Traders’ Diary: Everything you need to get ready for the week ahead

News

RBA, FOMC minutes overshadowed by hawkish tilt from Gov. Bullock

In the local central bank’s minutes, the RBA Board, led by new Gov. M. Bullock, highlighted the recent indictors wherein lingering resilience in labour market and domestic demand lines up pretty well with the sluggish moderation in underlying inflation – the States might be shifting gears vs inflation but we’re moving both behind the pack and slower than expected.

Speaking last week in Sydney, RBA Governor M. Bullock said homegrown inflation is behind our cost of living crisis and that she’d do whatever was required with the “blunt tools’ at the bank’s disposal to put that genie back in the bottle.

It was, in fact a reiteration of the minutes, released on Tuesday:

“High inflation was being underpinned by above-average price rises for a wide range of consumer goods and services… There was clear evidence – most notably for services price inflation, which was quite brisk – that this owed to domestically generated pressures associated with aggregate demand exceeding aggregate supply.”

Local stocks were knocked about by this and falling commodity prices midweek – the benchmark ASX200 ending the week -0.25% lower.

However, money markets are still reckoning it’s something like a 1 in 20 chance that the RBA will hike again when it next meets on December 5.

Nvidia, 11 months later

In the US, the chip making, trillion US dollar Mega Tech stock, Nvidia (NVDA) beat everyone except its own guidance after Q3 sales tripled from a year earlier to US$18.1 billion.

Profit, meantime, surged 14x to US$9.2bn.

But for all that… the NVDA stock was almost -3.5% lower last week.

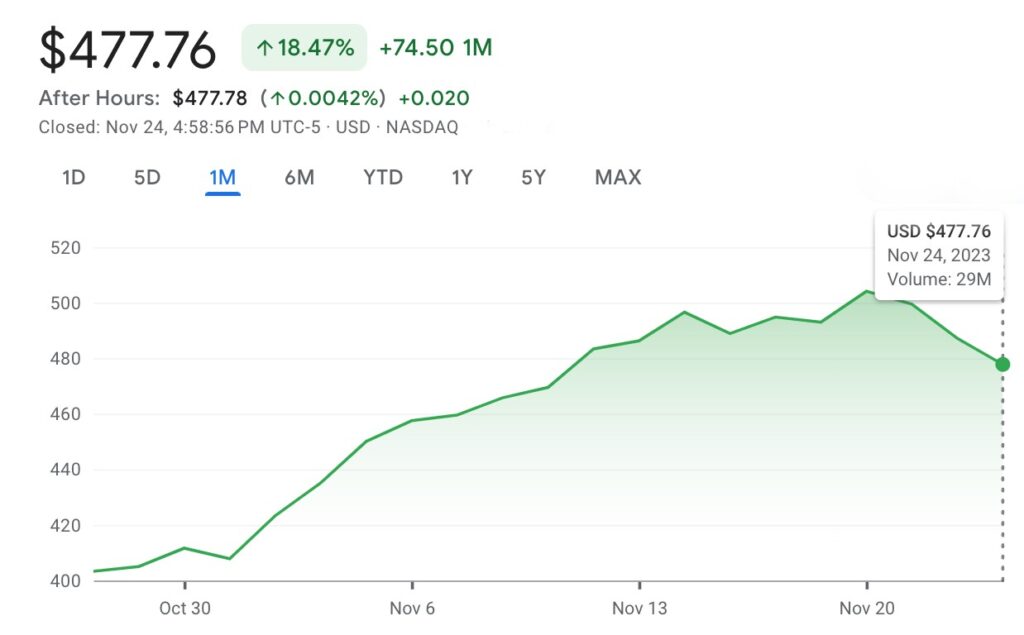

Of course, in the bigger picture that won’t worry too many… the share price has done this in a month:

And this over the year to date:

READ MORE: This is what Stockhead said about NVDA during our ‘Meet Nvidia Week’ back in February

A good year for NVDA, and it’s not over yet.

