You might be interested in

ESG

The Ethical Investor: Insurers kept busy as Australian regulators start cracking down on ESG greenwashing

News

The Ethical Investor: Does Australia have a slavery problem? We ask Ndevr Environmental's Brian Kraft

News

News

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is JP Equity Partners’ director and partner, Nic Brownbill.

The ongoing energy crunch threatens to morph into a financial crisis as serious as the one we saw in 2008, analysts have warned.

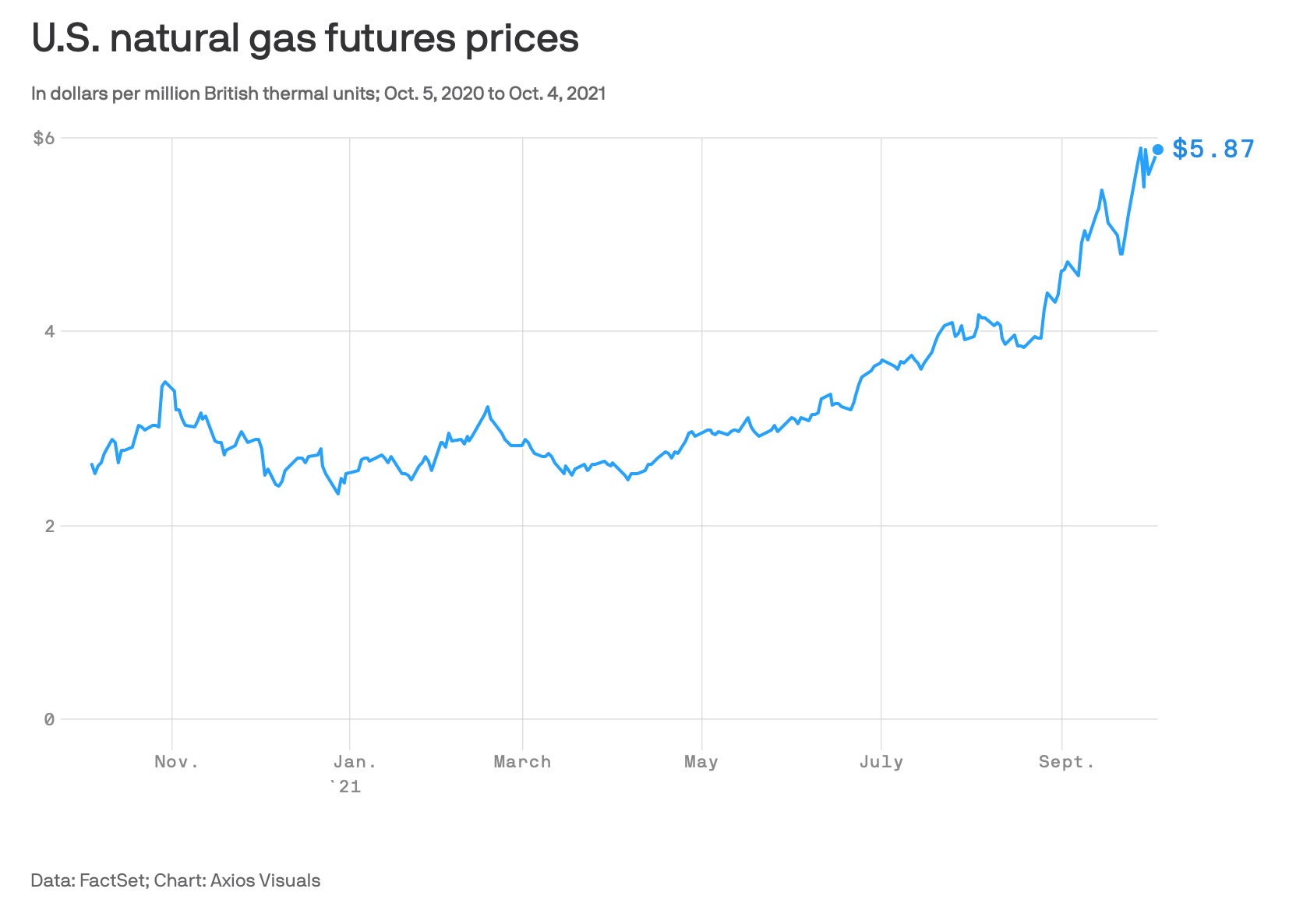

Natural gas prices are up a staggering 50% just over the past week, as inventories are falling at a scarily rapid rate across Europe ahead of the winter season.

