Bass Oil’s Indonesian getaway is costing more than expected as it delays payments

Energy

Energy

Bass Oil will pay more for its new Indonesian oil field after talking the vendor into accepting delayed payments.

The delay means Bass Oil will incur extra interest payments — which didn’t please shareholders.

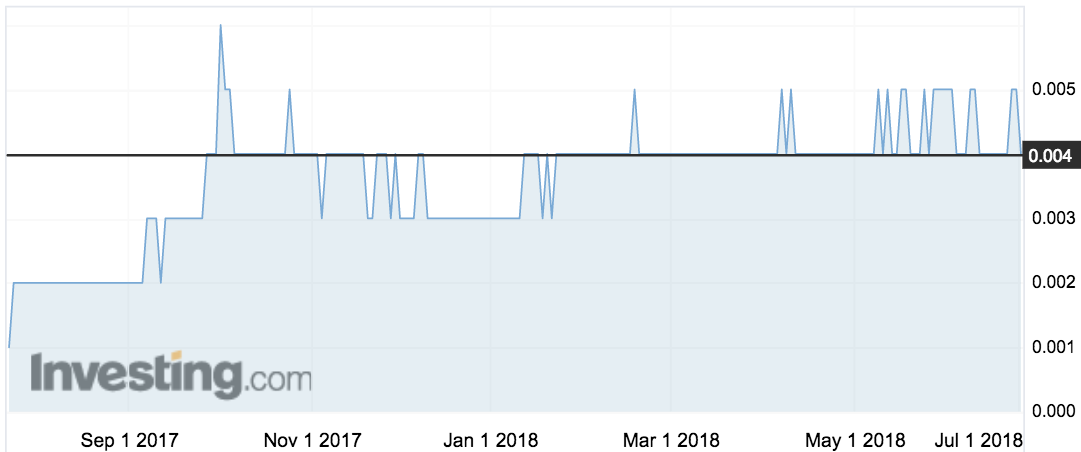

In the oil company (ASX:BAS) sent the stock down 10 per cent on Monday morning.

Bass bought 55 per cent of the oil-producing Tangai-Sukananti field in South Sumatra from Cooper Energy (ASX:COE) in March last year.

Investors have not yet rewarded the company for its shift from Victorian explorer to Indonesian producer — but the move was prescient because oil prices are now at four-year highs.

Over the weekend Brent crude hit $US79.31 while US-focused WTI prices touched $74.34.

On Monday, Cooper agreed to delaying the third and fourth payments by six months.

The third $500,000 payment was supposed to be made by the end of September, and is now due in March 2019, and the fourth and final payment of $770,000 is delayed from December to June 2019.

It’ll cost Bass 7.5 per cent a year in interest, or an extra $47,625.

The delay gives Bass breathing space.

At the end of March it had $US1.4 million ($1.9 million), with expected outgoings of $US1.3 million.

While it was receiving an increasing sum in receipts, it was still in a negative cashflow position of $US185,000.

“This extension of the settlement will allow Bass to commence the next phase of development of the Bunian and Tangai fields without the need to raise additional capital,” Bass said.

“The company plans by calendar year’s end to drill the Bunian 5 development well, upgrade the pump at the existing Bunian 1 production well, and install a pump at the Tangai 1 production well.”