UBS: 3 ways Australia’s post-COVID retail landscape will change, and the ASX companies set to benefit

News

News

With the initial shockwaves from the COVID-19 pandemic behind us, a key question for investors is what changes will be temporary and what will be more permanent?

And in the first of a five-part series on Australia’s retail sector (the nation’s largest employer), research analysts at UBS have flagged how our eating habits may change — and which companies could benefit.

Retail has been at the forefront of disruption caused by COVID-19, in both good and bad ways.

While department stores and boutique shops have been forced to close, “panic-buying” at grocery stores saw monthly retail sales climb by a record-high in March.

UBS says the changes to consumer behaviour caused by COVID-19 are likely to become more entrenched, in the following three ways: accelerated shift to online shopping, a change in eating patterns (more home-cooking), and a shift to private-label brands and new health products.

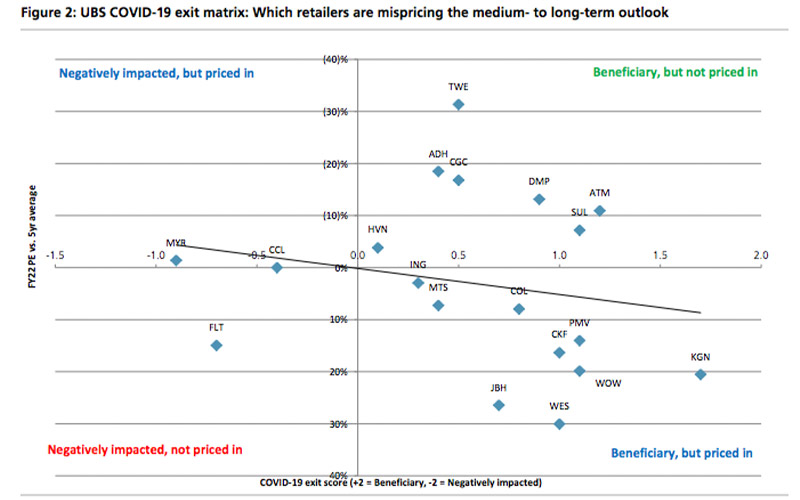

This chart provides a useful summary of which ASX stocks are set to benefit (or fall), and whether those changes have been priced in:

The analysts said online sales were now expected to account for around 30 per cent of incremental growth in annualised grocery sales over the next four years.

That increase will see online channels comprise around 8 per cent of total grocery sales by the 2023 financial year, up from UBS’ previous prediction of 5 to 7 per cent.

And it’s likely to benefit incumbent players Coles (ASX:COL) and Woolworths (ASX:WOW), because competitors Aldi and Metcash (ASX:MTS) don’t have an online presence.

The economic fallout from COVID-19 is likely to see a rise in the number of Australians eating at home, UBS said.

The analysts cited a sluggish economic environment in the near-term, which could see consumers put a priority on eating in and saving money.

They also cited broader headwinds facing the restaurant industry, with closures and industry consolidation “which could see the market contract by $5bn over the next five years”.

“We estimate that if 20 per cent of restaurants were to close, it could shift $800m-1.1bn of sales to the grocery channel, and reverse the trend of declining ‘cook at home’ occasion,” UBS said.

Based on average meal frequency of 4.4x per week, UBS said that every 0.1x increase in weekly cooking frequency could see total food sales rise by up to 1 per cent.

Lastly, UBS said the post-COVID-19 world would give rise to a “flight to value” in general consumer behaviour.

In the near-term, that will be driven by further demand for private-label products, which are already outpacing branded products at the major grocery stores.

Consumer demand will also skew towards new and innovative products with a focus on health and wellbeing.

“The net impact will, in our view, see a better educated, more decisive shopper that has higher expectations,” UBS said.

“We conclude that COVID-19 will accelerate the shift to retail-pull models and that vertically integrated grocers should be best positioned to benefit.”