Traders’ Diary: Everything you need to get ready for the week ahead

News

News

According to the minutes of the FOMC Dec 13th-14th meeting, Fed policymakers were worried about any “misperception” in the markets that their commitment to fighting inflation was flagging.

“A number of participants emphasised that it would be important to clearly communicate that a slowing in the pace of rate increases was not an indication of any weakening of the Committee’s resolve to achieve its price stability goal,” the minutes said.

However, policymakers acknowledged that they now needed to balance fighting inflation with the risks of a slowing economy.

Importantly, 17 of 19 officials projected the Fed funds rates to rise at or above 5.1% this year (currently at 4.25%).

Some analysts see this as proof that the Fed is still going to be on hawkish mode in 2023.

“It appears that officials remain hawkish and are especially concerned about the tight labor market,” said consulting firm deVere’s CEO, Nigel Green.

“We expect that the latest minutes will give the central bank further support to maintain interest rates higher for longer than had been previously priced-in by the markets.”

The hot US jobs market has bolstered the possibility of another super rate hike on February 1st when the Fed meets again.

The non-farm payroll reported the US economy added another 223,000 jobs in December, according to a Labour report on Friday.

The US unemployment rate meanwhile dipped to 3.5%, back to its pre-pandemic low.

During 2022, the US economy added 4.5 million jobs, the second strongest year on record.

“The Fed will stay on their tightening course, but risks of more hikes in the spring are easing as optimism is growing that wage pressures will continue to drop,” said OANDA analyst Edward Moya.

“Ideally the Fed would be happy if wages eased further and the unemployment did not surge, but that probably won’t happen throughout the rest of the year.

“This economy is still recession bound and the unemployment rate should start to rise fairly soon.”

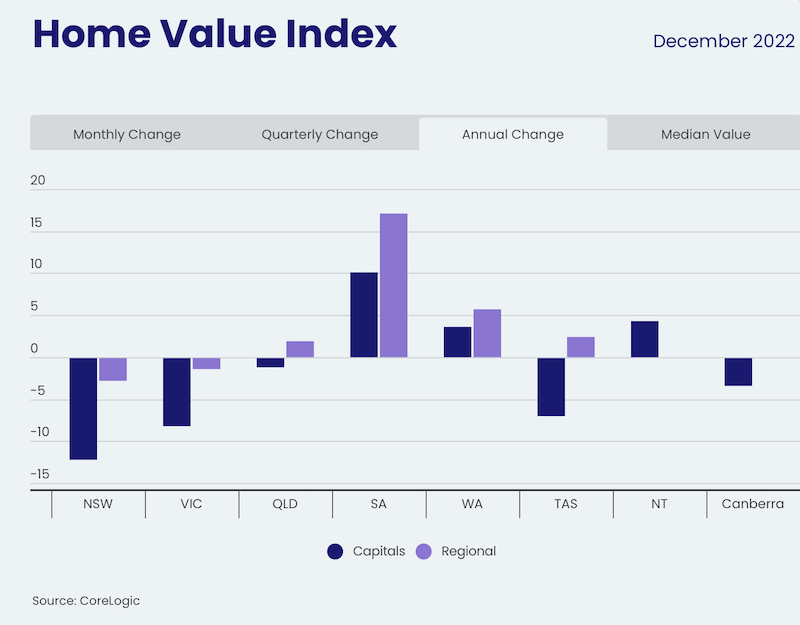

Data provider CoreLogic reported that home values in Australia finished the year lower for the first time since 2018.

Sydney homes fell another 1.4% in December, and are almost 13% lower than their peak in January of last year.

Melbourne has wiped out all of its pandemic gains, down 1.2% in December and 8.3% from its peak in February of 2022.

CoreLogic’s research director, Tim Lawless, said 2022 has been a year of contrasts, with housing values mostly rising through the first four months of the year, but falling sharply as the RBA commenced the fastest rate tightening cycle on record.

“The more expensive end of the market tends to lead the cycles, both through the upswing and the downturn,” Lawless said.

“Importantly, recent months have seen some cities recording less of a performance gap between the broad value-based cohorts.

“Sydney is a good example, where upper quartile house values actually fell at a slower pace than values across the lower quartile and broad middle of the market through the final quarter of the year,” he added.

All sources from Investing.com

MONDAY

Building approvals

TUESDAY

AIG construction and services index

WEDNESDAY

Australian CPI

Retail sales

THURSDAY

Exports and imports

Trade balance

FRIDAY

Home loans

MONDAY

US employment trends

US consumer credit

EU unemployment rate

EU Sentix investor confidence

TUESDAY

US Fed Chair Jerome Powell speaks

US EIA short term energy outlook

WEDNESDAY

US crude oil inventories

US gasoline production

THURSDAY

ECB economic bulletin

US CPI

US initial jobless claims

US Fed budget balance

China exports and imports

China trade balance

China CPI

FRIDAY

EU industrial production

EU trade balance

China exports and imports

China trade balance

Listing dates are from the ASX. Could change at short notice.

All other company information from our own Emma Davies.

Listing: 9 January

IPO: $30m at $1.35

The Company’s flagship project is the Goschen Project which has a substantial rare earth deposit of 413,107 tonnes of total rare earth oxide (TREO), with an accompanying mineral sands resource, located in the premier mineral sands province in North-West Victoria, Australia.

Goschen has a current Proved and Probable Ore Reserve of 198.7Mt.

And the scalability of the project is underpinned by a Mineral Resource inventory of 629Mt, comprising measured, indicated, and inferred resources with further resource expansion potential, the company says.

Listing: 12 January

IPO: $20m at $4

This company develops and sells AI-based traffic enforcement solutions, including the world’s first illegal mobile phone use enforcement camera program, deployed in New South Wales.

ACE’s patent pending technology also includes a windshield penetrating imaging system and high-performance artificial intelligence to detect illegal mobile phone use – which has been demonstrated in partnership with Tasmanian Police.

Listing: 13 January

IPO: $20m at $0.50

This company is focused on gold hydrogen, which is hydrogen that occurs naturally, generated by geological processes, and offers significant cost and emissions advantages relative to other means of hydrogen production.

Gold Hydrogen holds one granted Petroleum Exploration Licence in South Australia (PEL 687) that covers approximately 7,820 km2 on the Yorke Peninsula and Kangaroo Island in South Australia.

On PEL 687, the company is planning to confirm historic occurrences of natural hydrogen of up to 89% purity, at its flagship Ramsay Project.

They also have seven other tenements in application before the South Australian Government, across a further approximately 67,512 km2.

That’s the largest tenure position over naturally occurring hydrogen prospective acreage in Australia

Listing: 13 January

IPO: $8m at $0.20

We’ve all heard of the Lithium Triangle, the famous salars in Argentina and Chile where brines deliver around 40% of the world’s lithium materials.

Patagonia is coming to market with a slew of projects covering 23km2 across the Salta and Jujuy Provinces of Argentina, in close proximity to established producers and developers like Ganfeng, Allkem (ASX:AKE), Lake Resources (ASX:LKE), Power Minerals (ASX:PNN) and Lithium Energy (ASX:LEL).

The company plans to undertake follow-up exploration on the sites, with funds raised to pay vendor costs, provide working capital and IPO expenses, and cover around $1.725m of exploration expenditure including drilling at Tomas III.