Winchester on the reopening: Never bring a knife to a gunfight

News

Dear Saturday Stockheads.

As I furiously type away from the comforts of my jet-fuel-soaked backyard in beautiful, honest Sydenham – the children joyously slipping on the oily grass, clad in protective earmuffs – I am pleased to confirm that, yes, the Prime Minister did not fib about the borders and the international planes are coming in thick and fast.

Here in Sydney’s unsung suburb rich in secret breweries and friendly lesbians we are nestled against the very teat of the giant 16R/34L – Main north-south runway and its slightly smaller but no less comforting 16L/34R – Parallel north-south runway. Suddenly our cups runneth over again.

Alas, it hasn’t always been this way – we Sydenhamites have had nothing but perfidious silence for nigh on two years now. Horrible, horrible silence.

That all changed this week.

After seemingly endless low-decibel days of wind rustling through leaves, filthy birdsong and unwelcome neighbourly chatter – the country’s self-imposed exile, an ultimately forlorn attempt to neuter Covid-19 – is done and dusted.

Turns out Prime Minister Scott Morrison’s declaration the “wait is over” was not a cruel underhand fib at all – and the national borders did indeed come tumbling down.

There’s almost 60 international flights heading our way again today. And while, ’tis but a scratch of the pre-Covid daily roster of near 300 touchdowns, the tourism bosses are saying more than a million visitors will be coming our way to roost and spend in the coming months as revenue anxious airlines ramp up capacity.

Enjoying the last day of relative quiet, Stockhead last Sunday got on the phone to Merewether Capital’s chief investment officer Luke Winchester for his come-as-you-are, no-nonsense, straight-shooting take on the wee caps most exposed to this step change in the strange lives we’ve all been living of late.

Here is a near enough transcript of that highly-charged exchange:

Good morning Merewether Capital CIO Luke Winchester!

For the love of… it’s 6.45am on Sunday, Edwards! (mumbles incoherently, sounds of glass breaking, swearing, toilet flushes in distance… a juvenile emu or possibly a cassowary cries out)

Great! I’m really well, too! So… Luke, international borders reopening, we can travel the world again! Well, you can stay weird and insular in beautiful Merewether, but the rest of us are going to stretch our little legs I reckon…

Plenty to digest for investors I think – how fast do you expect a return to normal? Will we just go back to pre-Covid or do we see a pent up demand snap back where tourism booms for years?

Well. The tourism sector has been vocal around the strong interest in advance bookings, but this is not an industry one can turn on and off like a tap. Industry heads have been flagging for some time – the pace of its recovery is bound to the limited ramping up of capacity and what are certain to be ongoing constraints around labour and workforce challenges.

Or maybe everyone has just been stopped dead in their tracks and stared long and hard into the abyss of their own mortality and thought: is this it? Is THIS it??

Maybe. I don’t know. I told you, it upsets my pet cassowary when you talk like that. Let’s just buy and flog some microcaps.

Okay. Reopening play – first cab off the rank – let’s talk, um, of an Aussie business which will allow readers and investors – as excited as we are by emerging and micro caps – a starting or an entrance point to build up a reopening play in their portfolio?

