Weekly Small Cap and IPO Wrap: Zebit exits stage ASX and the PM’s re-‘hope’-ening

News

The ASX Emerging Companies (XEC) is down about 0.7% today, but still a solid 2% up on last Friday’s close.

The ASX200 (XJO) has closed circa 0.9% lower and is up 1.4% for the week.

I don’t want to put a dampener on this whole reopening party that the Prime Minister tried to sell us on this week, but when – by far – the country’s largest group of OS visitors belong to a nation so entirely pissed off at us they’d gladly shoot-foot-self rather than accept our exports, well, then those open borders will only serve to measure what our new-look economy is really missing.

Of the pre-COVID bazillion or so countries that send their tourists our way, various groups – and I include the post-Tim Harcourt Austrade in this – reckon somewhere between 15% – 17% come from China.

And when they come, they heroically binge-spend.

In the 12 months before COVID-19 arrived, Austrade says Chinese visitors bought some $12 billion of Aussieness while here.

Sadly, even if we weren’t public enemy number #7, Australia is the only place in the galaxy which does not recognise the Chinese-made vaccine Sinopharm as any bloody good – in an official capacity.

So, even if you’re a fully-Sinopharm-vaxxed Chinese retiree looking for a good time and unconcerned about associating with Australians, then, while that’s great, you can’t come.

And when it comes to trade, the now UTS Professor Harcourt says, while we should be alright with anything that can be done digitally…

“Unfortunately tourism and education will still be very slow going… and anything services related which is affected by people movement will be slowed down by the tyranny of social distance and China’s closed border policy.”

“I expect lots of exports and imports of goods – but Aussie companies, like all foreign companies – will be reluctant to invest in China or be based there.”

Recent geo-political tension between China and the rest of the world has made investors skittish, Harcourt warns.

“They don’t want their assets seized within China, now including Hong Kong given Xi’s takeover of that jurisdiction… but given China’s need for food and energy security, exports of Rocks and Crops will continue in the mining and agriculture sector.”

For the Aussie agri-exporters, Rabo senior commodities analyst Dr Cheryl Kalisch Gordon says ongoing supply chain issues and geopolitical tensions also loom large as challenges.

Kalisch Gordon says the tight global market for agricultural commodities had shielded Australia from the impact of losing China as a buyer in 2021.

“However, as markets unwind, we expect Australia may need to work harder on diversifying into alternative destinations,” she said.

I don’t care enormously about inflation on Friday, but it is relevant so lets do this quickly:

US January consumer price data has come in the highest since Phil Collins did this:

That’s 40 years ago, so the pressure is on the US Fed to rein in easy monetary settings.

US voting Fed member (the rather hawkish) James Bullard spoke after the inflation data was released, and said the Fed would need to raise rates by 100 basis points by July. He even flagged an emergency sesh, if required.

Diana Mousina, senior economist at AMP, says market pricing now reflects the comments and assumes interest rates will be around 1.25% in just six months.

“We agree with the market pricing and now see the Fed being more aggressive and front-loading interest rate hikes in the first half of the year to take the heat out of inflation,”Mousina said.

“We expect a 50 basis point hike in March, followed by another 25 basis point rise in May and June.”

The peak in annual US inflation is likely to be around nowish.

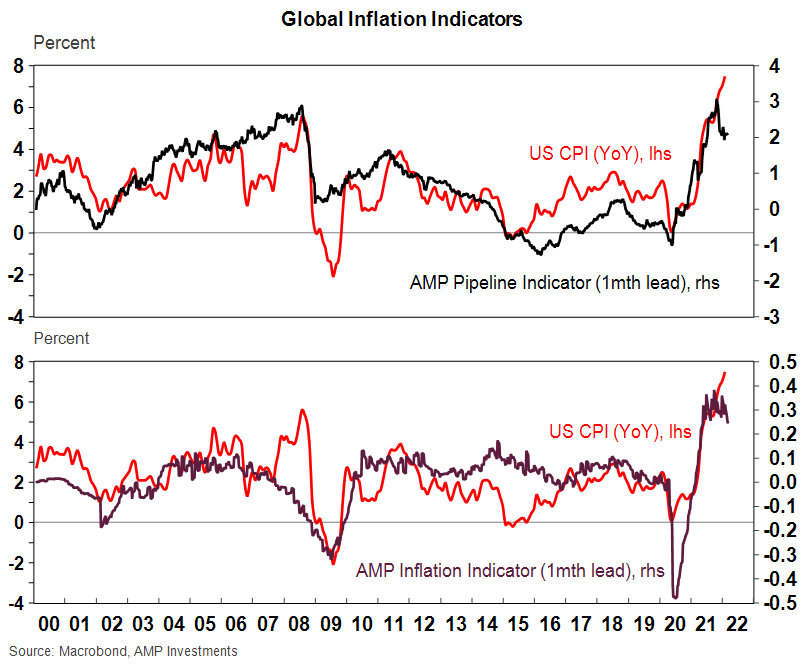

Or February/March, according to AMP’s inflation indicators which track both supply chain/pipeline pressures and traditional measures of inflation.

