You might be interested in

ESG

The Ethical Investor: 7 major opportunities in the energy transition, and where ASX investors can find them

News

The Ethical Investor: Green construction stocks, and ESG insights from Evergreen's Angela Ashton

News

News

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Shaw and Partners’ Senior Investment Advisor, Adam Dawes.

All eyes are on the COP26 international climate talks, to be held in Glasgow this November.

COP26 is short for the 26th Conference of the Parties to the UN Convention on Climate Change, and is an annual event that’s attended by world leaders.

This year’s event couldn’t come at a more critical time, as the world grapples with an energy crisis that has manifested into fuel shortages and widespread blackouts in China.

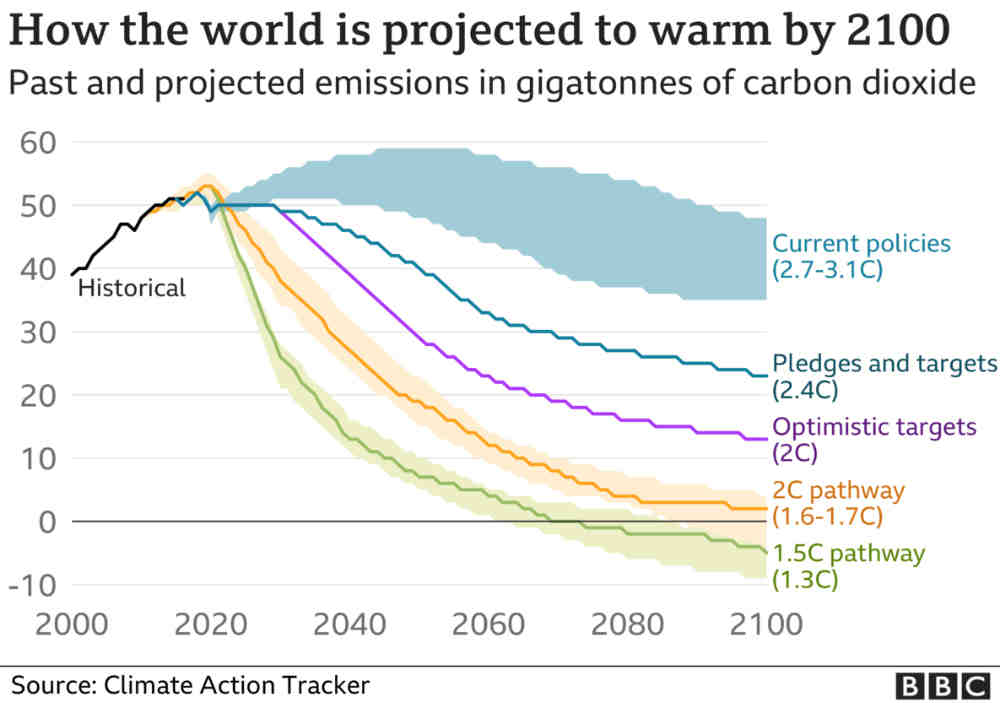

The conference will aim to reach agreements on a number of key targets – including keeping the goal of limiting a rise of 1.5 degrees Celsius alive, and putting an expiry date on the use of coals.

According to experts however, pledges put in place by governments today will hold us to 2.4C higher by 2100 – a situation that UN Secretary General António Guterres claimed would put humanity ‘on the brink of a catastrophe’.

The use of technology would certainly be at the forefront of discussions, but could advances in artificial intelligence (AI) really be used to avert climate change?

According to the World Economic Forum, AI is already being used to send natural disaster alerts in Japan, monitor deforestation in the Amazon, and design greener smart cities in China.

By 2030, AI could help cut global greenhouse gas emissions by 4%, claims a recent study by accounting firm PriceWaterhouse Coopers.

But some are still not convinced.

“You could end up with a social equity issue,” argues Rob Fisher, a partner of KPMG Impact, the firm’s ESG-related services division.

“If you are using AI to make decisions about people that might cause some disparate impact, how are you governing that? How much information about people is it appropriate to capture? What decisions are we going to let a machine make?”

Pressure is mounting on the Morrison government after the state of NSW committed to an ambitious emissions reduction target that has highlighted the Federal Government’s inaction.

The NSW government has just released a document detailing its plans to slash emissions by 50% below 2005 levels by 2030.

The Federal Government on the other hand, has so far refused to commit to a target of net zero emissions by 2050.

“I won’t be signing a blank cheque on behalf of Australians to targets without plans,” PM Morrison said defiantly.

So could this be the reason why the PM is in two minds about attending the COP26 Summit?

“We haven’t made any final decisions about attending COP26. I mean it is another trip overseas and I’ve been on several this year and spent a lot of time in quarantine,” Morrison told the West Australian newspaper.

Meanwhile, global asset manager Janus Henderson has just launched the Global Sustainable Equity Active ETF (ASX:FUTR) onto the ASX.

Janus’ FUTR ETF invests in companies seeking to confront global challenges posed by so-called “mega trends”.

“I think over time we’ll see sustainable and ESG strategies move into the mainstream – the interest is significant here in Australia and offshore,” Australia’s head of Janus Henderson, Matt Gaden, told Stockhead last week.

