The largest parts of Australia’s economy are going backwards

News

News

Australian economic growth slowed sharply last year, seeing annual growth decline to just 2.3%.

Based on the indicators in early 2019, things may be getting even worse.

Following news earlier this week that activity levels across Australia’s services sector — accounting for just under 80% of the economy — have deteriorated sharply this year, we’ve just received confirmation that the same trends are being seen across the construction sector, too.

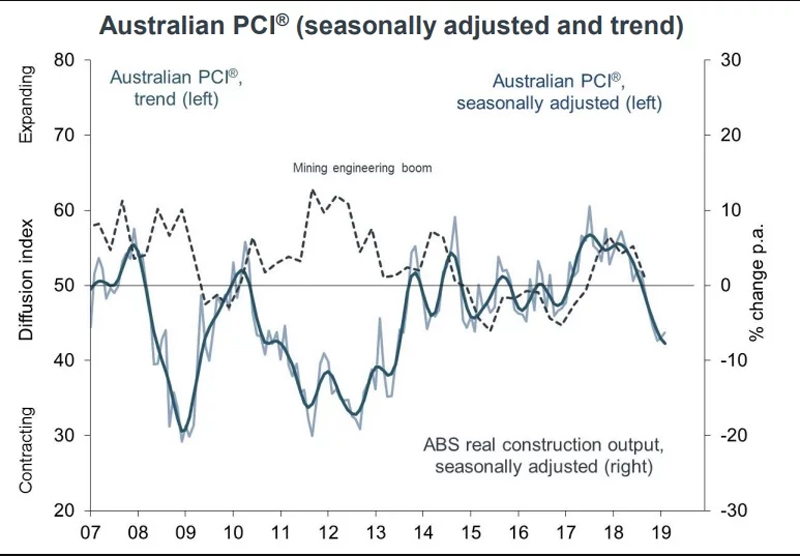

The Australian Industry Group’s (Ai Group) Performance of Construction Index (PCI) stood at 43.8 in February in seasonally adjusted terms, up 0.7 points on the level reported in January.

The PCI measures changes in activity levels across Australia’s construction sector from one month to the next. Anything above 50 signals that activity levels are improving while a reading below suggests they’re deteriorating. The distance away from 50 indicates how quickly activity levels are expanding or contracting.

So at 43.8 last month, the PCI indicates that activity levels continued to weaken sharply last month, albeit at a slightly slower pace.

As seen in the chart below, the conditions across the sector have deteriorated sharply over the past six months, fitting with many other indicators on housing, credit growth and construction seen in recent times.

“Australia’s construction downturn continued in February with activity falling in all four sub-sectors and employment levels contracting,” the Ai Group said.

“The downturn is most acute in the residential sub-sectors while both engineering and commercial construction also contracted again in February.”

In the Ai Group’s opinion, the drop in residential activity, in particular, is an “orderly wind-back from the historically high levels of activity”.

However, while true that residential construction still remains high in comparison to periods in the past, Tom Devitt, Economist at Australia’s Housing Industry Association, expressed significantly greater concern about the speed in which the building boom is unwinding.

“The housing market downturn accelerated in the second half of 2018,” he said.

“Across detached houses and apartments, activity is contracting and so too are new orders. The pipeline of building work looks to be shrinking at a concerning rate.”

Whether that “concerning rate” continues will laregly come down to how the broader economy performs in the period ahead, Devitt said.

“Residential building has been pivotal in driving activity in the rest of the economy for the past five years. Over the coming years as home building activity slows the sector will be reliant on the resilience of the broader economy.”

Given the recent steep deceleration in the economy, things may well get worse before they get better, especially with new work continuing to fall steeply.

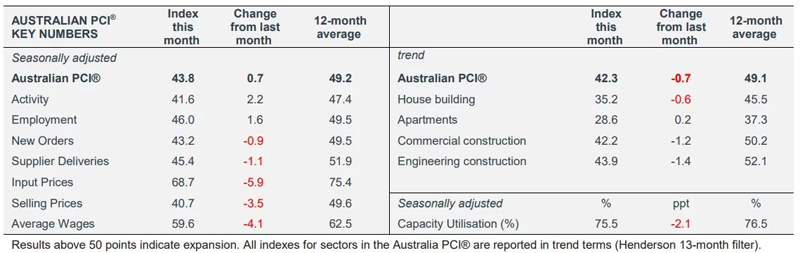

As seen in the table below from the Ai Group, not only did activity levels deteriorate sharply across all parts of the sector last month but new orders — seen as a lead indicator on activity levels in the future — also fell at a faster pace than January.

“With new orders also lower in February the construction downturn looks likely to continue over coming months,” the Ai Group said.

In trend terms, new orders for apartments and houses both fell at the fastest pace since 2013. New work for engineering and commercial firms also declined at the fastest pace in several years.

That result point to broad-based weakness across the construction sector not only this year but next given the lengthy time frame for apartment, commercial and engineering projects to be completed.

Adding to bleak outlook, margin pressures remained intense with input costs continuing to lift strongly while selling prices fell at the fastest pace since 2013.

“This indicates that rising input prices and other costs are not, on average, being passed on to customers, reflecting the strong competition among builders in securing work,” the Ai Group said.

“The on-going gap between these price series demonstrates that profit margins remain tight for many businesses in the construction industry.”

With activity levels weakening and new orders drying up, firms continued to cut staffing levels, albeit at a slightly slower pace than January.

However, given the construction sector employs around 10% of Australians, the staff cuts, on top of those being reported in the far larger services sector, adds to evidence that employment growth is likely to slow further in the months ahead.

Fitting with the reduced headcount, wage growth for construction workers also eased in February.

With the release of the PCI, it concludes the latest batch of report cards on Australia’s manufacturing, services and construction sectors from the Ai Group.

While the manufacturing sector is performing fairly well in early 2019, the services and construction sectors are not. That’s a major concern given they account for over 90% of the Australian economy.

Should the responses in the latest PMI surveys be indicative of what will be seen in the hard data in the months ahead, it points to the potential for even weaker economic growth than what was seen late last year.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.