‘Awe-inspiring’: Zinc explorer Peel soars 40pc after mega drilling result

Mining

Mining

Zinc explorer Peel Mining rocketed more than 40 per cent today after a discovery that included a zinc grading of 40 per cent.

Anything over 12 per cent zinc is considered high grade.

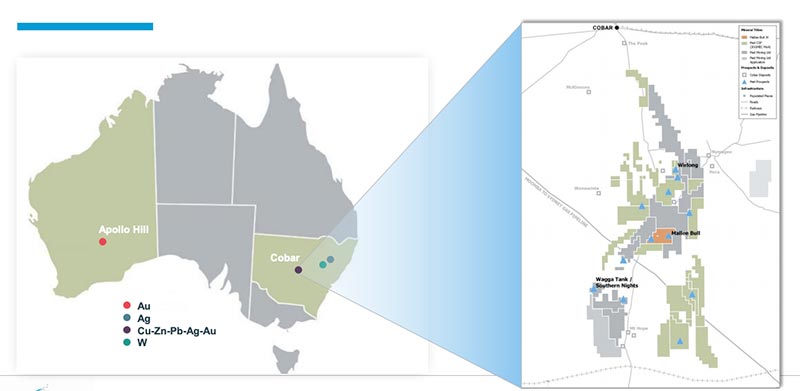

The find came from drilling results at Peel’s “Southern Nights” site in NSW.

The shares jumped from 31c to an intraday high of 45c with about $900,000 worth of shares changing hands.

Peel (ASX:PEX) reckons it’s the highest zinc intercept it has ever reported and — coupled with results from adjacent drill holes — indicates a zone of ”near surface, very high grade mineralisation”.

The 18.2 metre drill intercept also included 15 per cent lead, 1 per cent copper, 350 grams per tonne of silver, and 2.7 grams per tonne of gold – 182m from the surface.

Southern Nights is part of Peel’s Wagga Tank project, which it says is emerging as one of the most significant zinc “polymetallic” (meaning it contains several metals) discoveries in recent years.

Peel bought Wagga Tank – where no significant exploration had occurred since 1989 — in 2016 for $40,000.

About 20,000 metres of drilling is currently underway to help establish JORC mineral resources estimate by mid next year.

JORC refers to the mining industry’s official code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

It is an important step in the process to establish a mining operation in Australia.

The drilling program will also test how deep and wide the mineralised system is.

Peel managing director Rob Tysonsaid the grades were “awe-inspiring, highlighting the prize that the Cobar Basin can deliver”.

“With funding secured and 100 per cent unfettered ownership, Peel can expeditiously drill test this area to better determine or geometry, scale and evident economic potential,” he said.

The company was well funded to continue exploration, holding almost $4m in cash and cash equivalents at the end of September.

Peel’s share price hit a year high 81c in January, but it has been all downhill since then, and sat at a year-low 31c by Wednesday close.