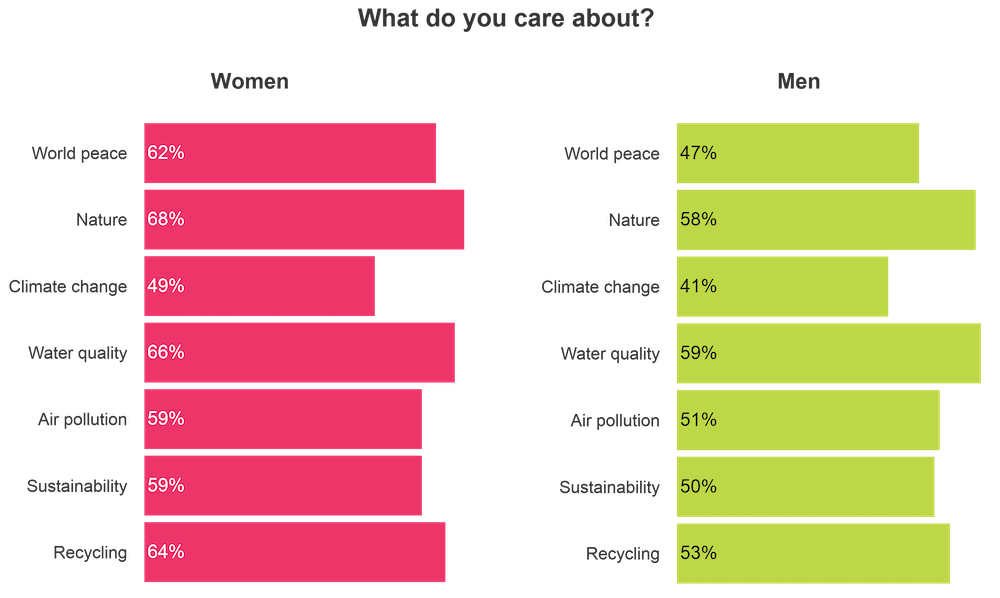

When it comes to the mainstream, a survey by Perpetual shows there are subtle differences between what men and women think are important when it comes to ESG investing:

An Australian investment advisor firm that’s hot on the heels of ESG-themed stocks is Shaw and Partners.

Stockhead spoke directly to Adam Dawes, one of the firm’s senior investment advisors to get his current views on ESG investing.

What’s your macro take on ESG investing at the moment?

There’s a huge wall of money that’s coming down the line with ESG, and it is at the forefront of a lot of investors’ minds. Ten years ago, you wouldn’t be able make money in an ESG investment, and you’d be laughed out of the room. To give you an example of why this is becoming such a prevalent issue, I asked my daughter who’s 14 years old the other day about what she wanted for Christmas, and she said clothes, but it must be ethically sourced. If that’s the psyche of most teenagers growing up, then you can’t ignore this ESG space.

What ESG-themed investments are you working on?

We’ve been working on a pre-IPO round for a business called Xpansive. It’s a business that trades carbon credits. Here in Australia, we trade water credits and we’re the best at it in the world. Xpansive is a global exchange platform for transacting energy and environmental commodity products such as water, carbon, renewable energy, and natural gas.

Any ASX stock you recommend for an ESG investment?

We’re definitely buying Calix (ASX:CXL). Calix’ technology basically allows heat to come out of manufacturing cement. That will secure some large royalties that will continue down the line, so we’ve got a really good outlook on Calix. Decarbonisation investor Carbon Direct has also just invested €15m for a 6.98% equity stake in Calix subsidiary, LEILAC. That was the first validation of the technology in a commercial sense.

What about ASX-listed ETFs?

There are two that we’re looking at to get access to a broad brush of ESG filters: Australian Sustainability Leaders (ASX:FAIR), and the Global Sustainabiluty Leaders fund (ASX:ETHI). These are funds that we think could give clients some kind of ethical investments, while diversifying risk across that space.

Brambles (ASX: BXB)

The global supply chain solutions company announced it is now a a carbon-neutral operations business, just one year into its 2025 sustainability targets. The company says its net CO2 emissions have been offset by investing in reforestation projects, and procurement of renewable electricity.

Bass Oil (ASX:BAS)

Bass announced a commitment to pursue clean energy opportunities on its oil and gas assets, as part of its Cooper Basin acquisition strategy. The company expects to complete the transaction with Cooper Energy to acquire an interest in a portfolio of Cooper Basin tenements by mid-October.

Genex Power (ASX:GNX)

The junior renewables company has inked a supply agreement with Tesla Motors Australia for the Bouldercombe Battery Project in Queensland. Set to be developed using Tesla’s Megapack lithium-ion battery technology, the 50MW/100MWh battery will comprise of 40 Megapacks and will be fully operational in the first half of 2023.

STAR Water

Unlisted STAR Water has developed a process by which recycled materials are examined through the company’s patented Kalkulus computer modelling tool, to solve community issues such as waste management, water scarcity and water contamination. The company wants to tap into the growing ESG market as it eyes a possible listing on the Sydney Stock Exchange.