Trader’s Diary: Everything you need to get ready for the week ahead

News

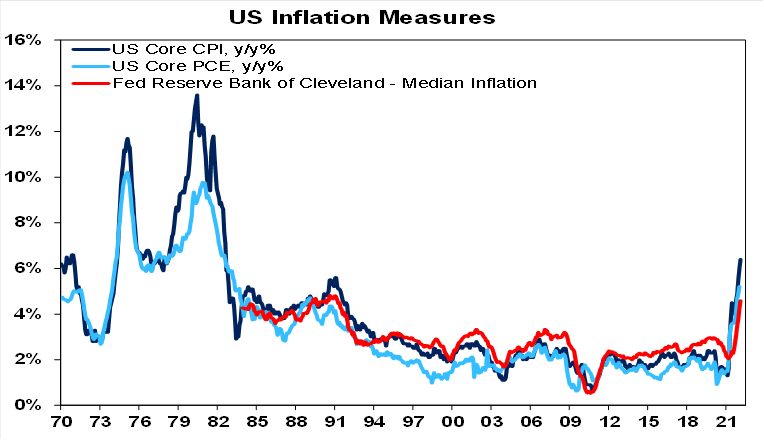

High inflation and volatility in commodity prices both dominated economic headlines.

US prices increased by 7.9% in the last 12 months, which was the largest annual increase in the CPI index in 40 years.

What’s more concerning is that the figure does not yet include the full impact from the US ban of Russian energy imports and other commodities.

At US$5.25 a gallon, US motorists are already paying the highest petrol prices in nominal (non-inflation-adjusted) dollars, breaking the US$4.11 per gallon record set on July 17, 2008 (according to US Today).

The Biden administration has been trying to get the Middle East countries and Venezuela to ramp up their oil production to cover potential shortage, but no avail so far.

Brent crude closed a highly volatile week at US$112.70 a barrel after surging to US$140 earlier this week.

The key economics data to watch this week is Wednesday’s US FEd FOMC meeting, which is expected to result in a 25bp increase in rates.

Experts are however predicted a total of 200bp rate increase in the US for 2022.

Meanwhile, Australia has joined the US and the UK and banned imports of Russian oil. As we’re not a major importer of Russian energy products, the move is not expected to have much impact in the country.

“Australia has diverse and resilient oil supply chains, and adequate fuel supplies,” a spokesperson for foreign minister, Marise Payne, said on Friday.

Other economics data to watch this week include the RBA meeting on Tuesday, and the CPI data release in the Eurozone on Thursday.

Sources: Commsec.

TUESDAY:

ANZ and Roy Morgan consumer confidence.

RBA Board meeting.

Property prices indexes for the December quarter.

THURSDAY:

Labour force for February. Commsec says 40,000 jobs may have been added.

TUESDAY:

US producer prices for February.

WEDNESDAY:

US Fed Reserve (FOMC) policy decision. A 0.25% hike is expected.

US retail sales for February.

THURSDAY:

US industrial production for February.

FRIDAY:

US existing homes sales.

TUESDAY:

China retail sales for January and February.

TUESDAY:

Eurozone industrial production for January and February.

THURSDAY:

European Central Bank President Lagarde speaks.

Eurozone CPI release.

FRIDAY:

Eurozone wages and labour cost for the quarter.

Source: ASX

Equity Story Group (ASX:EQS), a stock market trading advice, research, investor education and fund management company that raised $5.5m at 20c a share.

Many Peaks Gold (ASX:MPG), a minerals explorer that raised $5.5m at 20c a share.