Last week was a wee turnaround for oil prices, clocking US$76/barrel for WTI, yet prices wallow below levels observed at the beginning of this ongoing horror show in Israel and Gaza.

Now there’s cracks in OPEC+ and expectations the cartel might not go deepen output cuts next year. The producer group has postponed its policy meeting to November 30, adding to production cut uncertainties.

Iron ore’s jumped to $127/tonne – its best score since June. That’s on the back of Chinese regulators and a supposed list of 50 private and state-owned developers eligible for special funding as Beijing looks for fun new ways to bolster the property sector.

Back in the States ahead of the Thanksgiving exodus, the Federal Open Market Committee (FOMC) on Tuesday released the minutes for the Oct-Nov cash rate meet – deciding that a “further softening in labour market conditions” was a must have for the FOMC to feel reconciled that inflation will return to target.

And right on cue, the FOMC got the proof they wanted the next day with the US October jobless numbers providing just the downside surprise on both headline and core inflation to see inflation Stateside is now moving lower.

The New York Stock Exchange punters have been betting so for a few weeks now.

Which is why US Treasury yields on Friday clocked multi-month lows on the weight around cooling inflation and a relaxing Federal Reserve.

The three major US indices rising for a fourth straight positive week over Thanksgiving — the longest run of gains for both the S&P 500 and the Nasdaq since June.

CNBC says the Dow Jones Industrial, (up +1.3% last week), hasn’t been off on a big long green run of gains like this since around Easter.

Local markets have been looking like they needed to rotate the strike and last week they indeed managed to get some down time with the US Thanksgiving break allowing markets to catch a breath on light volumes and thinner crowds.

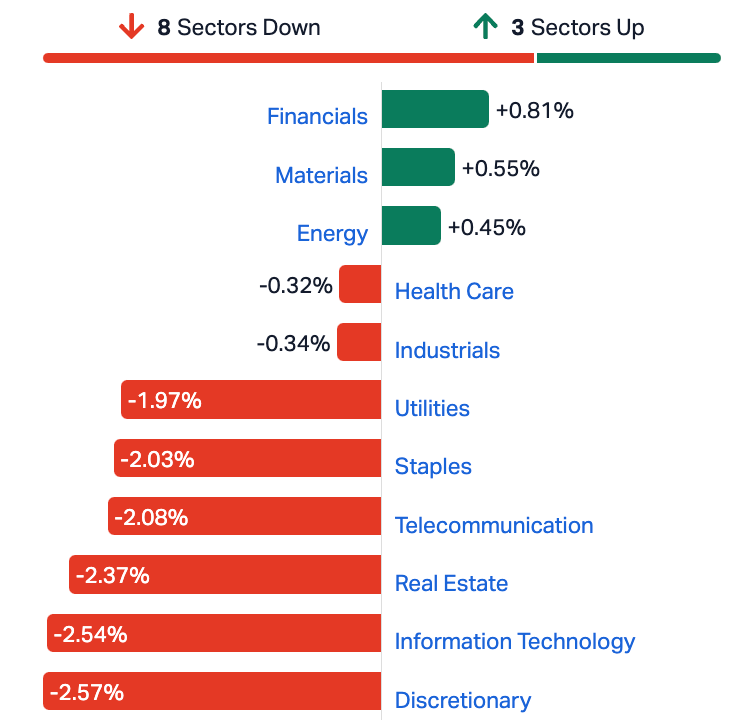

Growth stocks especially within the IT and Real Estate were the weakest two sectors, while Aussie Resources stocks – all within the influential Energy, Financials and Materials Sectors – were the 3 sectors to come out of it with slight gains.

The ASX benchmark traded within a 0.9% range as the bigger cap end of town pretty well reflected the sector level moves over the week. As these standout performances suggest…

ASX DIGGERS:

Bellevue Gold (ASX:BGL) +10.7%, Whitehaven Coal (ASX:WHC) +8%, Paladin Energy (ASX:PDN) +6.7% and De Grey Mining (ASX:DEG) +4.5%

ASX MONEY:

Generation Development Group (ASX:GDG) +5.15%, Income Asset Management Group (ASX:IAM) +4.94%, E&P Financial Group (ASX:EP1) +4.90% and Suncorp Group (ASX:SUN) +3.3%.