In China, power outages forced the government into a desperate backflip, as the country began to unload Australian coals from bonded warehouses despite the political spat that led to an unofficial ban on Aussie coals since last year.

As a result, thermal coal prices rose to record levels, with low volatility 6000kcal product from Newcastle soaring 5% to US$240/t this week.

Higher energy prices are fanning concerns of spiralling inflation worldwide and derailing the global economic rebound.

And it’s has put the spotlight on the risks of “greenflation”, an inflationary scenario caused by capital moving away from fossil fuel investments and into ESG-compliant projects – too much, too quickly.

“The world faces a growing paradox in the campaign to contain climate change,” Morgan Stanley chief global strategist Ruchir Sharma told FT.

“The harder it pushes the transition to a greener economy, the more expensive the campaign becomes.”

He argues that tightening regulations have discouraged investment in traditional fossil mines, with the unintended result being rising prices for metals such as copper, aluminium and lithium.

These metals are ironically essential inputs into solar and wind power technologies, as well as electric cars.

Solving this conundrum will require a balance, he said, arguing that transition towards clean energy and zero carbon needs to be eased, not rushed.

Jeff Currie, global head of commodities research at Goldman Sachs meanwhile, is of a different view and said the current crisis could be exactly what the world needs to transition into renewables.

“Rising energy prices could help to accelerate the energy transition, and that higher prices would make all forms of renewable energy more commercially attractive,” Currie told Bloomberg TV.

Political debate over the use of fossil fuels and coals has also taken centre stage downunder.

The Minister for Resources and Water, Keith Pitt, is adamant that coal will remain a significant contributor to the Australian economy well beyond 2030 as global demand continues to grow.

“The future of this crucial industry will be decided by the Australian Government, not a foreign body that wants to shut it down costing thousands of jobs and billions of export dollars for our economy,” Minister Pitt said.

But activists want all forms of funding to fossil fuel projects to cease, with a group of shareholders calling on banks to stop the lending practice.

