The Ethical Investor: VC fund Giant Leap sees big opportunity amid boom in Aussie impact startups

News

News

Almost an unknown trend just a few years ago, Australia’s impact startup ecosystem is rapidly developing despite recent market headwinds.

According to venture capital (VC) fund Giant Leap, the percentage of impact startups as a proportion of all funded Australian startups has increased 1.5x in the last 5 years.

This growth is perhaps not much of a surprise, given that Australia is ranked by Thomson Reuters Foundation as the second-best country in the world to be a social entrepreneur just behind Canada.

And what it does show is that an increasing number of founders are willing to take risks and use business as a force for good.

So what exactly is an impact startup?

An impact startup is a recently founded company whose business is solving a major societal problem.

Some of the popular sectors they focus on are micro finance, education, healthcare and most recently, renewable energy.

These startups are gaining traction and receiving plenty of seed funding from VCs like Giant Leap as they move rapidly from a niche investment category to the mainstream.

The trend is expected to continue well into the future.

A recent survey shows that more than 60% of Aussie investors expect their advisors to incorporate their values, or consider the societal or environmental implications, of investments.

In fact, two of the top three funds rated by Canstar on financial performance over the last 12 months were ethical superfunds – adding credence to the widely held belief that ethically screened asset classes are more resilient.

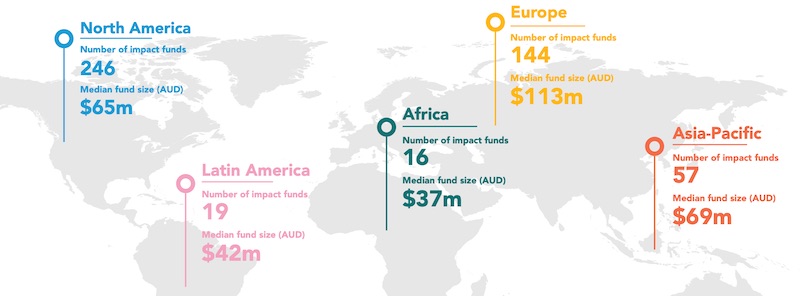

While Australia’s impact startup ecosystem is rapidly developing, it is still a very small piece of the global impact startup community.

Much like the broader VC industry, the impact VC industry is dominated by the US.

According to Giant Leap’s data, most of the impact startups that are sprouting in Australia are largely focusing on issues of sustainability and health & wellbeing.

The theme of empowering people is also another category that Giant Leap believes could see a lot of traction in the future.

The urgency of global warming combined with growing consumer awareness are leading to a growing interest in clean tech.

In the renewable energy space, Australia has amongst the highest penetration of rooftop solar, driven by government incentives and reduction in cost of solar by 82% since 2010.

Giant Leap has seen several startups focusing on developing this technology, including building software to plan grid-compatible virtual power plants.

Battery technology is also one of the top themes for startups.

Battery costs have fallen by nearly 90% over the past decade, paving the way for both a 100% renewable grid and growth in the electric vehicles industry.

In this space, Giant Leap has seen startups developing more efficient batteries with hydrogen technology, and creating batteries that can be more cheaply installed in homes.

Recycling of plastics and glass waste is also one of the big startup opportunities.

Recycling has been a critical issue for Australia since China stopped accepting unsorted waste in 2018, leading to increasingly large recycling stockpiles in Australian warehouses.

The digitisation of healthcare is transforming methods of healthcare service delivery and improving health outcomes.

The global digital health market is predicted to reach US$505 billion by 2025, up from US$86 billion in 2018.

In this space, telehealth is the biggest opportunity for startup founders according to Giant Leap.

The Australian government has given support to the telehealth sector, making changes to the Medicare rebates and adopting new telehealth technologies for medical professionals.

During the Australian Covid-19 lockdowns in 2020, telehealth consultations jumped from under 100,000 per month to over 5 million.

Corporate wellbeing also offers a great opportunity in the healthcare space, says Giant Leap.

Workplace stress is a silent long-term killer, leading to long term anxiety, depression, and costing Australian businesses $13 billion in absenteeism and healthcare costs.

The opportunity for startups who can use software to deliver wellness initiatives to employees is substantial.

Artificial intelligence (AI) diagnostics also present a potential sizeable market. The superior computing power and capability of AI is well suited to diagnostics, amplifying clinicians’ ability to identify the causes of an illness.

Great Leap says that key trends and opportunities in this thematic includes education.

There are significant opportunities in the edtech market, which is forecast to grow at 12.2% annually to reach US$404 billion by 2025.

The need for high-quality, online education has been especially highlighted due to the pandemic when schools were forced to suspend face-to-face classes.

Giant Leap was launched in 2016 by The Impact Investment Group (IIG) as Australia’s first venture capital fund 100% dedicated to investing in impact startups.

