Bathurst profits from coking coal’s bright outlook

Mining

The outlook for steelmaking coal looks positive, says NZ coal miner Bathurst Resources (ASX:BRL), which has now boosted FY19 profit estimates for the second quarter in a row.

Bathurst now expects to make $105m for the financial year ended 30 June 2019.

The miner, which produces both coking (for steel) and thermal coal (for power stations) made a record profit of $25.4m for the December half.

Roughly half of the company’s coal is sold to the steel-making industry in New Zealand and overseas.

This coking, or metallurgical, coal fetches far higher prices than thermal coal.

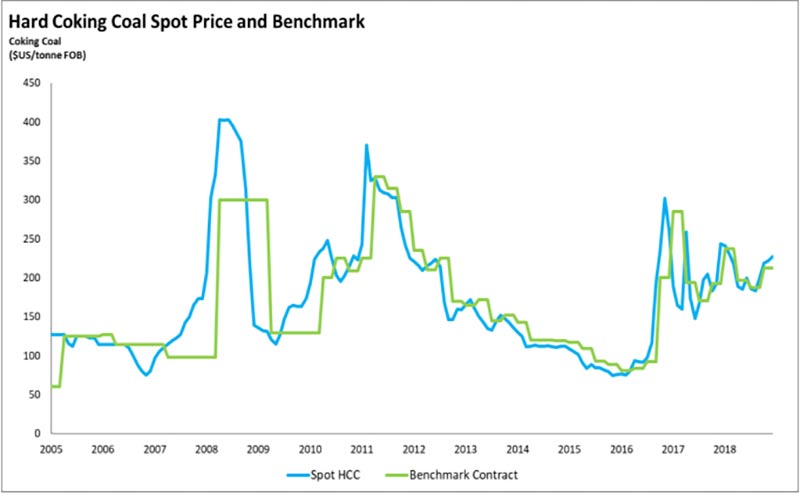

The company’s 1.1 million tonne a year Stockton mine (65 per cent ownership) benefited from strong coking coal prices: the average price received was NZD $214/t ($AU205).

Global steel demand will stay strong, the company told investors.

Added to this, disruptions to coking coal transport due to flooding in Queensland means the outlook “remains positive for prices for the remainder of FY19”.

“Key investments in current operations and overseas opportunities during the period have also set us up well for continued future growth, with sales and production continuing to meet guidance,” Bathurst chief Richard Tacon says.

A new deal with Jameson Resources (ASX:JAL) saw Bathurst sink an initial $7.7m in the Crown Mountain coking coal project in British Columbia, Canada.

Bathurst, which now owns 8 per cent of Jameson’s Canadian subsidiary, has committed to invest up to $128 million to develop Crown Mountain, which would make the project a 50-50 joint venture.

READ: Bathurst succeeds (against all odds) as a coal miner in New Zealand