The right formula for a record quarter, but just how big can Bubs Australia get?

News

So just how much can infant formula company Bubs Australia (ASX:BUB) grow? The Aussie infant formula manufacturer has just achieved both the American and Chinese dream in one quarter of spectacular action.

The company today announced it had record Q4 gross revenue of $48.1m, up 278% previous corresponding period (pcp) and up 174% QoQ, delivering the fourth consecutive quarter of growth on prior year.

FY22 gross revenue was $104.2m, up 123% pcp and more than double last year.

Bubs said it has achieved sustained growth momentum across all key product segments (A2 Beta-Casein, Organic Grass-fed, and Easy-digest Goat infant formula), along with all key markets Australia, China and the big US of A.

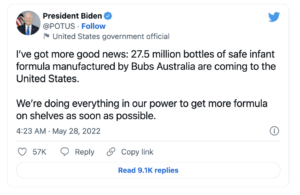

It’s the US that is key to Bubs’ burgeoning status, when as far back as May when Stockhead’s Christian Edwards (so aptly) said, US President Joe Biden just handed Bubs a Golden Ticket to help solve an infant formula shortage that had gripped the US.

Biden even took to Twitter to make the announcement leaving Australia’s finance media (including us) scrambling for a response from Bubs.

Bubs won US FDA discretion for all six of its Bubs Infant Formula products for import – a rare deal indeed – with well over half a million tins delivered between May and July.

The scintillating white powder is now sold in 5400 stores across 34 states including the largest stockists of infant formula Walmart, Kroger, Albertsons/Safeway and Target.

The Bubs share price has risen more than 8% on today’s results and 23% YTD to 58 cents.

Obviously, Bubs founder and CEO Kristy Carr is a proud mum today.

The quarterlies show it may well just have been worth staying up for a Zoom meeting with Mr President from its warehouse in Dandenong South in Melbourne to get the US deal over the line.

“The last quarter has seen the business reach critical mass following exceptional growth across Australia, China and rapid expansion in the the US with our involvement in the Biden-Harris Administrations’ Operation Fly Formula initiative aimed at helping to mitigate the ongoing infant formula shortage crisis,” Carr said in today’s announcement.

“This business diversification and increased scale of our most profitable products and channels has flowed through to our operating margins, delivering profitability for the full year (excluding non-cash equity compensation expenses).”

Carr went on to say the quarter demonstrates initial success of Bubs’ comprehensive business strategies, led by its clean label infant formula products experiencing high growth in all three key market segments “despite a challenging macro environment”.

While a temporary measure to solve the US infant formula crisis, the FDA is looking to make exporting infant formula into the US a more permanent arrangement, but it’s not yet a deal inked in print (maybe don’t count your kids before they hatch).

“We are confident of the long-term growth prospects for the USA now that the Food and Drug Administration has committed to a framework for suppliers like Bubs, who have already been approved to import infant formula products, to remain on shelf beyond November 2022,” Carr said.

“As a result, we envisage the USA will become a lead export market opportunity on par with China in the future.”

In June Bubs upgraded FY22 gross revenue to be over $100 million, subject to scheduled operations occurring without disruption, with at least 100% increase on the $1.2 million underlying EBITDA (excluding non-cash equity compensation expenses).

Executive Chair Dennis Lin said the USA represents the most dynamic opportunity and long-term growth prospect for the business.

“Now that we have achieved scale with over $100 million in gross revenue, we expect margin accretive growth to continue, and anticipate FY23 revenue and margin contribution will be largely attributed to growth in China and the USA, and across our portfolio segments, with infant formula forming a significantly higher proportion of revenue than the current 60%,” Lin said.

“The team will be singularly focused on delivering earnings accretive growth in FY23 and beyond for our existing and new shareholders.”

Bubs remains bullish on its China prospects, despite all the disruptions and a tough stance of the Chinese Government towards the ongoing covid-19 pandemic.

Bubs said the Alpha-Group equity-linked strategic partnership and the China launch of Bubs Supreme A2 beta-casein has proven to be highly successful, remaining its most profitable channel:

“The strategic rethink about our Daigou business triggered by the covid-19 pandemic and the subsequent signing of an equity alliance with Alpha Group, our largest corporate Daigou partner has been rewarded with rapid growth in corporate Daigou sales which now stand at a record high, growing 13-fold in Q4 FY22 compared to the same period last year,” – Kirsty Carr, CEO

While growth is contributing positively to profitability, Bubs says it has “also necessitated and required an initial larger base of working capital and inventory”.

In early July Bubs announced a $63 million capital raise for working capital to support accelerated expansion, build inventory and its presence in the US along with ambitious plans to triple its processing and canning facilities.

As of June 30, 2022 the company still held $16.3 million in cash reserves (before receipt of cap raise funds).

Once the institutional and retail components of the cap raising are done it expects to have a wad of funds, though diluted value – $82.3 million to be exact – comprising of $76.3 million cash, $2 million drawn debt and $8 million undrawn debt.

Bubs has spent a lot of money to get where it is today. Just how far the new found funding and US alliance will take Bubs, time will tell.