2.35moz resource could just be the ‘tip of the iceberg’ at Awak Mas

Mining

Special Report: Nusantara (ASX:NUS) believes the Awak Mas project in Indonesia is hiding a “sizeable mineralising system” above and beyond the existing 2.35 million oz resource.

The wider 143.9sqkm Awak Mas ‘Contract of Work’ area has not been thoroughly explored in the past, with most effort focused on the known Awak Mas, Salu Bulo and Tarra deposits.

But there are numerous occurrences of gold mineralisation in the area surrounding the Awak Mas deposit, which provide substantial encouragement of a sizeable mineralising system, Nusantara says.

Geophysical surveying — an early stage, non-invasive method to detect potential deposits — is an important tool for target identification and ranking in a field as prospective as this one.

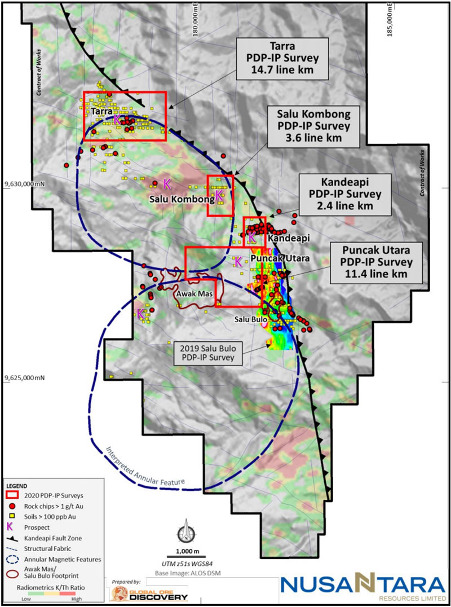

A successful 2019 pilot (test) program at Salu Bulo identified potential mineralised extensions and repetitions for drill testing.

A larger ground based induced polarisation (IP) geophysical survey will now kick off over key target areas at Awak Mas.

These are the first modern geophysical programs conducted on the ‘Contract of Work’, Nusantara says.

The program will run for about four months and extend IP coverage over a larger area, which includes the main prospects identified from surface work to date.

The new program will target areas that coincide with soil and rock chip samples anomalous for gold, and geologically significant settings.

Managing Director Neil Whitaker is excited about the targets that the IP survey may identify.

“We know that the Awak Mas project is highly prospective because we see examples of gold mineralisation across much of our ground and we have already been successful in extending the known deposits,” he says.

“The challenge has been prioritising one new area over another when we already have a mine we to build.

“IP provides deep ground penetration and will give us far greater confidence on what targets could be the tip of another iceberg.”

Nusantara is attracting strong investor interest as it targets 2022 commissioning of the Awak Mas gold mine. Assuming no major delays due to Covid-19 then full production in 2023.

A DFS addendum, released in June, upgraded the project’s already strong economics.

Nusantara’s drive to secure finance has been boosted by the appointment of experienced banker Matthew Doube as its CFO.

His appointment follows the company securing a $US15m ($21m) investment – enough to conclude financing for stage-one early works – from Indonesian integrated energy company and major shareholder PT Indika Energy for a 25 per cent stake in the project.

This story was developed in collaboration with Nusantara, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.