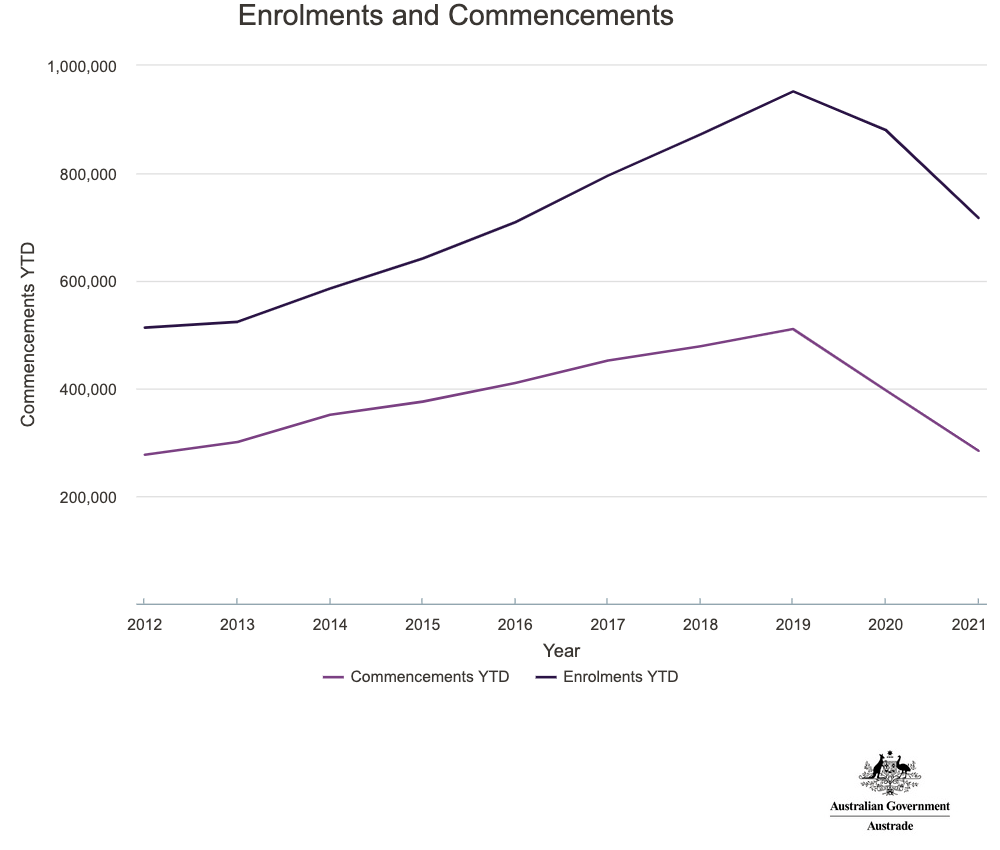

Well, I’ll try to bring some listed names which fly a wee bit under the radar, so a good one in this regard is iCollege (ASX:ICT). Life’s been quietly confronting for ICT during the pandemic and its various lockdowns. When your main game is as a provider of vocational educational training (VET) and over 80% of your students pre-Covid student-base are offshore, some fast, creative thinking is in order, and that’s what they’ve done and done well.

That’s right Luke. Management, led by a pretty interesting guy as chair, the ex-CEO Simon Tolhurst, took some fascinating steps to ensure the business would survive. Initially, as revenue dropped off a cliff post March 2020, the board placed ICT in an induced fiscal coma. Or what, in sci-fi terms we call cryogenic stasis… Like in Aliens.

Yes. JUST like in Aliens. But while it was put on life support, the business still managed to snap up its peer the vocational training provider Red Hill Education (ASX:RDH).

But if I have, wait for it… “Total Recall”. At the time, iCollege’s management said the proposed acquisition would create like a ‘champion education portfolio’ by slapping together two Aussie sector leaders, which instantly expands their geographic diversity footprint and sell it on offering the ol’ “significant value” for shareholders line.

No, the merger just further consolidated the industry – and importantly – really unlocked hard to access capital to survive (yeah, and thrive) during Covid. So ICT estimates roughly $100m of revenue bled out of the industry from half a dozen or so competitors who couldn’t survive. Big.

One thing I’m certain of with regards to border reopenings is that the Federal Government will crank the international student lever HARD.

And they need to (push for a student return). The international student market is crucial to a whole bunch of interconnected sectors and industries and their return will alleviate the pressure of worker shortages in low paying jobs.

Okay. Sell it to me. What’s the headline, standout angle thingy that makes you reach for your wallet about this option?

Well, one thing I like is that this isn’t just a nice solid macro recovery play, the iCollege/Redhill merger also makes a lot of sense from a synergy point of view. They have almost no overlap in geographic coverage. iCollege does Queensland, SA, WA and then Redhill is east coast – NSW and Vic.

