You might be interested in

News

ASX Small Caps and IPO Weekly Wrap: Everything sank except gold. What a mess.

News

Closing Bell: Israel's strikes grip markets; oil and gold spike while the ASX tumbles over 1pc

News

Highlights from last week include the US jobs data released on Friday, which was up 194k in September, its slowest gain this year.

However, the US unemployment rate fell to 4.8% in September, compared to 5.2% a month ago.

Earlier in the week, the US Senate approved a short term increase in debt ceiling of US$480 billion, ensuring Treasury will have enough funds until December to prevent it from defaulting.

In Australia, the RBA meeting concluded with the central bank maintaining the cash rate at a record low of 0.1%.

The bank signalled that loan serviceability buffers should be strengthened amid the booming property market.

On Wednesday, the Australian Prudential Regulation Authority (APRA) responded, telling the big banks it expects it to increase the so-called serviceability buffer from 2.5% to 3% from the end of October.

The serviceability buffer assesses a new borrower’s ability to make loan repayments if interest rates rise, or there’s a change in their personal circumstances. It’s a figure added onto the rate of an existing mortgage.

“Price falls (in properties) could be widespread if interest rates were to increase sharply due to unexpected inflation or rising risk premiums,” the RBA said in its Financial Stability Review released on Friday.

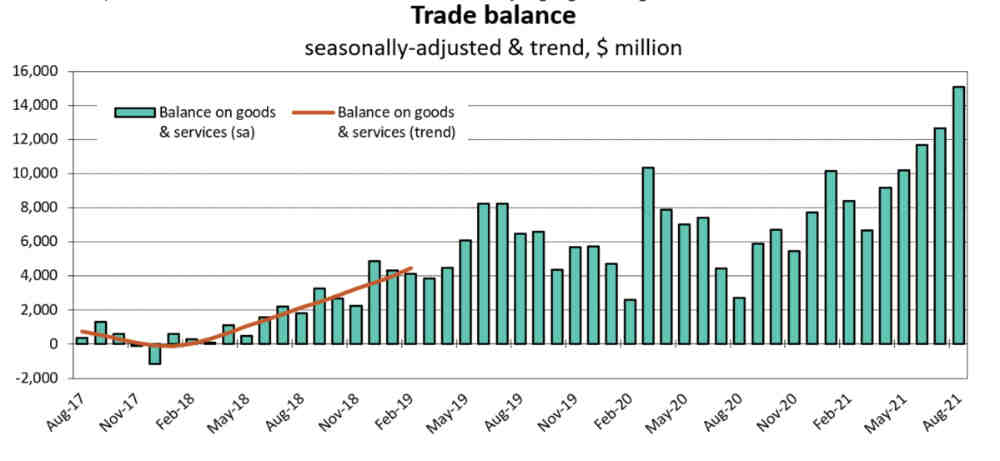

Meanwhile, Australia’s trade surplus surged to a record $15bn in August, amid higher energy prices and larger export volumes in coal and LNG, which offset falls in our iron ore exports.

The focus will be on important employment numbers to be released on Thursday.

TUESDAY: NAB Business Confidence. The index dropped by 5 points last month.

THURSDAY:

RBA Assistant Governor Guy Debelle will deliver an online speech titled: ‘Climate risks and the Australian financial system’

ABS to release jobs report. The consensus is for 120,000 in job losses, and Commonwealth Bank expects the unemployment rate to rise from 4.5% to 5%.

Focus will be on US inflation data to be released on Thursday.

WEDNESDAY: The US Fed will release minutes of the September 21-22 meeting where Chairman Powell spoke about the commencement of tapering.

THURSDAY:

Weekly jobless claims. It increased by 326k last week.

US CPI. The market expects no change in CPI at 4%.

FRIDAY: US retail sales. Last month, sales increased by 2.5% but economists expect that to drop to 0.4% this month.

TUESDAY: Economic sentiment in the Eurozone.

WEDNESDAY: Industrial production. The year-on-year data is expected to drop from 7.7% to 4.9%.

China is back from a week of national holidays last week.

MONDAY: Trade balance for September. The forecast is for a drop from US$58.3bn to US$51bn.

TUESDAY: Export and imports data. The forecast is for both to drop.

WEDNESDAY: Chinese CPI. The consensus is for an increase from 0.8% to 0.9%.

MONDAY

Recharge Metals (ASX:REC), a mineral explorer that raised $5m at 20c.

TUESDAY

Minerals 260 (ASX:MI6), a mineral explorer that raised $15m at 50c.

Diablo Resources (ASX:DBO), a mineral explorer that raised $6.5m at 20c.

Resilience Mining Mongolia (ASX:RM1), a copper and gold explorer with projects in Mongolia. The company raised $6m at 20c.

THURSDAY

Aurum Resources (ASX:AUE), a mineral explorer that raised $5m at 20c.

Eastern Metals (ASX:EMS), an Australian junior base and precious metals exploration company with initial interests in three projects located in the Northern Territory and New South Wales. The company raised $4.5m at 20c.