Adavale expands its Tanzanian nickel footprint

Mining

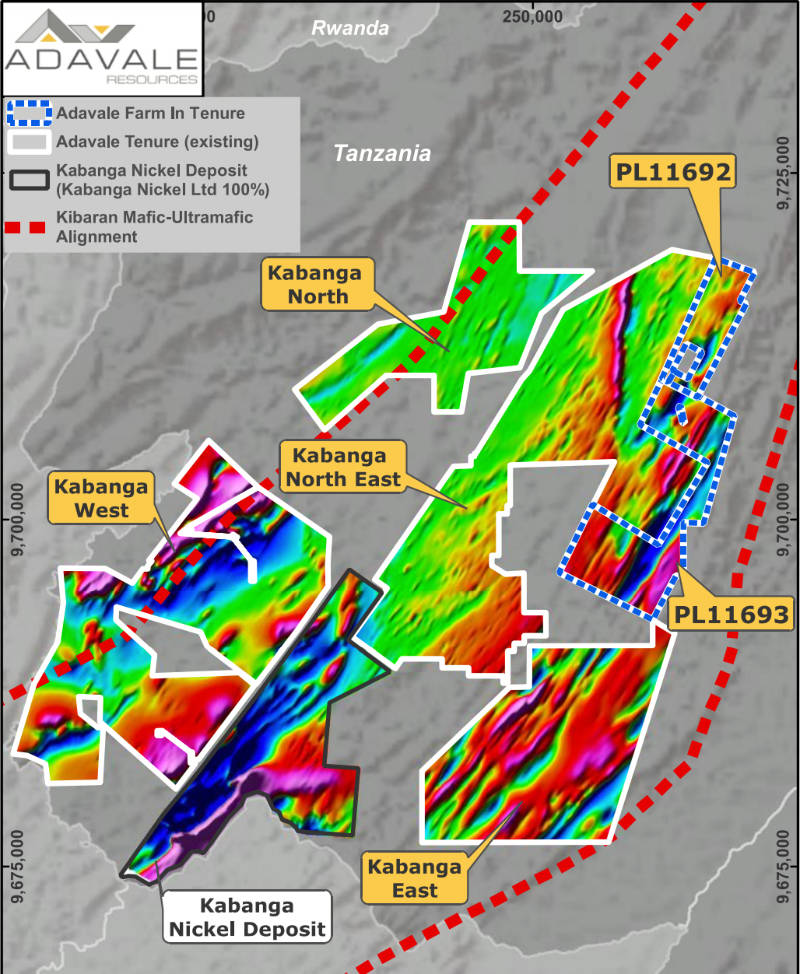

Adavale is expanding its nickel footprint through a farm-in to two prospective yet underexplored licences adjacent to its existing Kabanga NE licence in Tanzania.

The licences, which cover a total area of 98.89sqkm, are located around the historical LUH06 drill hole that intersected a mineralised layered mafic-ultramafic intrusion that returned 1.1% nickel over 8.4m in massive sulphides.

Importantly, Adavale Resources’ (ASX:ADD) recently completed gravity survey had indicated that this intrusion could extend over 4km into the farm-in licence areas.

The farm-in comes as the company’s ongoing diamond drilling program at the Kabanga Jirani project continues to intersect mafic intrusions hosting mineralised sulphide veins with the most recent hole returning a 25m mafic body from a depth of 30m.

“Securing the right to explore these licences is a major win as Adavale places great value on their prospectivity,” chairman Grant Pierce said.

“Significantly PL11692/2021 surrounds a 3.74 km2 area containing a 8.4m massive sulphide intersection grading 1.1%, proving mineralisation is in the area.

“We are extremely excited about getting boots on the ground and applying modern technologies to better understand the geometry of the intrusion, potential extensions and define drill targets.”

He added that initial ground truthing work will commence as soon as practicable.

The two licences cover the under-explored Luhuma layered mafic-ultramafic intrusion (LMUI) located within the Karagwe-Ankole Belt.

Little modern exploration has been conducted at Luhuma since the late 1990’s when BHP terminated their activities in Tanzania due to the conflict in neighbouring Burundi.

Historical work includes a reconnaissance stream sediment sampling program by the United Nations Development Program between 1974 and 1979 as well as regional airborne GEOTEM, stream sediment, soils and rock chip sampling surveys completed by BHP.

BHP also drilled several holes including LUH06 in the Tanzanian government held PL 6173/2009 that had returned the 8.4m zone grading 1.1% nickel.

Work completed to date suggests the LMUI is potentially a significant layered intrusion up to 4km long that requires modern exploration, including gravity surveys, to unlock its potential.

Under the first stage of the four-stage farm-in, Adavale has the immediate and exclusive right to explore and evaluate the 2 licences for 12 months upon payment per licence of US$12,500 in cash and US$25,000 in Adavale shares.

During the first 12 months Adavale must spend at least the minimum US$500 per square kilometre on exploration as required by the Mining Commission.

Should the company be satisfied by its exploration results, it can proceed with the right to earn 65% interest in the licences by paying on a per licence basis to the vendor US$25,000 in cash and US$75,000 in shares while continuing the minimum exploration expenditure requirements.

The third stage will see Adavale increase its stake in the licences to 80% by paying per licence a further US$50,000 in cash and US$112,500 in shares while the final stage gives the company the right of first refusal to match any third-party offers to buy out the remaining 20%.

Should an operational mine come into production from the licences, the vendor will receive a Net Smelter Return of 1.5%.

This article was developed in collaboration with Adavale Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.