Aligned stars and blue skies: why Boadicea could take flight in 2021

Mining

Mining

When Boadicea Resources first listed on the ASX in 2012, it watched its share price soar from the IPO price of 20c to above 60c on day one.

That movement came on the back of the then-recent discovery by Sirius Resources of the Nova-Bollinger nickel deposit now owned by Independence Group (ASX:IGO). That discovery sent the region into a frenzy and share prices soaring.

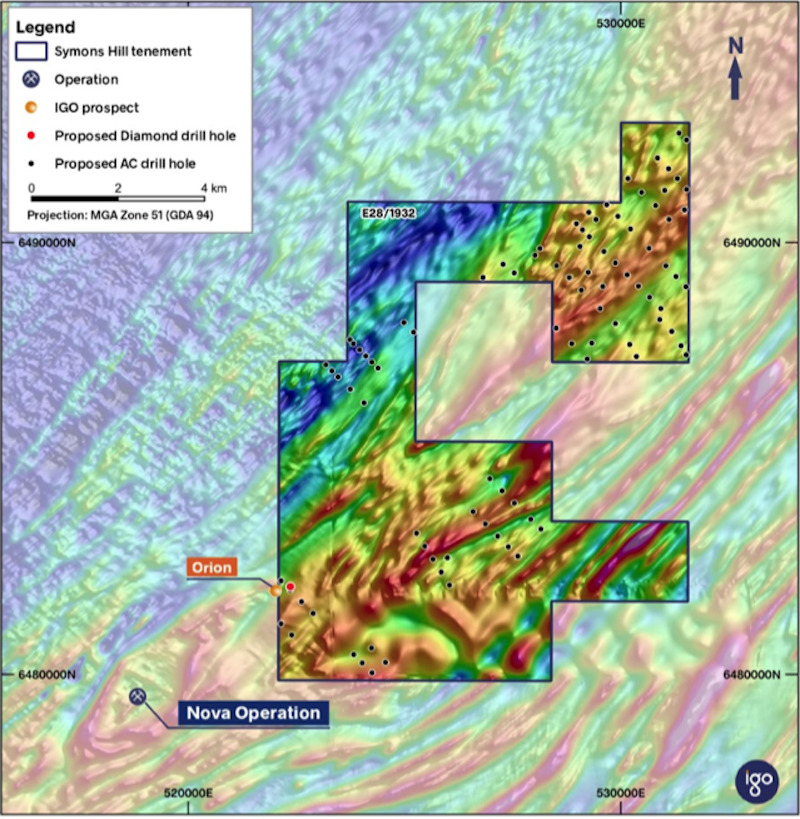

Boadicea (ASX:BOA) has owned the neighbouring Symons Hill project to the northeast of Nova-Bollinger since then. As of April 2021, it still does. With a new management team taking over the reigns and if things go according to plan that could change.

In September last year, neighbouring IGO came calling with a $7 million deal to exclusively explore Symons Hill, as well as eight other Boadicea tenements in the Fraser Range, over a period of five years.

Under the terms of that deal, if IGO finds a deposit and produces a JORC-compliant resource on any of those tenements, a $50 million sale agreement would be triggered and the tenements change hands.

Boadicea would also be entitled to a 0.75% net smelter royalty from the material mined in its area.

“Any sort of drilling IGO does in the area, any geophysics, geochemistry or drilling, we will be releasing to the market as part of our continuous disclosure and all of this activity is 100% paid for by IGO,” Boadicea managing director Jon Reynolds told Stockhead.

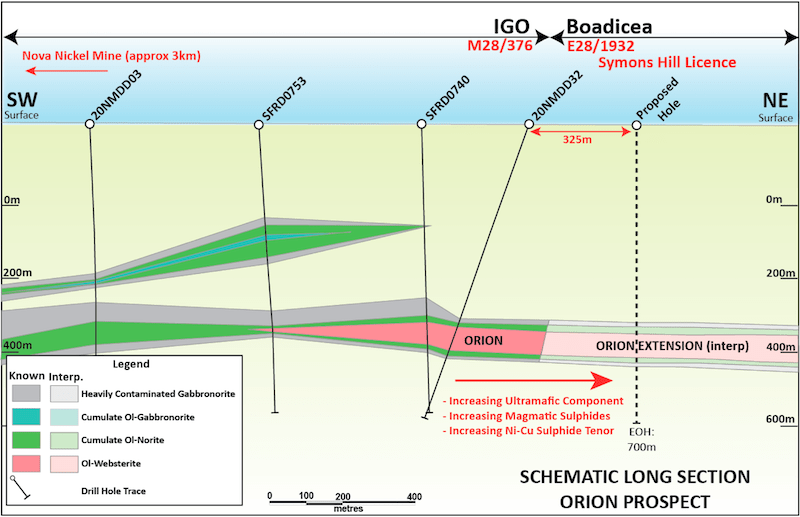

The news will be watched with interest from all parties. Symons Hill is located directly adjacent to Orion – the exploration prospect ranked highest of all by IGO in the Fraser Range. Orion is located only 3 km from the Nova Nickel mine.

IGO has been drilling Orion since the start of the year, putting multiple holes into it to within 25m of the Boadicea licence boundary.

“Blebby, multiphase magmatic sulphides (pyrrhotite-pentlandite-chalcopyrite) are present in the intrusion, with sulphide content increasing towards the northeast toward the Symons Hill licence,” IGO said in a recent report.

A look at the long section gives a pretty good indication as to why there’s some excitement at play.

Next month, the proposed hole in the above will be drilled on Boadicea’s tenement, to follow the highly prospective Orion intrusion interpreted by 3D seismic data.