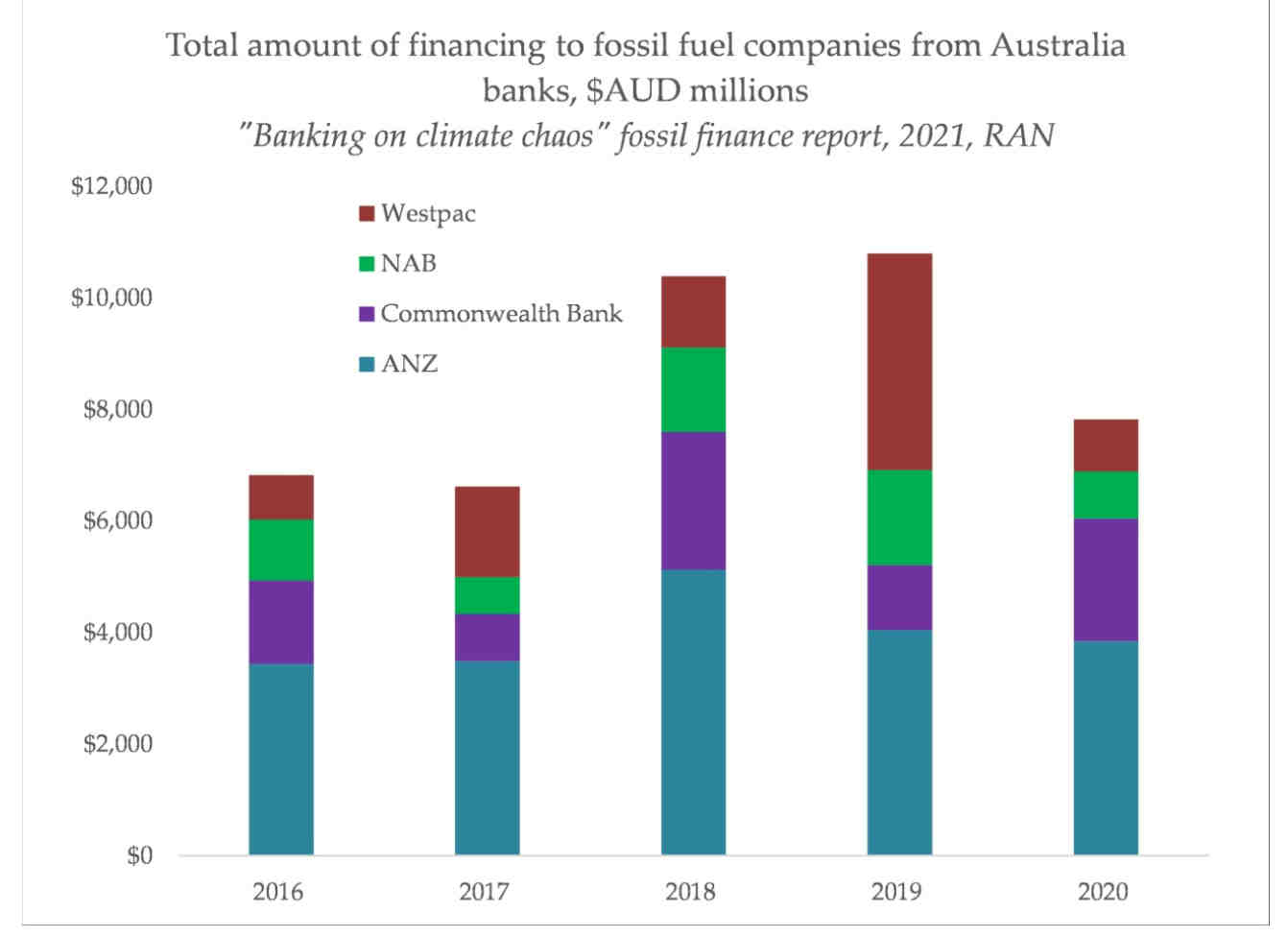

The resolution, lodged by environmental group Market Forces this week, demanded that National Australia Bank (ASX:NAB), Westpac (ASX:WBC) and ANZ (ASX:ANZ) to abide by their 2050 commitments and stop funding fossil fuel projects.

“These resolutions make crystal clear to ANZ, NAB and Westpac their commitments to net zero by 2050 are meaningless without ruling out financing the expansion of the fossil fuel industry,” said Jack Bertolus, Market Forces’ campaigns coordinator.

According to data, lending to oil and gas companies by the Big Four Banks does seem to have peaked in 2019:

Other ASX companies seem to be on board with this trend, with the latest Perennial Better Futures annual survey revealing that green house emission tops the list as the biggest area of focus for most ASX-listed companies.

Meanwhile John McMurdo, the CEO of wealth manager Australian Ethical, is convinced that restricting financing to the fossil fuel industry is crucial in averting a climate crisis.

“It’s time to end our national embarrassment when it comes to climate action and support for the fossil fuel industry,” he said.

“We should not pour money into legacy industries that don’t have credible transition plans in the hopes they change of their own volition. Starving problem industries of finance sends a far more powerful message.”

Comet Resources (ASX:CRL)

The company has just adopted an ESG framework with 21 core metrics created by the World Economic Forum (WEF). Comet says its goal is to demonstrate commitment and progress on making ESG disclosures, but more broadly, aims to progress a range of ESG benchmarks as set out by the WEF’s ESG White Paper.

Fortescue Metals (ASX:FMG)

The company has set a target to achieve net zero Scope 3 emissions by 2040. Apart from crude steel manufacturing, which accounts for 98% of its Scope 3 emissions, FMG also said it wants to reduce and ultimately eliminate emissions from its shipping partners.

Santos (ASX:STO)

The oil and gas company says it welcomes the Federal government’s release of the carbon capture and storage (CCS) method for the Emissions Reduction Fund. Santos confirmed that it will apply to register its Moomba CCS Project to generate carbon credits for the Fund. The $210 million Moomba CCS Project is one of the biggest in the world, which store s1.7 million tonnes of carbon dioxide per year in the same reservoirs that held oil and gas in place for tens of millions of years.