Aussie oil stocks yet to feel the price pain – but they will

Energy

Oil prices have dropped more than 21 per cent since the start of November, just months after analysts started speculating about the possibility of a return to $US100 a barrel oil.

The impact on Aussie oil stocks is likely to be delayed as right now the market for oil small caps is vibrant, thanks to multiple positive quarterlies based on July-September oil prices.

Only a handful witnessed a share price fall over the last month and almost half are seeing double-digit gains.

>> Scroll down for a list of who’s who in ASX oil.

The real impact is likely to come once the December quarter results begin to roll in.

Right now, the numbers investors are seeing are from the September quarter, when oil prices were hitting record highs.

Eon NRG (ASX:E2E) company secretary Simon Adams admitted as much to Stockhead last week, after their 400 per cent share price rise that came on the back of a revenue bounce for October.

He said they don’t expect November revenue to be quite as good.

What goes up, must come down

Oil prices began to surge from the start of 2018 as production cuts imposed by OPEC on its members a year before began to make themselves felt.

But before the excitement could translate into more cash for exploration in Australia, the price began to fall again.

Since the start of November the two main global oil prices have fallen dramatically.

US-focused West Texas Intermediate was just over $US50 ($69) a barrel on Monday, down 23 per cent this month.

The North Sea oil marker, Brent, was hovering just over $US59 and down 21 per cent this month.

On Friday, crude prices saw their largest one day fall since July 2015.

It’s all on the US

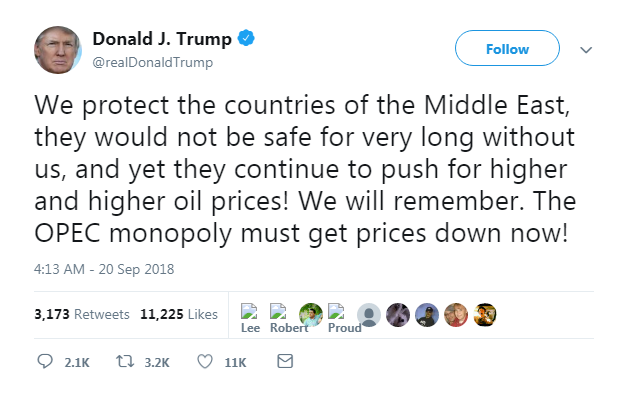

All signs point to the US being the root cause — but not because of President Donald Trump’s threats towards Saudi Arabia to keep prices down.

The price fall is partly due to a surge in US production to record levels, and partly due to lower than expected demand in October.

Energy researcher Wood MacKenzie says US monthly production was 11.65 million barrels a day in September and similar in October, beating Saudi Arabia’s nearly 11 million barrels a day and Russian production of 11.4 million a day.

It’s a flood of oil so large that some analysts are sceptical that quiet plans for the OPEC meeting on December 6 to cut production may not make much difference.

The US Energy Information Administration (EIA) estimates that in 2019, oil production in the US will average 12.1 million barrels a day.

Inventories in the US are rising, too, as lower global demand in October combined with high production by the US and Saudi Arabia.

Inventories in the US grew by 4.9 million barrels in the week to November 16, and by more than 10 million barrels the week before.

| Ticker | Name | Price Nov 26 | 1 month % change | 6 month % change | Market Cap |

|---|---|---|---|---|---|

| SEA | SUNDANCE ENERGY AUSTRALIA LT | 6c | 57 | 30 | 385m |

| E2E | Eon NRG | 1.7c | 183 | 70 | 7.3m |

| HZN | HORIZON OIL | 11c | 33 | 33 | 137m |

| TPD | TALON PETROLEUM | 0.3c | 33 | 33 | 3.8m |

| AOW | AMERICAN PATRIOT OIL & GAS L | 2c | 27 | 16 | 13.5m |

| TEG | TRIANGLE ENERGY GLOBAL | 7c | 26 | 45 | 15,4m |

| ABL | ABILENE OIL AND GAS | 0.4c | 25 | 50 | 1.6m |

| FDM | FREEDOM OIL AND GAS | 15c | 24 | 93 | 156m |

| BRK | BROOKSIDE ENERGY | 1c | 23 | 0 | 12.9m |

| IPB | IPB PETROLEUM | 3c | 23 | -15 | 5.2m |

| ATS | AUSTRALIS OIL & GAS | 35c | 21 | 16 | 314m |

| GBP | GLOBAL PETROLEUM | 3c | 20 | 10 | 6m |

| BYE | BYRON ENERGY | 23c | 17 | 52 | 159m |

| KEY | KEY PETROLEUM | 1c | 17 | 33 | 8.4m |

| TDO | 3D OIL | 9c | 14 | -29 | 24.4m |

| OEL | OTTO ENERGY | 5c | 14 | 41 | 93.5m |

| MAY | MELBANA ENERGY | 2c | 13 | -20 | 28.1m |

| BUL | BLUE ENERGY | 6c | 12 | 116 | 68m |

| COE | COOPER ENERGY | 43c | 12 | -12 | 680m |

| EXR | ELIXIR PETROLEUM | 4c | 9 | 57 | 11.8m |

| BRU | BURU ENERGY | 23c | 9 | 65 | 99.3m |

| CVN | CARNARVON PETROLEUM | 35c | 9 | -60 | 417m |

| FPL | FREMONT PETROLEUM CORP | 1c | 8 | 50 | 6.8m |

| 88E | 88 ENERGY | 2c | 6 | 139 | 108m |

| ELK | ELK PETROLEUM | 6c | 3 | 21 | 99m |

| WBE | WHITEBARK ENERGY | 0.3c | 0 | 117 | 4.7m |

| BUY | BOUNTY OIL & GAS NL | 0.4c | 0 | 50 | 3.8m |

| TMK | TAMASKA OIL & GAS | 0.2c | 0 | 50 | 3.9m |

| BAS | BASS OIL | 0.4c | 0 | 0 | 10.4m |

| TAP | TAP OIL | 9c | -1 | -18 | 39m |

| PSA | PETSEC ENERGY | 13c | -4 | -12 | 42m |

| HE8 | HELIOS ENERGY | 15c | -7 | -59 | 212m |

| KPL | KINA PETROLEUM | 9c | -12 | -16 | 33m |

| PCL | PANCONTINENTAL OIL & GAS NL | 3c | -17 | 33 | 16m |

| WEL | WINCHESTER ENERGY | 4c | -17 | 29 | 10m |

| ICN | ICON ENERGY LIMITED | 2c | -17 | 4 | 14m |

| JPR | JUPITER ENERGY | 5c | -23 | 26 | 8m |

| OEX | OILEX | 1c | -33 | -50 | 1.4m |

| LKO | LAKES OIL NL | 0.2c | -50 | 50 | 61m |