ASX GROWTH and HOMES:

Healius (ASX:HLS) -23.5%, Star Entertainment Group (ASX:SGR) -10.7%, Technology One (ASX:TNE) -7.2%, Charter Hall (ASX:CHC) -4.2%, and Mirvac (ASX:MGR) -3.7%.

Best performing ASX small cap stocks from November 20-24:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CC9 | Chariot Corporation | 1.04 | 145% | $53,165,387 |

| SHN | Sunshine Metals Ltd | 0.022 | 100% | $13,464,093 |

| AMM | Armada Metals | 0.056 | 93% | $10,354,084 |

| M2M | Mt Malcolm Mines NL | 0.034 | 79% | $3,479,679 |

| ROO | Roots Sustainable | 0.007 | 75% | $1,124,217 |

| AML | Aeon Metals Ltd | 0.012 | 71% | $13,156,807 |

| RNX | Renegade Exploration | 0.01 | 67% | $8,727,514 |

| CXU | Cauldron Energy Ltd | 0.019 | 58% | $20,378,942 |

| POD | Podium Minerals | 0.055 | 57% | $20,038,513 |

| VMM | Viridis Mining | 1.94 | 53% | $83,760,315 |

| TG1 | Techgen Metals Ltd | 0.1 | 52% | $6,404,967 |

| ASP | Aspermont Limited | 0.012 | 50% | $29,265,164 |

| AUH | Austchina Holdings | 0.003 | 50% | $6,233,651 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | $1,615,563 |

| KNM | Kneomedia Limited | 0.003 | 50% | $4,599,814 |

| M4M | Macro Metals Limited | 0.0045 | 50% | $12,335,389 |

| SIT | Site Group Int Ltd | 0.003 | 50% | $7,807,471 |

| VPR | Volt Power Group | 0.0015 | 50% | $16,074,312 |

| PLG | Pearlgullironlimited | 0.04 | 48% | $8,181,672 |

| PRS | Prospech Limited | 0.037 | 48% | $7,911,359 |

| LVH | Livehire Limited | 0.058 | 45% | $21,026,161 |

| NWF | Newfield Resources | 0.13 | 44% | $114,666,141 |

| TCG | Turaco Gold Limited | 0.1 | 43% | $48,260,800 |

| MEM | Memphasys Ltd | 0.014 | 40% | $11,514,245 |

| RLC | Reedy Lagoon Corp | 0.007 | 40% | $4,316,785 |

| TAS | Tasman Resources Ltd | 0.007 | 40% | $4,276,016 |

| AMT | Allegra Medical | 0.057 | 39% | $6,219,773 |

| MRR | Minrex Resources Ltd | 0.022 | 38% | $23,867,085 |

| TMG | Trigg Minerals Ltd | 0.011 | 38% | $3,747,562 |

| RGL | Riversgold | 0.015 | 36% | $10,463,876 |

| WSR | Westar Resources | 0.027 | 35% | $5,190,010 |

| CAG | Caperange | 0.12 | 35% | $11,388,996 |

| UBI | Universal Biosensors | 0.255 | 34% | $40,350,193 |

| AHN | Athena Resources | 0.004 | 33% | $4,281,870 |

| AVM | Advance Metals Ltd | 0.004 | 33% | $2,167,040 |

| MOH | Moho Resources | 0.012 | 33% | $6,120,800 |

| MTL | Mantle Minerals Ltd | 0.004 | 33% | $24,589,783 |

| PNX | PNX Metals Limited | 0.004 | 33% | $21,522,499 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| JRV | Jervois Global Ltd | 0.044 | 33% | $113,505,869 |

