Galan just got the government agreement it needs to start commercialising its Argentinian lithium

News

Closing Bell: Geopolitical tensions, China's economy roil the ASX as Aussie dollar trades below US65c

Mining

Mining

Liontown Resources (ASX:LTR) has been hard rock lithium’s shining light this year.

In late April the stock was worth a touch over 2c. Now it’s over 15c – an impressive gain of 530 per cent over the past few months.

In early July, Liontown boosted the resource at its flagship Kathleen Valley project by 353 per cent.

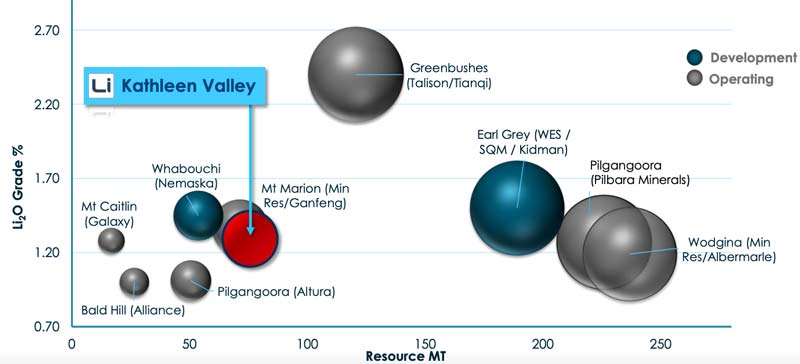

The resource now stands at 74.9 million tonnes at 1.3 per cent lithium, containing 2.5 million tonnes of lithium carbonate equivalent.

Bridge Street Capital Partners analyst Chris Baker recently said that Kathleen Valley matched Mineral Resources’ (ASX:MIN) Mt Marion deposit, and was already “substantially larger and higher grade” than Alliance Minerals’ (ASX:A40) Bald Hill and Galaxy’s (ASX:GXY) Mt Caitlin.

It’s already the 5th biggest resource in Australia, Liontown says.

But Kathleen Valley isn’t the only monster Liontown is wrestling with.

The emerging high-grade Buldania lithium asset in WA’s Norseman region is 1.4km long and growing, Liontown told investors today.

Buldania is in the Eastern Goldfields province, a region well-known for hosting large lithium deposits like Mt Marion and Bald Hill.

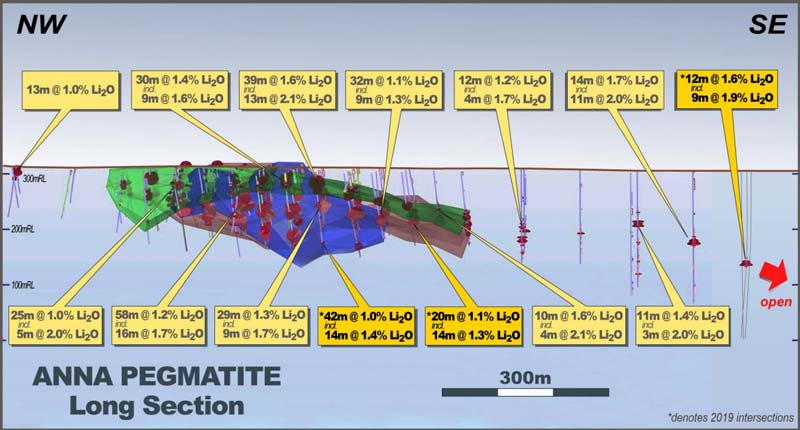

The latest drilling at Buldania has extended mineralisation at the Anna prospect for at least 1.4km.

Latest results include 9m at 1.9 per cent lithium oxide (Li2O) from 171m, inside a larger 12m section grading 1.6 per cent.

Liontown says mineralisation is hosted by multiple, stacked, sub-parallel pegmatite lenses ~5 to 25m in thickness. In places, the pegmatites merge to form zones more than 50m thick.

And the system remains open along strike and at depth:

Liontown is currently working toward a maiden mineral resource estimate for Anna, which means most of the drilling has focused on this one particular area.

But the explorer has also punched a few holes into a fresh target about 5km away, with stellar results like 6m at 1.5 per cent Li2O from 54m.

“Most of the NW Pegmatite area remains untested and further drilling will be undertaken as part of the current program,” the explorer says.

Galan Lithium (ASX:GLN) hits exceptionally high-grade/high purity brines at Candelas, including 70.4m at 744mg/l lithium.

Galan boss Juan Pablo (‘JP’) Vargas de la Vega says the results from drill hole eight confirm high-grade continuity over a minimum 3.5km strike and 2.5km width in the northern section of the channel.

“With this new data, Galan will now commence work on its maiden JORC compliant resource estimate for the northern portion of Candelas which is on track for delivery in Q3 this year,” he says.

The explorer is also prepping for a pre-feasibility study (PFS) into project development.

Galan was up 6.25 per cent in morning trade.

BMG (ASX:BMG) has chosen a drilling contractor to undertake its maiden drilling program at the Salar West project in the Atacama region of Chile.

The 400m, two-hole program will test the strong lithium brine targets identified in recent TEM geophysical surveys.

BMG expects the rig to mobilise to site around the end of the month, with the program to take around three weeks.

The stock was unchanged in morning trade.