Auric on the board with barnstorming first quarter performance

Mining

Mining

Auric Mining is celebrating a dominant first quarter as an ASX-listed explorer, having hit the ground running since coming on the market in February.

The gold explorer’s maiden quarterly report tells the story of Auric’s (ASX:AWJ) quick start in its first few months of listed life – completing a maiden reverse circulation drill program, announcing mineral resource estimates for two projects and uncovering a previously unrecognised zone of mineralisation.

It’s progress which is sure to make observers take note – this is not a company about to sit on its hands.

Updates for the three Auric projects – all in WA’s goldfields – are as follows.

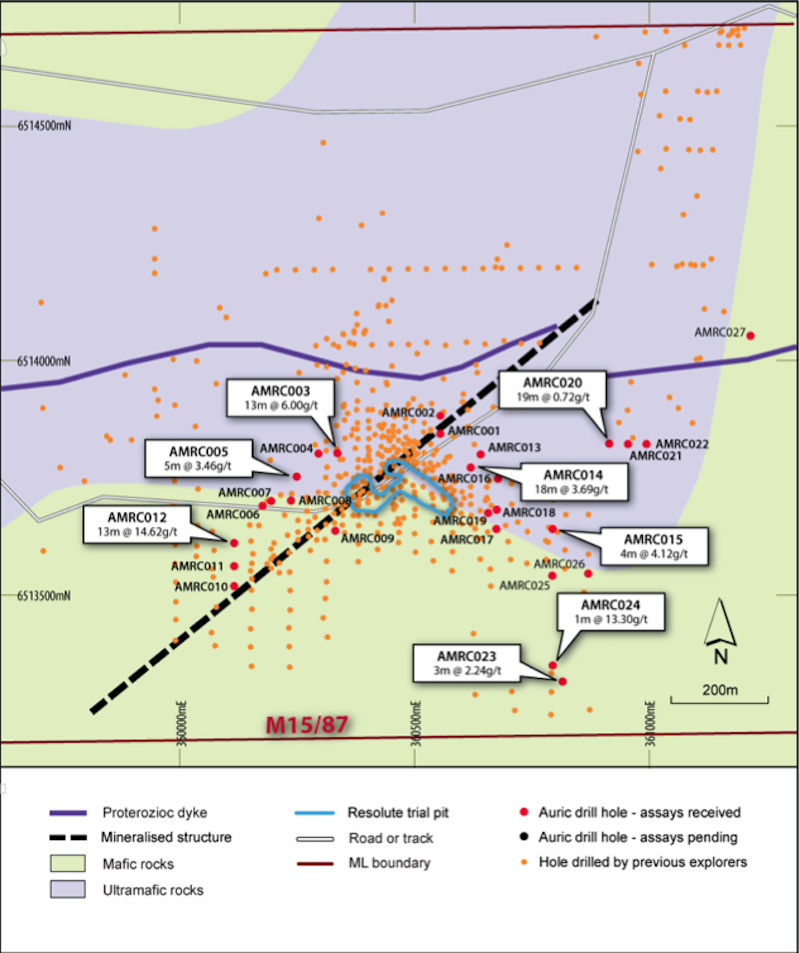

The Munda gold project has been the subject of a number of exploration and resource drilling programs since the 1960s and was even the site of a small trial pit by Resolute Mining in 1999, but the most recent work by Auric may be the most promising of the lot.

Drilling during the quarter delivered some standout intercepts at Munda, where a 27-hole program was carried out for a total of 3664m to test potential extensions to known mineralisation.

Significant assays reported from Munda include the following:

Auric said the intersections reported in AMRC014 were on the margin of the current resource model, with further drilling needed to test the potential extension of mineralisation down dip.

At present, the inferred mineral resource estimate for Munda is 3.77 million tonnes at 1.43g/t for 173,000 ounces of gold at a 0.5g/t cut-off.

Outside of this, a broad zone of shallow mineralisation was hit in AMRC020 around 200m northeast of the known resource zone at Munda, which the company believes could represent a previously unrecognised zone of mineralisation.

That hit came in at 19m at 0.72g/t gold from just 26m. Auric said further drilling was also needed here to confirm the potentially mineralised area.

Munda is around 5km west of the settlement of Widgiemooltha, where Auric has focused its exploration efforts.

