Auroch kicks off landmark project studies at Nepean, Saints nickel projects

Mining

Mining

Advanced nickel sulphide play Auroch has launched scoping studies – the first proper look at whether a project is economic to build — at both its Nepean and Saints projects in WA.

The studies will evaluate several mining scenarios at Nepean, including an initial open pit mine “which could generate significant cash flow in the short to medium term”, as well as potential underground mining scenarios.

A scoping study of potential underground mining scenarios at Saints – which currently hosts a high-grade resource of 1.05 million tonnes at 2% nickel and 0.2% copper for over 21,000t nickel — will be run in parallel to the studies at Nepean.

Auroch Minerals (ASX:AOU) has an existing offtake agreement in place for Saints with BHP Nickel West (ASX:BHP), whilst high-grade ore from the historic nickel mine at Nepean, when in production, was processed at the Kambalda Nickel Operations (KNO).

BHP is currently preparing to restart KNO early next year.

The scoping studies may lead to nickel sulphide production and cash flow in the medium term, Auroch managing director Aidan Platel says.

The timing is perfect.

“With the nickel price consistently around US$19,000/t and forecast to increase, we believe there is great potential to take both projects forward to production and hence generate significant cash flow for the Company in the medium term,” Platel says.

“We have developed a good relationship with the processing team at BHP and have an existing off-take with them for Saints, so we are keen to develop this further and to potentially build a solid business case to provide high-grade nickel sulphide feed for their processing facilities to produce Class 1 nickel products required for batteries for the fast-growing electric vehicle (EV) market.”

Parallel to these studies, Auroch continues with aggressive exploration for a new nickel sulphide discovery across all three of its WA nickel projects.

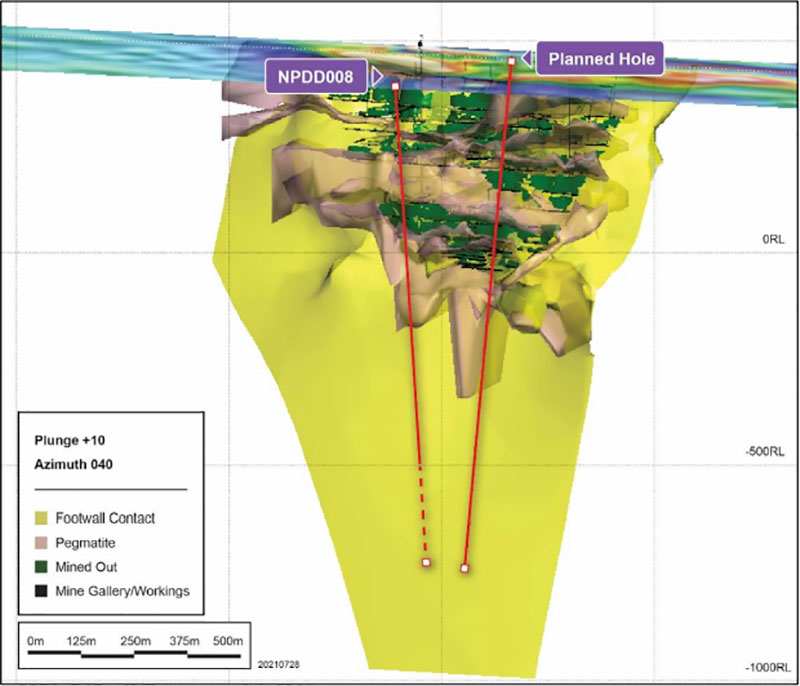

“Our exciting Nepean Deeps diamond drill programme beneath the historic Nepean nickel mine is currently underway, with the first hole NPDD008 on target and on schedule at a depth of ~400m,” Platel says.

“The hole is planned to reach a depth of 1,200m and we look forward to keeping the market informed of its progress.”

The Nepean mine in WA was the second producing nickel mine in the country and produced over 32,202 tonnes of nickel metal at an average recovered grade of 2.99% until very low nickel prices below $US4,000/t in 1987 forced production to halt.

Historical mine workings also ceased after encountering a large cross-cutting pegmatite intrusion about 500m below surface.

Auroch will drill the first two holes to test the all-important projected footwall position for potential nickel sulphide mineralisation about 400m below the underground workings.

The first drill hole is expected to reach target depth in two to three weeks.

This article was developed in collaboration with Auroch Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.