IGO is also planning a large moving loop electromagnetic survey (MLEM), which will test the extent of the Orion intrusive complex for massive sulphide-related conductors.

MLEM surveys are planned for other BOA land, including the exciting Transline and South Plumridge tenements, which are located near Legend’s Mawson discovery, while three aircore drill programs will be carried out during Q2 at Transline North and South and Symons Hill.

Talk about a program of work. Boadicea won’t have to put up a cent.

While its position in the Fraser Range is a remarkable one to be in, it does also have its limitations in terms of what it can deliver for Boadicea.

Free-carried regular newsflow in a hot commodity space followed by $50 million and an NSR should a resource be defined is nothing to sneeze at, but the payment is ultimately capped at $50 million + NSR with a resource. No more, no less.

This was front of mind for Boadicea management when negotiating the IGO deal over the Fraser Range tenements. Having watched the stars align with Orion in the south of WA, the company set about finding a project with blue sky potential.

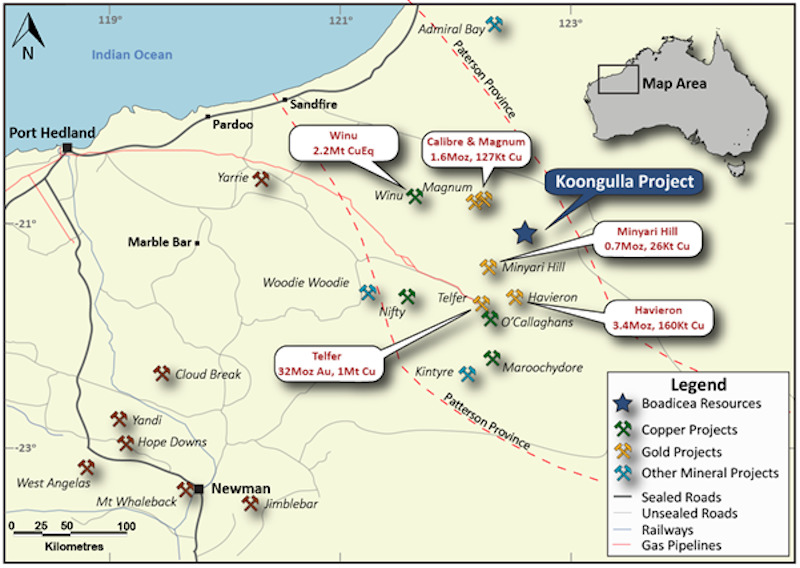

It turned its attentions to the blue skies of WA’s north. The Paterson Province, where a number of significant copper-gold projects have sprung up over many years, would prove to be that place.

The company acquired 95% of the unexplored Koongulla project from a vendor for the bargain price of $15,000 and a 5% free carry of costs until a decision to mine. Boadicea’s project also spans two tenements under application, with a combined total area of 612km2.

Have a look at some of the projects in the vicinity.

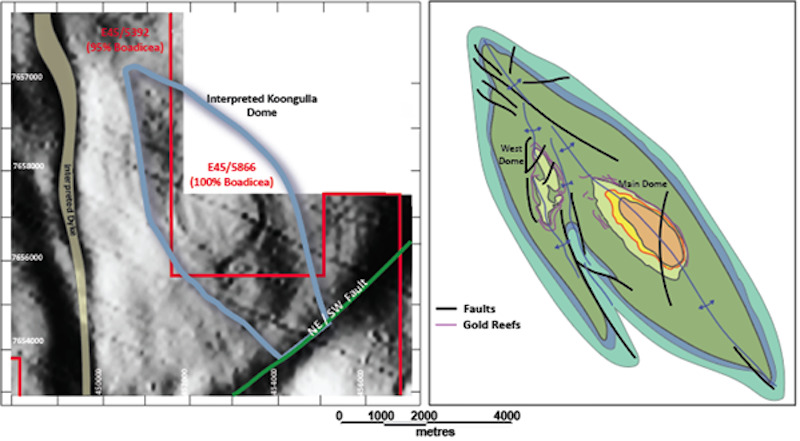

It’s more than nearology. In March, Boadicea announced that airborne geophysics over Koongulla had interpreted a dome structure on the project – similar to that which ultimately revealed the 30-million-ounce Telfer deposit down the road.

The dome was interpreted to be shallower than anticipated on the eastern side of the Paterson, at around 200-250m of cover, and five potential exploration targets were defined for copper-gold mineralisation at Koongulla.

“Dome features are the primary source of mineralisation concentration in the Paterson,” Reynolds said.

“Telfer is a dome, so is Calibre, Magnum. Antipa and Rumble Resources – they’re all focused on dome features.

“Our dome feature is about the same dimensions as Telfer and has the same orientation of about 7km long and 3km wide. I’m not saying we’ve got a Telfer, but we’ve got something that’s quite exciting and worth following up.”

Boadicea is planning a gravity survey and progressing heritage survey and native title agreements at present, with hopes of drilling later in the year.

“It’s early days, but we’ve got something there that indicates a mineralisation focus, a pathway and the money to drill it,” Reynolds said.

“There’s a lot of potential in the ground there.”

In addition to its Koongulla project, Boadicea also added the Clarke Reward project to its books in February.

Named for the company’s esteemed founding CEO and chairman Clarke Dudley, who passed away suddenly in 2020, Clarke Reward is 17km west of the Mt Coolon gold mine and is based on a large isolated circular magnetic anomaly identified in geophysical data.

The target is currently under application, with a licence expected soon.

This article was developed in collaboration with Boadicea Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.