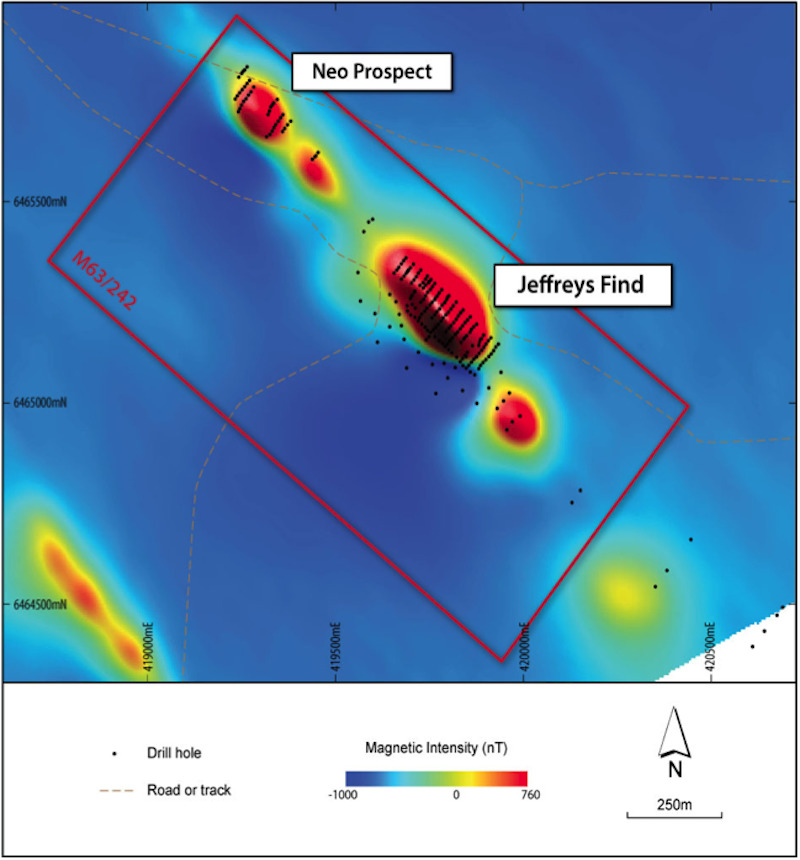

At Jeffreys Find, around 45km northeast of the town of Norseman, a current indicated and inferred mineral resource has been defined of 1.22Mt at 1.22g/t for 47,900oz gold at a 0.5g/t cut-off.

The mineralisation includes the Jeffreys Find deposit and the Neo prospect, around 550m northwest of the former. The mineralisation is associated with a moderately south-westerly dipping banded iron formation (BIF) unit which is distinctive in magnetic images over around 1.6km.

The BIF comprises magnetite-grunerite-chert and is bounded by sandstones, siltstones, cherts and limestones.

Exploration carried out at Jeffreys Find since the discovery of its namesake deposit has been dominated by RC drilling, with comparatively minor amounts of diamond drilling or explorative rotary air blast drilling.

The majority of this work was undertaken in the 1980s by then-owner Carpentaria Exploration, with some additional work carried out by Red Back Mining in the 90s.

The project was purchased by Auric from Mincor Resources in September last year, and during the quarter AWJ made an application for a miscellaneous licence for the purpose of a haul road and other infrastructure.

This would allow the company to link the tenement area to the Eyre Highway – around 14km away.