Then for student sourcing (iCollege is Asia and Redhill is Europe, South America) or even look at study offerings: iCollege is vocational courses, Redhill, English testing).

On top of that, you’re putting together probably the best two management teams in the space with Redhill CEO Glenn Elith taking over that role of the combined entity and former iCollege CEO (Mr Tolhurst) shifting to Chairman. May not be an immediate bounce on border reopenings but for a medium-longer term trade, I love it.

I love it. Nice. Emphatic. Umm… so what else have we got? What about the stock-standard, garden-variety travel agents? Any preferences?

Yeah. I don’t mind Webjet (ASX:WEB) and you can even throw Flight Centre (ASX:FLT) and Helloworld Travel (ASX:HLO) in there too. They have run hard already and – as always – readers should be reminded don’t take the chart to heart! These three all raised a ton of capital at the Covid lows, so from a market cap point of view they are all ahead of their pre-Covid levels even though the prices remain lower.

Despite that, I still think you can hold these proven performers. A lot of people have thought the trajectory of these businesses through Covid was irrational – as they recovered strongly despite revenues going to essentially zero – but I’ve been on the other side of that to a degree.

You’re taking the consolidation equation aka what we just discussed in the smaller unlisted VET players and applying that to the travel agent industry?

Very good, Watson. It (the sector) will undergo a massive consolidation as travel recovers, your small private players are gone and like most things the industry has entrenched itself further online which benefits the bigger fish – WEB, FLT and HLO – it’s simple math.

Plus it is an industry that benefits from scale. The bigger you are the better prices and deals you can secure and attract more customers… never take a knife to a gunfight.

That’s a prescient quote taken from The Untouchables, Brian DePalma’s surprisingly visceral 1987 remake of the TV show in a script by David Mamet and set on fire by a wooden Kevin Costner wearing Georgio Armani.

Exactly right.

For now, these are businesses worth holding, because they’re well below pre-Covid levels like ICT, but I think you can hold them from here for either a short trade on pent up travel demand. Or, well, Europe is showing us how quickly travel is returning when all the restrictions are dropped.

Ok. Happy days. So, Luke, not everyone can live in historic Sydenham ….

…and thus call themselves a clear beneficiary of our return to open borders, so let’s flip it for a moment – what are the businesses most likely to struggle with reopening their mojo?

Well, again you can throw a bunch of other brick and mortar retailers in here – Universal Store Holdings (ASX:UNI), Dusk Group (ASX:DSK), Shaver Shop (ASX: SSG) – but let’s pick on Adairs (ASX:ADH).

Their trading update the other day highlighted some deeply-rooted challenges the business is facing; cycling tough comps where sales were brought forward, supply chain issues, higher logistics costs, higher marketing/discounting to move excess inventory, no rent rebates, no JobKeeper and wage pressures… AND they bungled their warehousing strategy.

Now you just take all that and just squeeze it into a big cake tin and throw it in a macro environment where for the FIRST time in two years consumers can choose to spend money somewhere other than discretionary goods? NO THANKS!

No Thanks!

What? Don’t do that.

Sorry. I thought I’d try to be encouraging…

Just…don’t. Anyway, just like the share prices of the travel agents remained stubbornly higher despite poor results, most retailers have looked really cheap based on the numbers they were reporting – but I think the market has been right here, these guys are about to go through a really tough period.

It’s a new iteration of competition and it really can’t be underestimated how much share of wallet was forced to funnel into retail, because… consumers couldn’t spend anywhere else!

All that demand brought forward and now people can travel, eat, drink, ski, go to the opera. Again it just does not bode well for Adairs et al.

(uncomfortable silence, broken by Southern China flight 23a from Guangzhou…) Ok. So. That’s it?

That’s it.

Right, well that’s probably enough… Thanks ag…

Never call here again.