Alicanto says its multi-target Swedish monster is ready to roar…. and starting to stir interest in the North American Funds

Mining

Mining

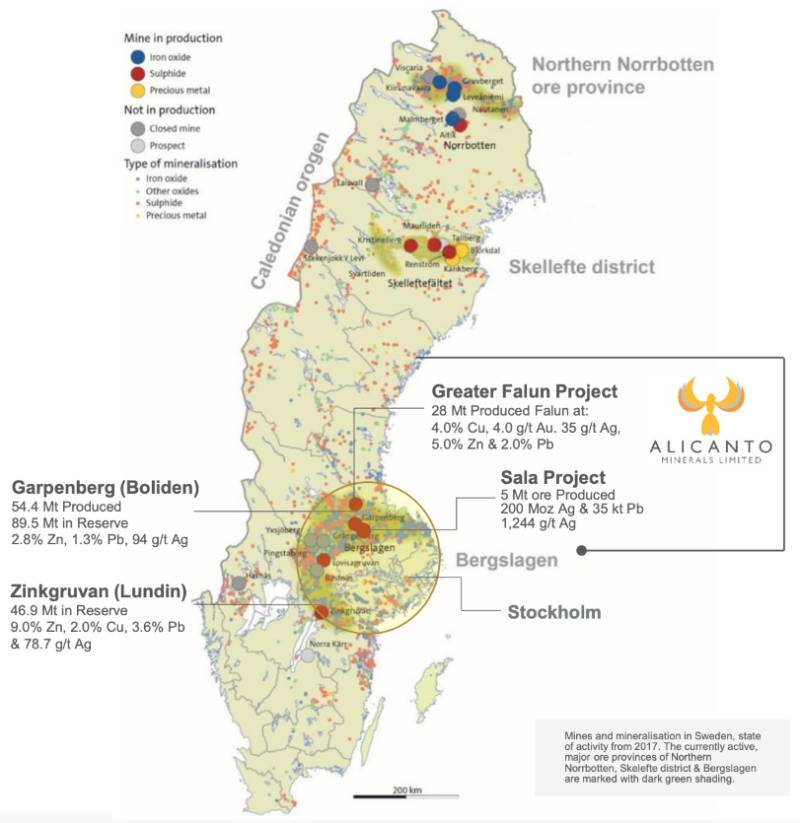

Location: deep in the mineral rich Bergslagen, Sweden. Alicanto straddles the Sala Project, its 2021 high-grade silver-zinc-lead acquisition which has set the 2022 stage for a much anticipated year of growth.

Alicanto snapped up the project – previously one of Europe’s largest and highest grade mines having already yielded some 200Moz of silver at an average grade of 1,244g/t – backing the belief there was still plenty left to discover.

And drilling by Alicanto Minerals (ASX:AQI) and previous operators have since proven this belief to be true, with assays returning exceptional wide, high-grade results such as:

The exceptional results follow the Swedish Geological Society releasing to the company 12,225m of shallow, historical drilling never previously viewed in the public domain.

Within this package was a previously unknown zone about 200m southeast of the Prince Lode with an intercept of 87m @ 5.3% zinc and 40 g/t silver further backing the potential of the Sala project to host significant resources.

Even better – half of these historical assays are located within the Stage 1 resource target area, saving AQI circa 5,000m of drilling cost and time, while the remaining assays will give the Stage 2 program a head start.

Investors have already begun aligning themselves with the project’s prospectivity, with North American and Australian large institutional investors snapping up $7m worth of AQI shares in a private placement that closed last month.

Sala will soon confirm proof-of-life with the company expecting to deliver a maiden resource estimate in the first quarter of 2022.

While Sala has proven to be remarkably successful, it’s not the only card on Alicanto’s table.

The company also owns the nearby Greater Falun project – producer of some 28 million tonnes of high-grade copper-gold-rich polymetallic ore over the best part of a millennium.

Incredibly (and despite over a thousand years of evidence where Falun has yielded):

AQI now says the mine is not what it seems.

Alicanto believes previous interpretations of Greater Falun as a volcanogenic massive sulphide system are just plain wrong, positing instead that the project is actually a monstrous skarn-hosted system.

While most of its activities in 2021 have focused primarily on Sala, the company has certainly not forgotten about its older project.

Besides already returning some intriguing drill results, AQI says it’s already carried out field work, submitting applications for a potential drilling program in 2022.

Both Sala and Greater Falun projects are located in the Bergslagen region of Sweden, a Tier-1 mineral belt which hosts Boliden’s massive Garpenberg mine and Lundin’s Zinkgruvan.

Speaking to Stockhead, Managing Director Peter George boiled the focus of 2022 down to the top five: silver, zinc, lead, copper and gold.

“With a good mix of precious and base metals – Alicanto’s not reliant upon one particular metal,” he noted.

“Our view is that the fundamentals haven’t changed in all of these metals with inflationary pressures traditionally having a positive impact on the precious metals and demand for base metals likely to continue to grow as the world recovers from the COVID 19 pandemic and stimulus packages encouraging expenditure on infrastructure.

“After a long period of a lack of investment in exploration and development of base metal projects, there is also a growing supply versus demand problem growing for most of these metals with most already in a yearly deficit that can only be fixed by exploration success.”

Alicanto’s conservative market cap of about $46m is inviting a significant re-rating next year given the maiden resource for Sala is due in the first quarter of 2022.

Further growth could come from extensional drilling along strike and at depth from the maiden resource and regional exploration outside of the resource target area.

This article was developed in collaboration with Alicanto Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.