Time is running out for Australia to capitalise on the lithium boom: report

Mining

Mining

Australia has a limited time-frame to position itself as a dominant supplier of lithium before it misses the boat on a $2 trillion-dollar opportunity, says a new report.

The report, released in Perth this morning by industry advocate Association of Mining and Exploration Companies (AMEC), is a call to incite industry and government to get cracking.

“The report establishes that there’s an 18-month to two-year window before the supply chain actually gets set for lithium batteries and battery components, and once that takes place it will be very, very difficult to break into the space,” AMEC CEO Warren Pearce told Stockhead.

“We’ve got an ideal opportunity as a consequence of our geology, which is that we actually have most of these minerals, with one exception, in Western Australia and there’s now an opportunity to try and see what we can push up the value chain.

“It’s just trying to start that conversation about what can we actually do in terms of the big picture stuff.

“If we just leave it to industry and expect them to do all the heavy lifting, we’re going to end up with a very successful mining and extractives operation and it will do very well — but we won’t ever get the value-add and the multiples of economic growth and economic outcome that we could potentially get.”

The lithium industry is forecast to reposition from a second or third-tier industry to a first-tier “strategically important industry central to the world’s economy”, retaining the title for at least the next two decades.

Storing energy in batteries is a rapidly growing disruptor for the entire energy sector, with annual compound growth estimates baselining above 10 per cent.

Some estimates indicate periods of year-on-year growth of 50 per cent peaking in the mid-2020s, according to the report.

Lithium is set to remain the key material component of these batteries “well beyond 2030” because of its availability and chemical ability to efficiently mobilise electrical charge.

Australia could capture 60 per cent of lithium market

The report by Future Smart Strategies predicts Australia is well-placed to capture as much 60 per cent of the global market based on this year’s contracted supply of 24,300 tonnes of lithium.

Australia also has the advantage of being able to rapidly and cost effectively expand production to meet demand, the report concluded.

And it’s not just lithium explorers that can capitalise on the opportunity.

“This new technology boom is going to have flow on effects for cobalt, for manganese, for nickel — all things that are used in the making of lithium ion batteries,” Mr Pearce said.

West Australian mines minister Bill Johnston recently travelled to Singapore, China and South Korea to better understand the demand dynamics of what’s happening in the battery space.

More focus needed downstream

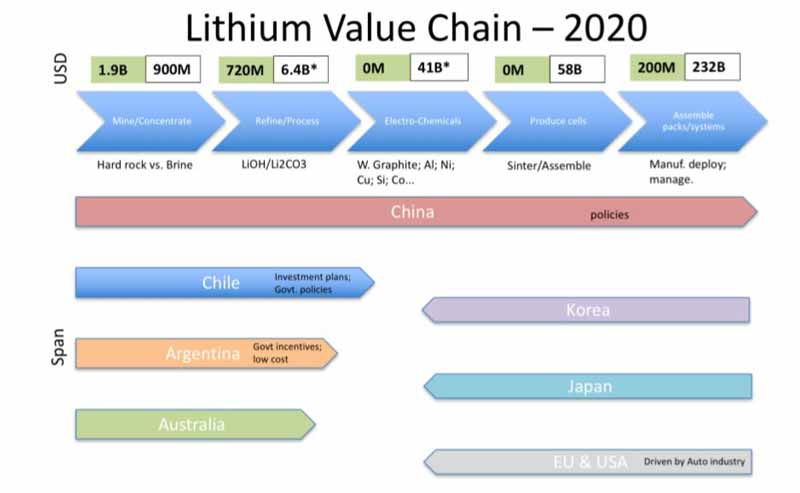

While Australia currently dominates in the mining of lithium, it is yet to take part in the refining, electro-chemicals, production of cells or assembly of finished products.

The 2020 forecast value chain reveals other producing countries, led by China, are ahead of Australia in the transition.

In Western Australia, Chinese-controlled Tianqi Lithium Australia is establishing a downstream processing hub in Kwinana with a second-stage expansion.

However, the report calls for production facilities in other locations such as the Pilbara.

A 20 million tonne per annum facility is estimated to cost US$350 million, which is on par with large plants in Argentina and Bolivia and well below smaller scale plants in Argentina and Finland.

“What we’re trying to do is use this report as a call to action for government and industry to see how we can collaborate together to actually kick goals in this space,” Mr Pearce said.