| RHK | Red Hawk Mining Ltd | 0.65 | 33% | $113,128,547 |

| MZZ | Matador Mining Ltd | 0.053 | 33% | $20,502,005 |

| YRL | Yandal Resources | 0.092 | 31% | $16,911,517 |

| 14D | 1414 Degrees Limited | 0.059 | 31% | $13,099,269 |

| GHY | Gold Hydrogen | 0.78 | 31% | $54,646,102 |

| NFL | Norfolk Metals | 0.3 | 30% | $7,732,874 |

| VEE | Veem Ltd | 0.86 | 30% | $106,539,770 |

| PTR | Petratherm Ltd | 0.057 | 30% | $12,810,815 |

| ALM | Alma Metals Ltd | 0.009 | 29% | $10,026,007 |

| ENV | Enova Mining Limited | 0.009 | 29% | $5,768,364 |

One of the biggest lithium IPOs of 2023, Chariot Corporation (ASX:CC9) was up 145% this week on no specific news. CC9 has one of the largest lithium exploration landholdings in the US and various JVs, farm outs and optioned projects.

READ MORE:How Chariot outsmarted a major to get a mountain of lithium. Literally, a mountain

Sunshine Metals (ASX:SHN) rose 100% this week after the microcap announced it had intersected multiple high-grade gold zones in the first of 12 RC holes at its Liontown prospect at the Ravenswood Consolidated project in northern QLD, including 17m @ 22.14g/t from 67m.

The zones are interpreted to be gold and copper-rich feeder zones to the overlying 2.3Mt resource

Armada Metals (ASX:AMM) rose 93% this week after picking up four early-stage lithium exploration projects for $150k cash and 26m shares in the emerging hard rock hub of Brazil.

Chairman Rick Anthon said the company was a lot like Freddy Mercury in wanting it all – saying the deal was an ‘exciting transaction… as we diversify both geographically and into lithium, while remaining in the critical metals space.’

“This area in Brazil is attracting significant exploration attention for the potential discovery of lithium-bearing pegmatites, with a number of other operators in the region and known occurrences.

“This new planned acquisition, along with our nickel projects in Africa, especially the Bend Nickel Project in Zimbabwe where we are currently drilling and results are expected soon, offers exciting new opportunity to Armada and its shareholders.”

The $10m capped stock has almost recovered its year-to-date losses on today’s news.

It had ~$2m in the bank at the end of September.

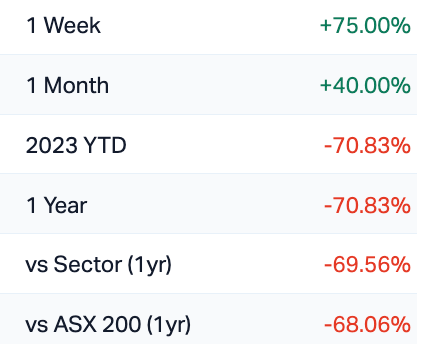

Finally, Roots Sustainable Agricultural Technologies (ASX:ROO) had a terrific week on the bourse, up 75%.

The Israeli-based ROO has a passion for managing a plant’s root zone temperatures in the face of the shortage of water for irrigation. It’s jumped today after successfully delivering equipment from Israel to the United Arab Emirates, for a major client Silal Food and Technology.

The ag-tech it has supplied is set to be installed this week, enabling the demonstration of the “application of Root Zone Temperature optimisation technology as part of its berry farming operations at the COP28 global conference at Expo City, Dubai in early December”.

It needed a win too, as you can see:

James Gerrish at Market Matters says his team continues to expect equities to rally into Christmas.

“The second half of December (is) traditionally the strongest period as many investors enjoy the bountiful dividends from the banks,” he told Stockhead.

“The end of this week will herald the last month of 2023… let’s hope we are correct, and a few good weeks can at least see us wave goodbye to a tough year with some gains for the index.

“So far, the ASX200 is up just two points after 11-months of toil.”

Although, as I look at their numbers, it seems the Market Matters Active Growth Portfolio is up over +13% year-to-date.

Pretty serious this week, regarding our near-term inflation futures.

The October monthly CPI indicator will drop and that’ll be the kicker.

The indicator will be an important update on how other parts of the basket are tracking. There’s quite a few moving parts for the October numbers.