But, with annual inflation now at 7.5% it will take some time for consumer prices to normalise.

Gold and rare earths explorer Killi, which plans to dig a bit of gold out of the Tanami region in WA raised $6m at $0.20.

It closed on Thursday at $0.50.

The team of former and current Cassini Resources/ Caspin Resources (ASX:CPN) are highly experienced, talented and probably feeling rather vindicated. They reckon there could be some momentous rare earths upside, with its Killi Killi project tenements right next to where PVW Resources (ASX:PVW) reported huge potential for rare earths mineralisation.

The Killi crew include CEO Kathryn Cutler, chairman Richard Bevan, and non-executive directors Greg Miles and Phil Warren.

They’ll be rather – I believe the technical term is – chuffed: late in Friday trade the share price has shed about 8% but still sits around $0.45.

Down in Tassie, Killi has snapped up the Balfour copper project, and in Queensland the company has two gold projects – Ravenswood North and Mt Rawson West.

Killi plans to undertake a VTEM survey and ground gravity survey at West Tanami, with aircore drilling to start at the Lyrebird North, Hermes and Yosemite prospects and RC drilling to follow later in the year.

Then there’s plans afoot to complete a VTEM survey, soil geochem program followed by AC and RC drilling at the Ravenswood North project, along with airecore and RC drilling at the Balfour and Mt Rawson West projects.

My Rewards International (ASX:MRI)

The MRI ticker code seems a little wasted on a loyalty rewards platform, especially when so many ASX-listed medtechs and medical imagery firms could use a catchy tagline.

Nevertheless here is a mature rewards business which comes to the bourse already generating almost $30m of annual revenues.

MRI raised $5m from investors at 20c per share, and a few hours into life as a listed entity those shares are worth about $0.13 cents a pop,

Listing on Tuesday with a $6m initial offering at at $0.20 a share was the spinout of private project generator, Tali Resources.

WA1 hit the boards with three WA exploration projects — including their flagship ‘West Arunta’ plus ‘Madura’ with some iron oxide copper gold ore deposits (IOCG) and ‘Hidden Valley’ (nickel, copper, PGEs).

The stock rose earlier in the week, but has fallen 8% today and is trading at $0.22 cents, late Friday.

Hidden Valley holds a number of potential intrusive bodies considered prospective for mafic-ultramafic intrusion-hosted Ni-Cu-PGE sulphides, à la Chalice Mining’s (ASX:CHN) Julimar.

As Reuben Adams, Stockhead deputy editor and sixth best looking person in the newsroom points out, IOCG deposits — like BHP’s Olympic Dam mine or more recent Oak Dam discovery — can be real biggies – and simple-to-process concentrations – of copper, gold and other elements like uranium.

Here are the best performing ASX small cap stocks for November 22 – November 26 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MAY | Melbana Energy Ltd | 0.064 | 88.2% | $176,438,650 |

