You might be interested in

Mining

Resources Top 5: Ramelius has a golden quarter, while PEC flexes in Lithium Valley

Mining

Resources Top 5: Many Peaks triple bags (and some) on acquiring Predictive Discovery gold project

Mining

Mining

It’s quarterlies season and the ASX market announcements page has become increasingly flooded with lodgements.

To save you the trouble of trudging through, we’ve wrapped up the highlights from some of the reports that caught our eye today.

The company says construction of the Norseman gold project in WA is nearing completion with first gold production expected in the September 2022 quarter.

Mining is progressing well ahead of the production start-up planned for late August 2022 and an extensive grade control program completed at the Green Lantern pit has confirmed the Green Lantern Mineral Resource model in the first 50 vertical metres.

Plus, the company secured US$21.5 million credit facility with Nebari Partners LLC (Nebari) to fund JV Activities.

During the June quarter, the company continued to maintain exploration at a high tempo across its projects in South Australia’s mineral endowed Gawler Craton, which is also home to BHP’s giant Olympic Dam mine.

Drilling continued at Horse Well, where top grades of up to 12.15% copper, 2.62g/t gold and 42.5g/t silver have been intersected to date.

The company recently identified a major mineralised fault zone and gained approvals for 12 drill holes.

Over at Warriner Creek holes targeting iron oxide-copper gold (IOCG) deposits concluded with assays pending, including analysis of rare earth element potential.

Cohiba is also testing for Zambian Copper Belt style mineralisation at Pernatty C – where significant zinc results have been returned – under a program co-funded by the South Australian Energy and Mining Department’s Accelerated Discovery Initiative.

It will also develop an exploration model on the potential feasibility to exploit this discovery.

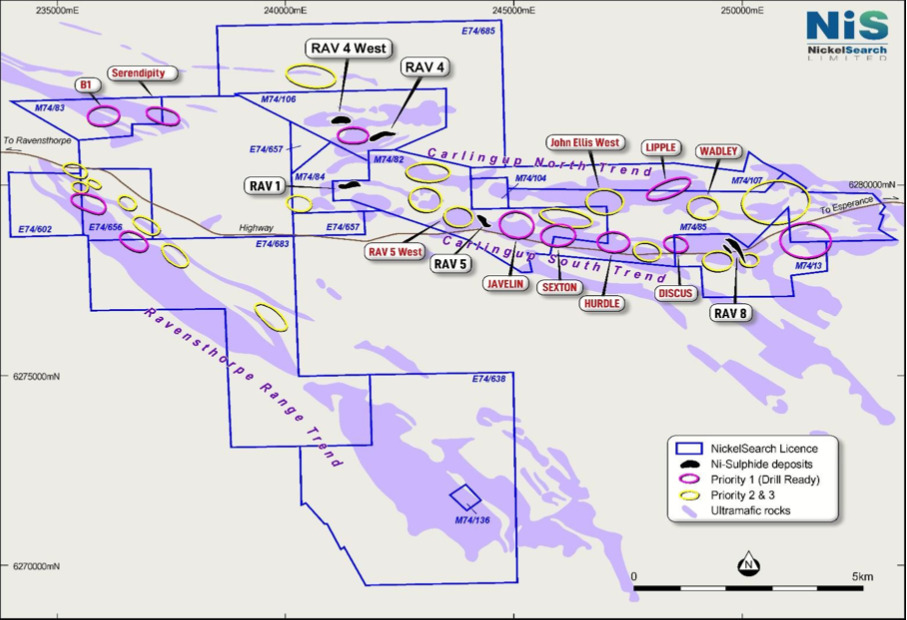

The nickel player completed a nickel sulphide targeting study over 30 greenfield exploration targets across the total Carlingup Nickel Project tenement package in WA, with 11 Priority 1 targets identified.

A large diameter diamond drill program at RAV8, RAV4 West and RAV1 was also completed, “which will add significantly to our understanding of each deposit as well as providing critical samples of both high-grade massive sulphide and lower grade disseminated nickel to establish the best processing routes going forward,” the company said.

NickelSearch also completed maiden drilling at Carlingup during the quarter and plans to issue an update to its Mineral Resource statement in Q3 CY2022.

Alvo wrapped up Fixed Loop Electromagnetic (FLEM) surveys across the Palma Project in Brazil at C3, C3 West, Macaw and Mafico – and says it highlighted multiple new potentially mineralised VMS conductors.

Plus, final assay results from phase 1 diamond drilling at C3 delivered high-grade polymetallic widths and grade including 15.0m at 2.89% copper, 4.41% zinc, 0.33% lead, 29.80g/t silver and 0.09g/t gold from 71m.

Drilling at new prospects Macaw, Mafico and C3 West is planned for Q3 CY2022 based on historical work and new FLEM surveys.

The company picked up the South Dakota Project (in South Dakota, USA) during the quarter, which is prospective for hard rock lithium.

Notably, it contains the Dewy and Custer projects represent large areas of fertile lithium-caesium-tantalum (LCT)-pegmatites covering several historic lithium mines and numerous historical industrial mineral pegmatite mines.

Iris is also in the process of enlarging the South Dakota footprint, actively staking further claims it considers “strategic, complementary, and accretive” to its existing tenure with the help of in-country consultant RLL.

PACIFIC NICKEL MINES (ASX:PNM)

During the quarter, PNM signed a non-binding, indicative term sheet with a subsidiary of Glencore for a US$22m senior secured debt facility and 4+2-year nickel laterite Direct Shipping Ore (DSO) offtake agreement for all of its Kolosori’s nickel laterite production in the Solomon Islands.

Work continued on the DFS and planning for construction of the wharf, haul road linking the mining areas, camp and mining facilities was undertaken.