Government policies will momentarily take some of the sting out of rents and energy inflation while strength in new housing, health insurance and domestic travel prices will provide an offset.

CBA forecasts consumer prices to be flat in the month, taking the annual rate down to 5.2%.

Some of the early building blocks of Q3 GDP will also print next week.

Retail trade figures for October are due and will be very, very closely watched.

Spending rebounded in the September quarter as mega events like the FIFA Women’s World Cup helped ther splurging.

Indeed, inflation adjusted retail spending registered positive growth (+0.2%/qtr) for the first time since the corresponding quarter in 2022.

That said, real retail spending per capita continued to decline in Q3 23.

According to CBA’s internal spending data, October points to a return to weakness.

“We forecast a solid contraction of 0.6%. Seasonal factors may be at play and the upshot of this being we are likely to experience some volatility in the monthly retail numbers for the next few months,” CBA economist Harry Ottley observed last week.

Josh Gilbert, market analyst at eToro, shares his key focus points for the week ahead

AU Retail Sales

On Tuesday, the latest retail sales figure will be delivered. As always, retail sales is a key data point on the RBA’s list and often provides valuable foresight for the direction of interest rates. A resilient consumer this year has seen spending hold up well, despite consumer surveys telling us that households are increasingly pessimistic.

With retail spending still high, the fear is that this will continue to feed inflation, the very challenge the RBA is trying to combat. If households continue to splash cash, it gives the RBA headroom to hike rates further should they feel necessary. With RBA Governor Bullock maintaining a relatively wary tone in her most recent address, a buoyant set of retail figures on Tuesday could mean a further hawkish tone from the RBA. However, next week’s figures may show the signs of a spending slowdown, with a contraction of 0.3% expected. This will be a step in the right direction and good news locally. Retail sales numbers may be skewed in the months ahead with seasonal spending, but a contraction next week would be well welcomed by investors.

AU Monthly CPI

After Bullock’s aforementioned hawkish tone throughout the week, it’s fitting that on Wednesday, the monthly CPI reading is released. The RBA Governor expressed her concerns this week that the inflation challenge is “increasingly homegrown and demand-driven”, showing there is still work to do locally.

It’s worth noting that, whilst other Central Banks are ending their tightening cycles, Australia seems far from a conclusion. The key for other nations has been higher interest rates.

The BOE sits at 5.25%, and the Fed sits at 5.25-5.5%, both just under 100bps higher than the RBA’s cash rate. Clearly, the board feels there is more work to be done on inflation – and that could, therefore, mean the cash rate has higher to go.

The good news is that the CPI indicator is expected to ease next week to 5.3% from 5.6% in September. This is a welcome prediction for many, given other deciding factors, such as unemployment and retail sales, remain stubborn.

Black Friday and Cyber Monday

Originally an American tradition, Black Friday sales have well and truly ingrained themselves in the Australian calendar. Today’s deals are more than a one-day event, however, with the more e-commerce-focused Cyber Monday bookending this weekend and plenty of retailers extending their deals into next week to drive as much pre-Christmas foot traffic as possible.

According to retail groups, the annual sales event is set to eclipse the once-unbeatable Boxing Day sales phenomenon. With consumer habits now well and truly adjusted to go all-in on a late November splurge, retailers now see little choice but to participate or risk missing out on one of the biggest consumer events of the year.

While the true impact won’t show up in next week’s retail sales figures, December results will likely indicate a jump in spending over November, something that may well be a key factor in driving ongoing rate rises into the new year.

