You might be interested in

News

ASX Large Caps: Market snaps four-day losing streak as China hits back at West 'de-risking'

News

ASX Large Caps: Local bourse gets jitters as inflation hits highest level since 1990 at 7.3%

Health & Biotech

If you really want to go for a Covid-related investment strategy that actually has something to do with getting crook, then maybe check out what they’re up to in the local Private Health Insurance industry.

That’s the advice of the analysts at UBS, and it’s not rich in ambiguity.

Covid-19 has put the health insurers right in the crosshairs, with both head and tailwinds blowing across the sector.

The almost alternating wave of elective surgery delays have delivered a healthy cut in the volume of insured medical procedures and that naturally means bottom line savings for the companies providing health insurance. And consequently several of the listed insurers chose to defer the annual premium increases for six months, or sought to to return money across the customer base by offering discounts to members.

On the plus side, Covid-19 and some of the other newcomers – like the delicious sounding Monkeypox – are likely to encourage more new customers, particularly younger ones, to consider taking up or taking off their health insurance.

With unemployment at record lows, anyone that lost their gig during the pandemic and thought health insurance was a discretion to cut, may well start reconsidering.

UBS analysts have identified much improved consumer sentiment towards the PHI value proposition.

And their pick, Medibank Private (ASX:MPL) pretty much agrees.

Market Matters on MPL:

Last month the insurer says Aussie participation in private health insurance is growing and remains “strong” – citing the recent step-change in Aussie attitudes

Private health insurance is making a lot more sense as public hospital wait times blow out and new and varied disease outbreaks do their bit to keep health fears front of mind.

But MPL says private cover is now both more affordable and better value.

These factors should drive above-average policy-holder growth, in UBS’ view. Less downgrading of policies and lower acquisition costs are also most likely to keep on into FY23 and support ASX-listed PHI stocks.

Additionally, UBS feel that the balance of regulatory risks is now skewed to the upside, and then there’s the go-digital trends which can improve both claims and customer experience – an area where UBS sees MPL with something of a first mover advantage and where it is both more advanced and experienced.

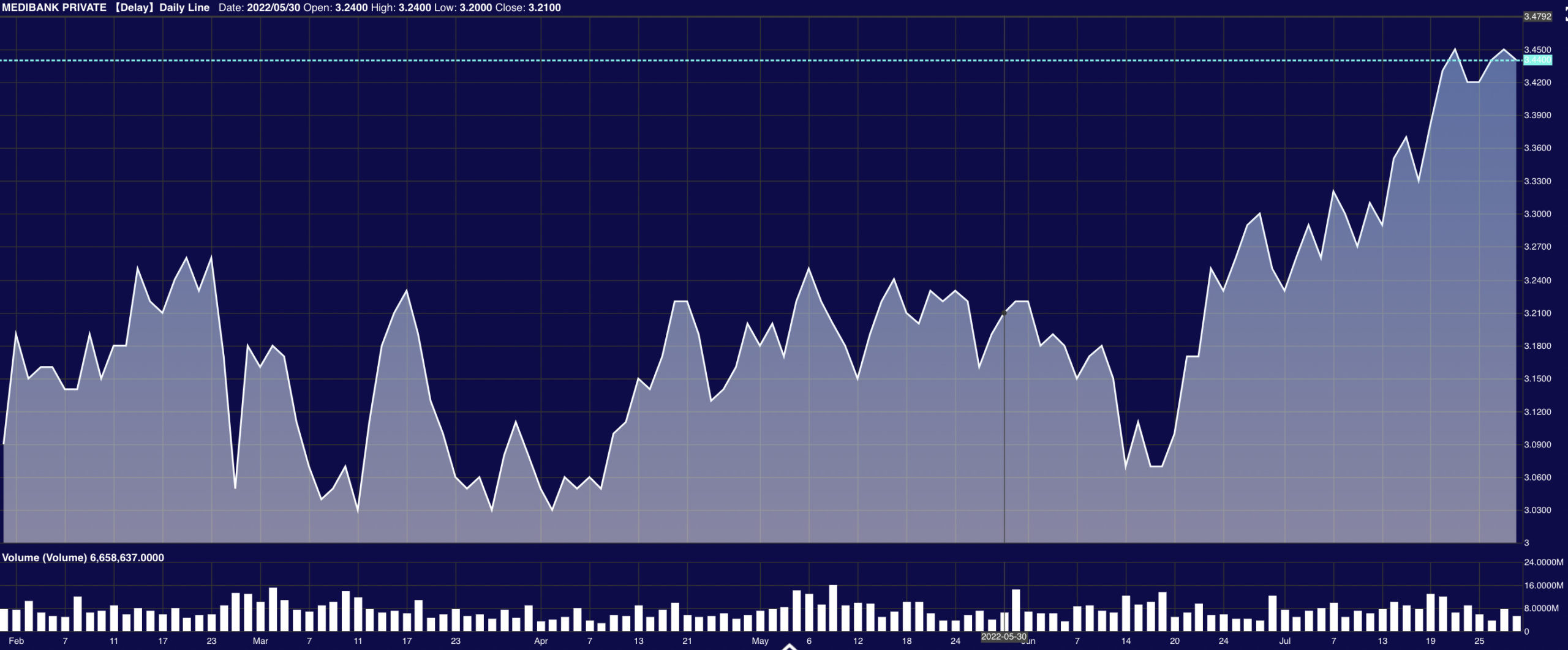

Medibank has now hit six straight quarters of industry policyholder growth.

“And we continue to gain market share in a highly competitive sector, well over 27%,” MPL said in a recent investor call. The company added 5 basis points in 1H22 and 14 basis points in CY21.

UBS says that the key ‘new to industry’ and ‘younger Australian’ cohorts are now both major contributors to policyholder growth, which Medibank has been telling investors are positive signs for industry sustainability.

Finally, MPL says there’s also been a “significant” improvement in policyholder lapses and it expects industry participation growth to be higher than pre-pandemic levels over the medium term.

Growth will be supported by population growth, continuing shifts in consumer attitudes towards health and “strong bipartisan support”, for the role of private health.

James Gerrish at Market Matters said last year MPL delivered an impressive 40% lift in profits for FY21, as the coronavirus delivered an expected strong tailwind to the business.

“People have significantly prioritised their health since the pandemic swept the world and who can blame them? The outlook for MPL is solid with the company fairly optimistic moving forward although the landscape is clearly a tricky one to predict in these unprecedented times.”

Having said that, UBS adds that the penny-pinching Aussies approaching the current cost-of-living challenges mean the industry’s key selling point of affordability is still front and centre for securing growth.

Subsequently the health insurer was one of the sector players that held back making a call on the usual April premium and has delayed the likely increase of 3.1% until October.

Even so, resident policyholder growth sits between 3.1% to 3.3% so far in FY22.

Breaking it down – in the current volatile market – UBS believes MPL brings a number of attractive attributes to the table:

“MPL is amongst the pre-eminent players in the PHI industry, and while the stock does not look cheap at ~19x, UBS think these attributes are unique within the financial sector and attractive at this point in the cycle (and the multiple is in line with average levels).”

Medibank Private: UBS upgrades rating to Buy

Consensus Recommendation: Buy

Consensus Price Target: $3.58

UBS Recommendation: Buy

UBS Price Target: $3.90 (from $3.35)

Crestone Wealth Recommendation: Outperform

Crestone Wealth Price Target: $3.52