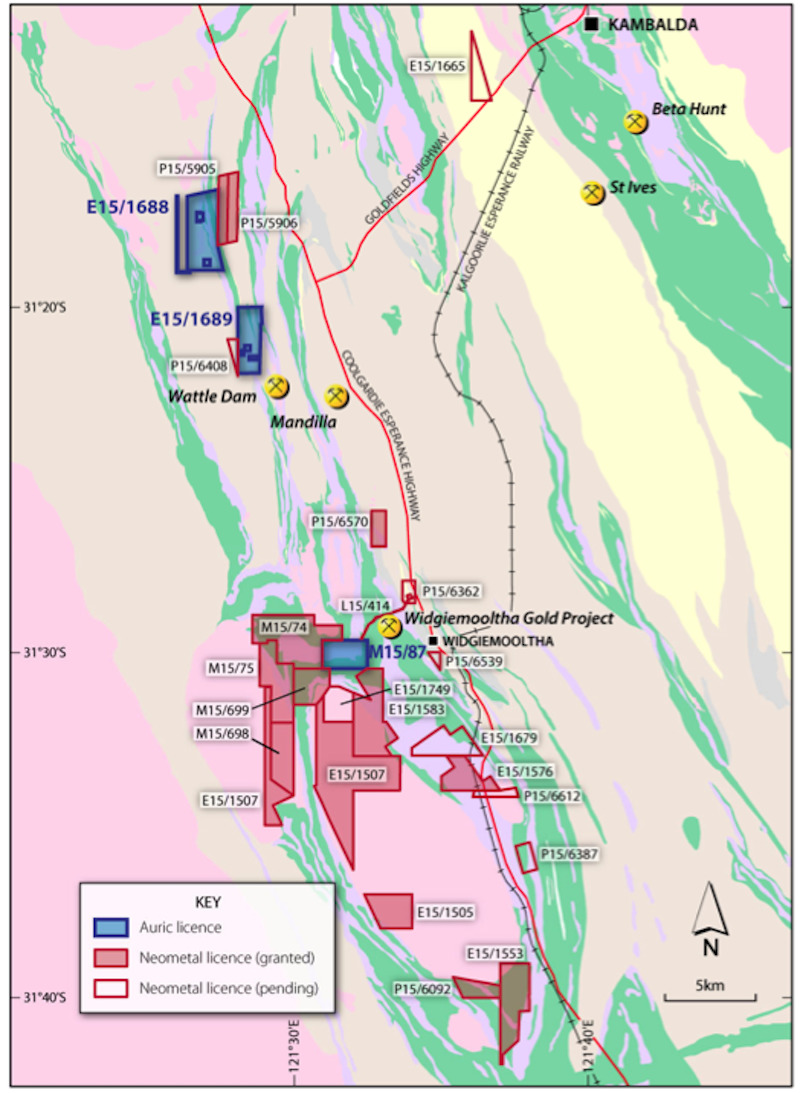

Auric has undertaken a series of soil auger samples at Spargoville, which sits 4km west of the Coolgardie Esperance Highway and 35km southwest of Kambalda on one granted exploration licence and one licence in application.

These were in follow up to work done by previous explorers which identified several gold anomalies only partially tested by drilling at Spargoville, including the Fugitive prospect, where previous aircore and RC drilling returned a number of mineralised intercepts at a 0.5g/t gold cut-off, including 25m at 1.67g/t from 44m.

A total of 285 samples were taken during the quarter just gone at nominal spacings of 100m by 25m. The program was designed to infill auger sampling undertaken by Breakaway Resources between 2003 and 2005, where gold anomalism had been demonstrated.

The samples have since been submitted to MinAnalytical – a lab with sample preparation facilities in Kalgoorlie, and analyses undertaken in Perth.

Assays for the Spargoville samples are pending.

Having hit the ground running after listing on February 12, Auric got off to a promising start at all three of its WA-based gold exploration projects in the first quarter – and there’s more strong form on show at early in the second.

On April 19, the company announced plans to acquire 100% of gold rights across certain tenements held by Neometals (ASX:NMT) in the Widgiemooltha area.

It was an acquisition which expanded Auric’s gold exploration footprint in the area by a massive 1800%, from 4.7km2 to 91km2, in what is a proven gold production region.

That’s some serious metres gained.

Many of the tenements are proximate to Spargoville, and the consideration to Neometals is $700,000 worth of shares at a volume-weighted average price of 20.41c each, along with cash of $200,000 and a 1% gross royalty on tenement E15/1583.

Speaking at the time, Auric managing director Mark English said the acquisition would rapidly accelerate the company’s Widgiemooltha growth strategy.

“It was always our stated plan to increase our tenement footprint in the tier one mining region of Widgiemooltha,” he said.

“This gold rights acquisition has achieved this for our shareholders. We are now funded to commence exploration on prospective tenements within the package.

“Neometals will become a top-10 shareholder in Auric. We look forward to exploring the larger footprint in the Widgiemooltha area.”

With wider expanses to work in and some great leads to build on, Auric looms as one to watch as the year progresses.

This article was developed in collaboration with Auric Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.