You might be interested in

News

Closing Bell: Tech stocks in demand ahead of Tesla results; Osteopore up 130pc on clinical trial news

News

Things you may not know about Made in Australia, and ASX stocks that manufacture right here

News

News

The main economic headline last week was the US inflation rate, which has soared to a 40-year high.

Year on year, consumer prices in the US surged by 8.5%, representing the largest annual gain since December 1981.

The main culprit? A double-digit rise in energy prices driven mainly by the Russian invasion of Ukraine.

In addition to consumer inflation, prices the market pays to US producers (also called the PPI index), also leapt by 11% to a 12-year high.

And of course it’s not just the US that’s battling this inflation phenomenon.

A procession of central banks around the world have been hiking rates over the last week or so to combat higher prices.

Last week, the Bank of Canada and NZRB raised their rates by 0.5%. NZ is currently struggling from the highest inflation since the 1990s.

Other central banks to have increased their rates recently include the Bank of Korea, which sprung a surprise 0.25% hike.

The Reserve Bank of India didn’t hike, but the bank changed its language to set the scene for tightening. In the UK, the bond market is pricing in another 0.25% BoE tightening in early May after a 0.25% hike back in March.

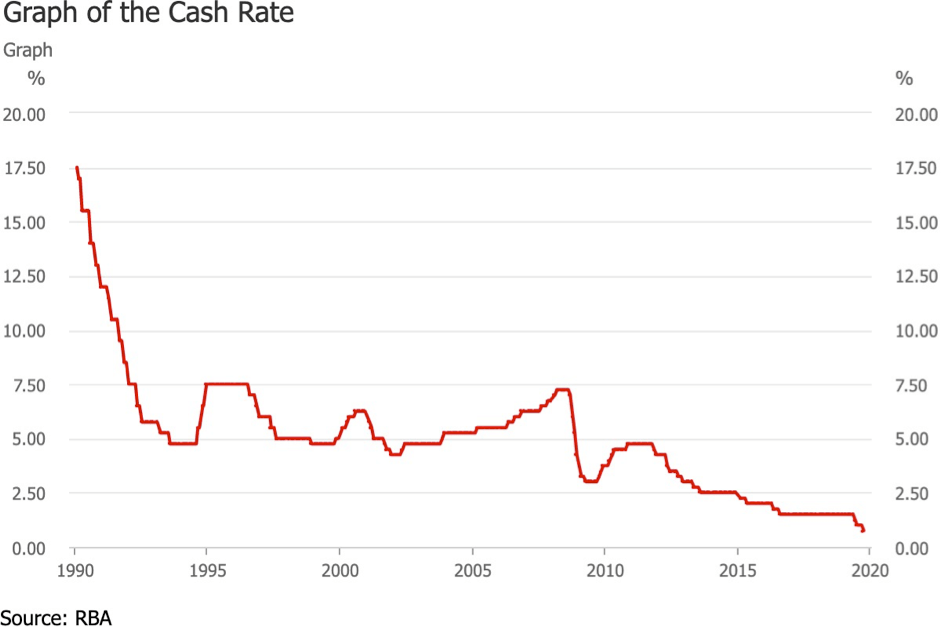

Meanwhile, Australia’s RBA has adjusted its statement language to set the scene for a potential hike this year.

So far, the RBA has defied the bond market by keeping the cash rate at 0.1%.

But persistently low unemployment rate (currently at 4%, Albo..), may force the RBA to shift gears in the coming board meeting set for 3 May.

Sources: Commsec.

TUESDAY

Reserve Bank board meeting minutes (held on 1 April).

WEDNESDAY

Weekly consumer confidence.

FRIDAY

S&P global purchasing manager’s index for April.

TUESDAY

US housing starts and building permits.

WEDNESDAY

US Fed Reserve beige book. This is an update on economic conditions in US districts.

FRIDAY

US S&P global purchasing managers index for April.

WEDNESDAY

Industrial production for February.

THURSDAY

Euruzone CPI release.

Euro Central Bank President will speak.

FRIDAY

Eurozone manufacturing PMI.

As Stockhead’s Emma Davies reports, these are the stocks that are expected to float this week:

Expected listing: 19 April

IPO: $5m at $0.20

The explorer and developer is targeting gold and base metals discoveries.

In SA, the company has the Yumbarra Project (nickel and mineral sands), along with the Fowler, Coorabie Shear Zone, and Tallacootra projects (nickel/copper and gold)

The Sandford Project in Victoria is prospective for gold and base metals (copper, lead, silver, and zinc), as well as ionic REE clays and heavy mineral sands.

Listing: 20 April

IPO: $10m at $0.20

RLF is focused on the manufacture and sale of technology-based plant nutrition products.

Plant Proton Delivery Technology (PPD Tech) aims to solve some of the world’s biggest agricultural, environmental, and human challenges and enables farmers to grow higher yielding, better quality, and more nutritious produce, while massively reducing atmospheric carbon.