Preparations are underway to construct a second field trial stockpile for detailed assessment of the DSO drying characteristics, and the company says the DFS will be finalised once a LiDAR survey and moisture content assessment have been completed.

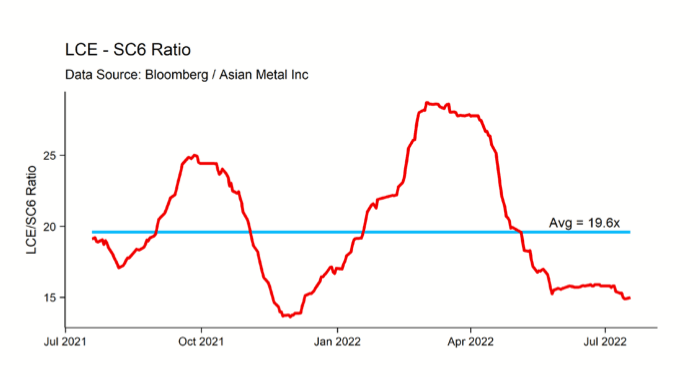

During the quarter, PAM Reported an inaugural Mineral Resource Estimate for the Reung Kiet Lithium Project in Thailand of 10.4Mt at 0.44% Li2O for approximately 113,000t contained LCE.

Infill and extension drilling is ongoing with an updated Mineral Resource Estimate scheduled for later this year, which will form part of the scoping study that will consider production of 10,000t LCE for 10 years plus – also due later this year.

The company finished the quarter with $4.6m cash.

The company raise $30m during the quarter and has has continued its Austrian operations while monitoring changing COVID-19 rules within the European Union.

Technical work for the Definite Feasibility Study (DFS) has been completed for the Wolfsberg lithium project, and advanced financial planning work is continuing.

The company says “significant” supply chain issues are being experienced globally, shortages that impact the executable project rollout within Europe, increasing inflation rates and unexpected high prices for consumables including energy and chemical reagents are being reviewed for integration into the final DFS which may delay the anticipated completion date for the DFS into the fourth quarter of 2022.

The company flagged sales revenue of $4.36m and operating cash flow of $2.375m during the quarter, with production totalling 170,171oz silver and 170oz gold – with first silver poured at the Wonawinta project on 27 April.

This makes the company the only primary silver producer on the ASX, with positive cash flow and profitability expected over the September quarter.

MKR says silver production was slow to ramp up, but the plant is currently running at steady state production levels of 100t/hr with the production target rate remaining at 150,000oz per month.

Caeneus drilled 14 RC holes at the Pardoo project in WA in the quarter, with 1,870 samples sent for geochemical analysis and two targets generated (T1-T2).

Plus, the company says drilling results received to date indicate a large, mineralised nickel-cobalt-copper-palladium system, open down-dip and along strike to the east and west.

A metallurgical specialist in nickel sulphide flotation has now been engaged to conduct test work on recent drill samples including both fresh and oxide domains.

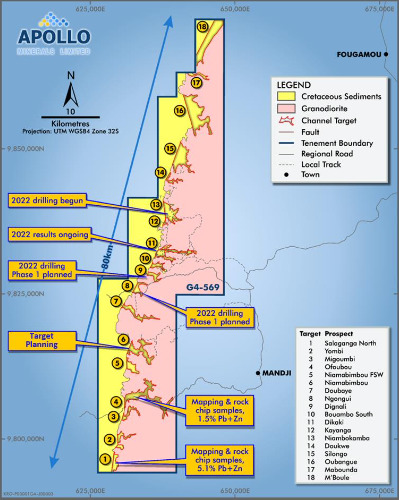

The company has doubled the Eastern Dikaki high-grade zone at its Kroussou zinc-lead project in Gabon, with broad step-out drilling showing mineralisation is now defined over 500m and open along trend.

Results included 10.6m at 3.5% zinc and lead from 25.5m and 19.0m at 3.7% zinc and lead from 39.4m.

Apollo also flagged base metal grades of up to 5.1% zinc and lead returned from surface rock samples at Target Prospects 1 and 4.

Two diamond rigs are currently active on regional targets with further results expected in due course, plus a regional airborne electromagnetic (AEM) survey over the 80km of prospective strike length at the project is substantially complete with results expected in the September quarter.

During the quarter the company says it achieved gold production of 26,654oz and 25,908oz of gold poured at its Okvau Gold Project.

Process plant throughput continues to perform at over 9% above 2.0Mtpa DFS targeted nameplate rate and the company says mining operations remain on schedule and in line with milling requirements.

The All-In Sustaining Cost (AISC) was US$794/oz for quarter, however, Emerald says the AISC forecast for the 2023 financial year has increased slightly, in line with (predominantly) increasing fuel and explosives costs to US$740 – US$810 with guidance for gold production remaining at 25-30koz per quarter.

All assay results from the Cerro Verde Prospect (Dynasty Project) in Southern Ecuador have confirmed the potential for considerable additional epithermal gold and silver mineralisation.

And a revised program of geological mapping and geochemistry has highlighted the potential for Dynasty to also host a large-scale porphyry system in addition to gold and silver epithermal system/s.

At the Linderos Project (also in Southern Ecuador), a classic 750m wide doughnut-shaped porphyry anomaly has been defined by soil geochemistry at the Copper Ridge prospect – with initial drilling now approved.

Also at Linderos, the Meseta gold prospect is “shaping up to be a significant high-sulphidation epithermal gold system,” the company says.

At Stockhead we tell it like it is. Cohiba Minerals, Nickelsearch, Alvo Minerals, Iris Metals, Pan Asia Metals, European Lithium, Caeneus Minerlals, Apollo Minerals, and Titan Minerals are Stockhead advertisers, they did not sponsor this article.