Trader’s Diary: Everything you need to get ready for the week ahead

News

OPEC’s decision to stick to an increased output of 400k barrels/day next month saw oil prices climbing more than 5% last week to close near a two-month high.

The cartel agreed last year to boost output in such increments each month until production reaches pre-pandemic levels, but wants to review the policy every month.

So why are prices rising on increased production?

“If anything, the fear and panic of a month ago over widespread disruptions and a blow to demand recovery has now subsided, giving OPEC+ greater confidence to continue increasing supply,” says Singapore-based Vandana Hari, founder at energy analysts Vanda Insights.

On the jobs front, the US economy added 199k jobs last month, far below estimates of 422k. It was the second month in a row of lower than expected job growth in the US.

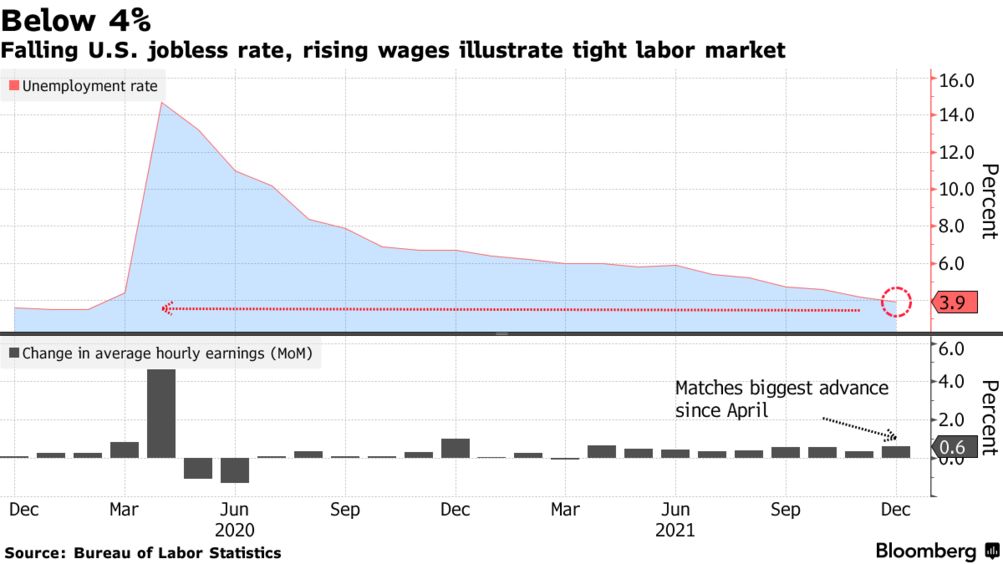

The US unemployment rate meanwhile, has declined more than expected to 3.9% in December (compared to 4.2% in November and 14.8% in April 2020).

How do we explain slower job growth with low unemployment rates?

Basically what it means is that although everyone who wants to get a job can get one, many don’t want to. The labour force participation rate (people who are trying to get a job) is currently way below pre COVID-19 levels.

In Australia, data released on Wednesday showed that job ads across Australia had fallen by 5.5% in December amid the Omicron lockdowns, but still remain 37% above pre-COVID levels.

ANZ senior economist, Catherine Birch, said the 5.5% drop in ANZ Job Ads in December “was not necessarily a bad sign”.

“ANZ Job Ads measures the total number of job ads (stock), rather than newly lodged job ads (flow).

“So if the number of advertised positions filled exceeds the number of jobs newly advertised during the month, the stock will fall.”

MONDAY:

Building approvals for November.

Inflation gauge (a reading on price pressures) for December.

RBA credits and debit cards usage in December.

TUESDAY

ANZ/Roy Morgan weekly consumer confidence.

WEDNESDAY

Job vacancies in November.

FRIDAY

Lending indicators for November, which includes housing, personal, business, and lease loans.

MONDAY

US consumer inflation expectations for December.

WEDNESDAY

US inflation for December. The current annual core CPI rate is at 4.9%

FRIDAY

US retail sales for December.

WEDNESDAY

Chinese inflation.

THURSDAY

Chinese trade balance

MONDAY

Eurozone unemployment rate for November.

(sources: Commsec and Investing.com)

According to the ASX, these companies are set to make their debut this week.

Careteq Limited (ASX:CTQ), a technology solutions provider in health and aged care that raised $6m at 20c a share.

ChemX Materials (ASX:CMX). The company’s main business is the development of projects and processes to produce materials in high demand in new energy and technology markets. It raised $8m at 20c.

Far East Gold (ASX:FEG), a mineral explorer that raised $12m at 20c.

NICO Resources (ASX:NC1), a mineral explorer that raised $12m at 20c.

Resilience Mining Mongolia (ASX:RM1), a copper and gold explorer in Mongolia that raised $6m at 20c.