All sources from Commsec, Westpac, Trading Economics, S&P Global Intelligence and Investing.com

MONDAY

Australia-Retail Sales-Retail Sales MM Final

TUESDAY

Nope

WEDNESDAY

Australia Construction Work Done Q3 23

Australia CPI Monthly-YY

Australia CPI annual trimmed mean YY

THURSDAY

Australia Building Approval Total YY

Australia M3 Money Supply

Australia Business capex-Plant/Machinery Capex

Australia Private sector credit/Housing Credit

FRIDAY

Australia Home prices CoreLogic

MONDAY

China (Mainland)-Sales & Orders-Industrial profit YTD

France-Consumer confidence-Consumer Confidence

Brazil-Current account-Foreign Direct Investment

France-Labor Mkt-Unemployment Class-A SA

United Kingdom-CBI reported sales-CBI Distributive Trades

United States-Build Permits revised-Build Permits R Chg MM

United States-New Home Sales-New Home Sales Chg MM

United States-Dallas Fed mfg-Dallas Fed Mfg Bus Idx

United States-Bill Auction – 3 & 6 month-6M Bill Auction

United States-Bill Auction – 3 Month-3M Bill Auction

United States-Note Auction – 2 year-2Y Note Auction

United States-Note Auction – 5 year-5Y Note Auction

South Korea-Consumer sentiment Index

TUESDAY

Germany-GfK consumer confidence-GfK

France-Consumer confidence

Taiwan-GDP Revised-GDP YY Revised

Brazil-Inflation Prelim-IPCA-15 Mid-Month CPI YY

Brazil-Bank Lending-Bank Lending MM

United States US Pork Export Sales Net

United States – Redbook

United States-FHFA Monthly Home Price Index

United States – Shiller Home Prices

United States-Consumer confidence-Consumer Confidence

United States Exp Soybean Inspected

United States-Richmond Fed Mfg Shipments

United States Dallas Fed Services Revenues

United States-Bill Auction – 12 month-12M Bill Auction

Brazil Central Govt Balance

United States-Note Auction – 7 Year-7Y Note Auction

South Korea-Business Sentiment Index (BSI)-BOK Manufacturing BSI

United States-API OIL STOCKS-API Cushing number

WEDNESDAY

France Non-Farm Payrolls Revised

Germany CPI YY

Switzerland-ZEW-Investor Sentiment

United Kingdom-Consumer Credit

Brazil-IGP-M Inflation-IGP-M Inflation Index

Brazil-Labour costs-CAGED Net Payroll Jobs

Brazil-Budget balance-Net Debt/GDP Ratio

India M3 Money Supply

Brazil-PPI MM

United States MBA 30-Yr Mortgage Rate

Germany Inflation Prelim-HICP Prelim YY

United States Prelim-Corporate Profits Prelim

United States GDP Prelim-PCE Prices Prelim

United States-Good Trade balance (Adv)-Retail Inventories Ex-Auto

United States-EIA OIL STOCKS-EIA Weekly Gasoline

Brazil-Labour costs-CAGED Net Payroll Jobs

Brazil-Foreign reserves-Foreign Exchange Flows

South Korea-Industrial output prelim-Retail Sales MM

Japan-Capital flows data-Foreign Stock Investment

Japan-Industrial output prelim-Industrial O/P Prelim

Japan-IP Forecast 1 Month-IP Forecast 1 Mth Ahead

Japan-Retail Sales-Large Scale Retail Sales YY

THURSDAY

South Korea Bank of Korea Base Rate

China (Mainland)-Non-Mfg PMI-NBS Non-Mfg PMI

China (Mainland)-PMI Manuf-Composite PMI

Japan Consumer Confid. Index

Japan Housing starts YY

Germany Import Prices YY

Germany Retail Sales-Retail Sales YY Real

Switzerland Retail Sales YY

France-Consumer spending MM

France GDP Final YY

France-Inflation CPI Prelim MM NSA

France-Producer Prices-Producer Prices YY

Switzerland-Leading indicator-KOF Indicator

Switzerland-Reserves-Official Reserves Assets

Germany-Unemployment-Unemployment

India-Fiscal Deficit-Fed Fiscal Deficit

Brazil-Jobless rate-Unemployment Rate

India-GDP Detail-GDP Quarterly YY

India-Infrastructure output-Infrastructure Output YY

United States Jobless claims

United States-Budget-Personal Income MM

United States-Consumption-PCE Svs Price Exl Energy & Hsg

United States US Pork Export Sales Net

United States-Jobless-Initial Jobless Claims