| PCL | Pancontinental Energ | 0.0055 | 83.3% | $42,925,337 |

| RFT | Rectifier Technologies | 0.076 | 72.7% | $108,617,412 |

| SLM | Solismineralsltd | 0.315 | 57.5% | $9,469,500 |

| FNT | Frontier Resources | 0.038 | 52.0% | $30,525,074 |

| MLS | Metals Australia | 0.003 | 50.0% | $15,715,672 |

| WCN | White Cliff Min Ltd | 0.033 | 50.0% | $20,936,874 |

| AAJ | Aruma Resources Ltd | 0.13 | 49.4% | $14,485,573 |

| ITM | Itech Minerals Ltd | 0.455 | 49.2% | $33,629,999 |

| CPM | Coopermetalslimited | 0.535 | 46.6% | $15,131,200 |

| BUX | Buxton Resources Ltd | 0.11 | 44.7% | $16,326,652 |

| TD1 | Tali Digital Limited | 0.027 | 42.1% | $24,229,551 |

| LNY | Laneway Res Ltd | 0.007 | 40.0% | $30,199,071 |

| SAN | Sagalio Energy Ltd | 0.025 | 38.9% | $4,707,183 |

| OAK | Oakridge | 0.275 | 37.5% | $5,158,704 |

| SHP | South Harz Potash | 0.185 | 37.0% | $79,362,668 |

| BRX | Belararoxlimited | 0.34 | 36.0% | $10,482,107 |

| ABX | ABX Group Limited | 0.135 | 35.0% | $31,302,714 |

| BLZ | Blaze Minerals Ltd | 0.054 | 35.0% | $17,160,005 |

| IVZ | Invictus Energy Ltd | 0.155 | 34.8% | $102,311,960 |

| ARR | American Rare Earths | 0.49 | 34.2% | $188,676,396 |

| ATR | Astron Corp Ltd | 0.71 | 34.0% | $87,571,111 |

| ARE | Argonaut Resources | 0.004 | 33.3% | $14,424,819 |

| VMG | VDM Group Limited | 0.002 | 33.3% | $13,855,322 |

| FME | Future Metals NL | 0.24 | 33.3% | $65,679,940 |

| BOC | Bougainville Copper | 0.53 | 32.5% | $160,425,000 |

| AUQ | Alara Resources Ltd | 0.078 | 32.2% | $57,845,198 |

| EMS | Eastern Metals | 0.28 | 30.2% | $9,434,000 |

| CAU | Cronos Australia | 0.39 | 30.0% | $192,718,897 |

| LNU | Linius Tech Limited | 0.022 | 29.4% | $35,746,315 |

| TER | Terracom Ltd | 0.265 | 29.3% | $203,474,060 |

| CPN | Caspin Resources | 1.00 | 29.0% | $70,868,021 |

| CPV | Clearvue Technologie | 0.445 | 29.0% | $99,517,962 |

| ICI | Icandy Interactive | 0.1675 | 28.8% | $164,868,239 |

| M2M | Mtmalcolmminesnl | 0.135 | 28.6% | $6,063,490 |

| OPN | Oppenneg | 0.18 | 28.6% | $22,189,183 |

| DLC | Delecta Limited | 0.0115 | 27.8% | $12,049,087 |

| TGN | Tungsten Min NL | 0.14 | 27.3% | $110,097,998 |

| XRG | Xreality Group Ltd | 0.085 | 26.9% | $27,609,408 |

| NET | Netlinkz Limited | 0.019 | 26.7% | $52,210,565 |

| DKM | Duketon Mining | 0.5 | 26.6% | $53,695,591 |

After hitting oil in Cuba Melbana Energy (ASX:MAY) has had a super week, the share price surged to seven year highs following on oil strike in Cuba and the price has kept rising as the company says its checking out the, “extensive oil interval we’ve intersected.”

And then there’s Solis Minerals (ASX:SLM) which earlier this week nabbed a shout out in Res Top 5.

Up 57%, for the week that was, so well earned.

Here are the worst performing ASX small cap stocks for the week ending February 11th [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| WEC | White Energy Company | 0.018 | -88.8% | $14,715,096 |

| ZBT | Zebit Inc | 0.085 | -54.1% | $18,453,867 |

| M3M | M3Mininglimited | 0.24 | -39.2% | $8,324,479 |

| FFC | Farmaforce Ltd | 0.035 | -35.2% | $4,573,834 |

| LAW | Lawfinance Ltd | 0.43 | -33.8% | $20,385,370 |

| KEY | KEY Petroleum | 0.002 | -33.3% | $5,903,784 |

| PHO | Phosco Ltd | 0.105 | -32.3% | $25,336,262 |

| TRT | Todd River Res Ltd | 0.06 | -28.6% | $43,674,884 |

| HFY | Hubify Ltd | 0.048 | -26.2% | $24,573,049 |

| BAS | Bass Oil Ltd | 0.0015 | -25.0% | $9,225,363 |

| EN1 | Engage:Bdr Limited | 0.0015 | -25.0% | $7,005,272 |

| PCH | Property Connect | 0.0015 | -25.0% | $1,028,795 |

| WOO | Wooboard Tech Ltd | 0.0015 | -25.0% | $7,644,325 |

| LBY | Laybuy Group Holding | 0.135 | -25.0% | $35,674,688 |

| AGS | Alliance Resources | 0.125 | -22.4% | $30,162,484 |

| BIR | BIR Financial Ltd | 0.027 | -20.6% | $2,637,340 |

| HCD | Hydrocarbon Dynamic | 0.012 | -20.0% | $5,723,771 |

| KLR | Kaili Resources Ltd | 0.024 | -20.0% | $3,242,808 |

And now to some news which for some reason invokes thoughts of Dr Evil, at his most evil… Zebit (ASX:ZBT) is delisting.

The ecommerce play says the bourse life is full of costs and admin. There’s a painful wait in the post, though. The move needs shareholder approval… which won’t happen until the next meet set down for sometime in March.

The share price is in fiscal purgatory till then, I guess. It’s down 54% in one day.

M3 Mining (ASX:M3M) and Paterson Resources (ASX:PSL) both took hits this week on not super unpleasant drilling results.

The following companies are in trading halts and are expected out in the next few trading days:

Eastern Metals (ASX:EMS) — material drilling result

Zebit (ASX:ZBT) — proposed delisting

Ardiden Ltd (ASX:ADV) — capital raising

Titanium Sands (ASX:TSL) – funding facility

Traka Resources (ASX:TSL) – pending announcement regarding a capital raise

Taruga Minerals (ASX:TAR) – proposed capital raise

RareX (ASX:REE) – regarding upcoming results at Cummins Range