You might be interested in

News

Closing Bell: Geopolitical tensions, China's economy roil the ASX as Aussie dollar trades below US65c

News

ASX Small Caps Lunch Wrap: Which utterly stupid word has been named Word of the Year today?

News

Oil and gas play Empire Energy has taken offence to suggestions by the ASX that it has breached “the spirit of the listing rules” by setting two issue prices for a $1.9 million placement.

“We do not agree and take our compliance with the ASX listing rules seriously,” the US-focused explorer told investors today.

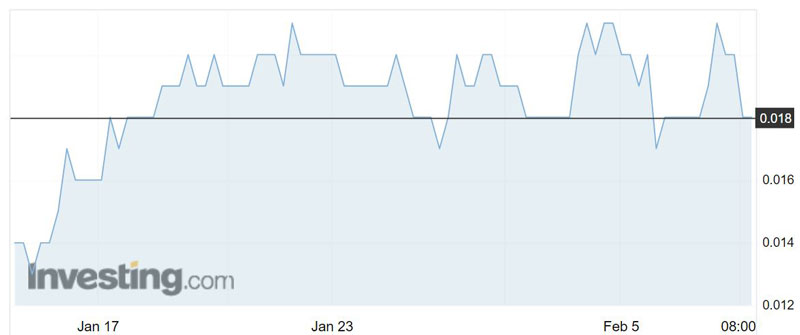

Empire shares (ASX:EEG) slipped as much as 15 per cent to 1.7c just after the market open on Tuesday, but recovered to be steady at 2c by the close.

On Monday Empire announced it would undertake a placement of two equal tranches of 75 million shares each priced at 1.09c and 1.41c, respectively, which equates to an average price of 1.25c.

Empire said, however, the ASX had raised concerns with the two prices set for the placement to sophisticated and institutional investors.

“The ASX has not suggested we have breached any listing rule but rather the spirit of the listing rules,” the company noted.

To appease the Australian bourse, Empire has decided to set one issue price of 1.25c for both tranches of the capital raising.

The company is raising the cash to fund its obligations over its Northern Territory tenements, continue its hunt for a farm-out partner, strengthen its management team and for working capital.

Empire said on Monday the placement was oversubscribed but would be scaled back.