To date, the fund has invested in over 25 companies that can deliver superior financial returns alongside real and measurable social and environmental benefits.

What brought you to Giant Leap?

“My background prior to Giant Leap was as a consultant, working in strategy and communication to a number of companies across retail FMCG,” Milgrom told Stockhead.

“I quickly realised that being a consultant is not the best business model to engage with startups, because for one, they have very little money.

“And two, you really want to work with startups who don’t need consultants in the first place. You want to work with those that have a real internal skill set.

“I wanted to work with companies where I believed that the outputs of their businesses, the things that they made and sold, are actually going to have a positive impact on people and the planet.

“So it became clear to me that the best place to situate myself was as an investor.

“Over the last five years, a lot of capital has moved into the sector but there’s much needed capital in the space, and so that was the impetus to start Giant Leap.”

How easy is it to convince people to invest in a venture capital fund?

“It takes a massive amount of trust and belief to invest in a venture capital fund,” explained Milgrom.

“It took us about two years to raise our first fund. We had 80 investors for that first fund, and we probably had to conduct 300 meetings or more to raise it.

“Thankfully when we raised our second fund, we managed to do it much faster and raised the equivalent of our first fund in just four weeks.

“We’re now about to close our second fund at about $50 million later this year.

“The process of raising funds is the same way as you would go through any other sales process.

“You have to conduct a lot of meetings, you have to find investors who believe in the mission and are excited about the sector, and will trust you to execute.”

Is the social impact sector ripe for disruption?

“Our investors definitely believe that the industries and sectors we’re tackling are ones that are going to drive economic success,” Milgrom said.

“Broadly speaking, we see our sectors as being education, health care, waste management, renewable energy, diversity and inclusion.

“They fit under the three broad themes of sustainable living, health and well being, and empowering people.

“We believe each of those sectors has a really deep systemic problems that companies can solve, and therefore provides a huge market opportunity.

“Our investors are looking for us to find companies and evaluate them both on the basis they can have a positive impact, but also on the basis that there’s a big market opportunity and financial reward there.”

How many startups does Giant Leap evaluate and how many do you invest in?

“We fall under the ESVCLP regime, which mandates a minimum percentage of Australian companies, but we also have the international companies in our portfolio at present,” Milgrom said.

“When we launched six years ago, we were looking at approximately 150 to 200 opportunities per year. But we’ve seen that increase every year and this year, we’ll see over 1,500 opportunities.

“What’s great for us is that as we track our deal flow, we’re seeing a higher proportion of those opportunities meet our impact and commercial thresholds. This means that not only are we seeing more ideas and opportunities, they’re better as well.

“Of those 1,500 opportunities that we look at, we would typically make somewhere between four and six investments per year.

“And for each, we would typically invest around $300k and up to $1 million, depending on the stage of the company.”

Tell us about some of the investments in your portfolio

“In the sustainable living space, the most well known one would probably be Sendle, which is a carbon neutral logistics platform,” said Milgrom.

“They use the existing delivery services capacity and use technology to fill into logistics in order to reduce carbon impact.

“In the empowering people space, one of the companies we work closely with is called Applied, a recruitment platform that uses behavioural science to remove unconscious bias and improve hiring decisions.

“Their platform is designed to remove the natural bias that we all have when looking at CVs, which often lead us to sub optimal decisions about who we want to interview.

“And in the Health and Wellbeing sector, the most well known is probably Seer Medical. They are a combination of hardware and software platform for epilepsy sufferers.

“What’s unique about Seer is that when you are diagnosed into an Epilepsy Centre, you’d normally have to stay there and the doctors would monitor and wait for you to have an episode.

“But because you’re outside of your normal environment, you may or may not have the episode.

“So what Seer has designed is a hardware and software that you can bring back to your house, and that monitoring can happen in the comfort of your own home.”

What’s your investing criteria and how do you measure social impact?

“Firstly, we have three tests for founders that form the basis of our mandate,” Milgrom explained.

“The first is that the companies we invest in must be mission driven to solve a big problem.

“We want them to be solving systemic long term problems, and that’s particularly important because we are long term investors.

“The second test is that the impact must be embedded in the business model. In other words, the product they sell must be the very impact they are trying to make.

“For example, in the context of an education company, if you’re selling education and the impact you’re making is on education, there’s a direct link there between impact and revenue.

“That is in contrast to a company where they may want to solve education, but they’re selling widgets, and so there’s not a direct link there.”

“And thirdly, is the impact has to be measurable.

“We work with each of our portfolio companies to devise measurable statistics they can report to us on a quarterly basis.

“We have an impact calculator, which we use when we’re assessing a business and look at the depth of their potential impact.

“This calculator looks at a number of factors. This includes the beneficiaries, and how underserved they are.

“We also measure how good the solution is, how much this solution is going to affect the beneficiaries, as well as what risks or negative consequences that might occur.”