You might be interested in

News

The Ethical Investor: Green finance is booming and fintechs offer ESG alternatives to banks

News

The Ethical Investor: ESG taking a beating in 2022 is exactly what we need, says Janus Henderson

News

News

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Murray Ackman, Credit Anaylst at the Pendal Group.

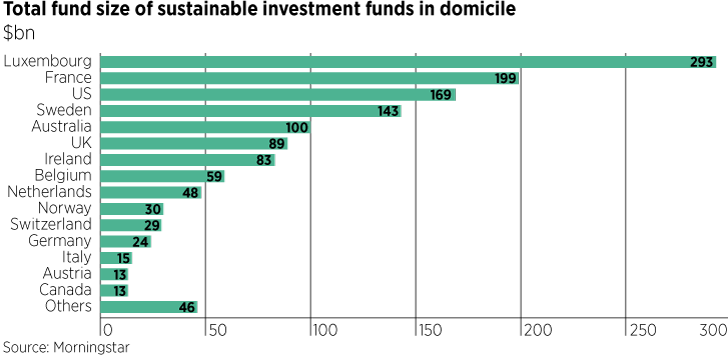

ESG assets are worth US$35 trillion and rising fast, with some predicting that could grow to US$53 trillion by 2025.

But some experts are arguing the money has failed to change the E, S, and G – and has done little to make the world a better place.

This is because most of the money is directed towards passive ESG funds, which could be problematic in tackling the very issues the funds are meant for.

According to Ken Squire, founder of institutional research service 13D Monitor, passive funds only use quantitative screenings to identify ESG companies that appear to exhibit positive ESG behaviour.

“For example, ESG funds screen for companies that have gender-diverse boards, but the analysis ends there,” Squire told CNBC.

In a quantitative-focused analysis, a diverse board that’s un-engaged will score the same ESG ranking as a diverse board that works selflessly for shareholders, and that’s a problem according to Squire.

What’s really needed is a change in mindset that forces investors to become Active ESG (AESG) investors, says Squire.

He suggested that AESG investors can truly make a difference by investing in funds that have a representative in the boardroom of the companies they invest in.

Zacks Equity Research echoes that sentiment, even going as far as to say that it was better to invest in a fossil fuel producer where you could influence the board, rather than invest in ESG companies passively.

Ackman has previously worked within the NGO sector, where he gained first-hand experience in many social projects which include training women in Bangladesh and rural India.

He joined the Pendal Group as a fixed income credit analyst, and explains to Stockhead about the rapid growth in green bonds investing.

What’s happening right now in the green bonds space?

“We’re seeing two big changes within the ESG fixed income space.

“The first is impact bonds; these are bonds that have a social or environmental outcome, while still paying coupons like a vanilla bond.”

“The credit risk for these bonds is with the issuer like the World Bank, rather than any underlying projects.”

“These bonds have grown massively, and last year we’ve just had a record year at $9bn, and this year that has doubled.”

“The second big change in the fixed income space is this new class of bonds called sustainability linked bonds.”

“They’ve been around in Australia for just six to nine months, and in Europe for maybe four years.”

“These are bonds that are tied to a particular target for the corporate.”

“So let’s say a corporate wants to reduce their emissions by X per cent by a particular time, and if they don’t make that KPI, then they have to provide an extra coupon payment on the bond, which is usually a 25 basis points step up.”

Who are issuing these bonds, and how can retail investors get in?

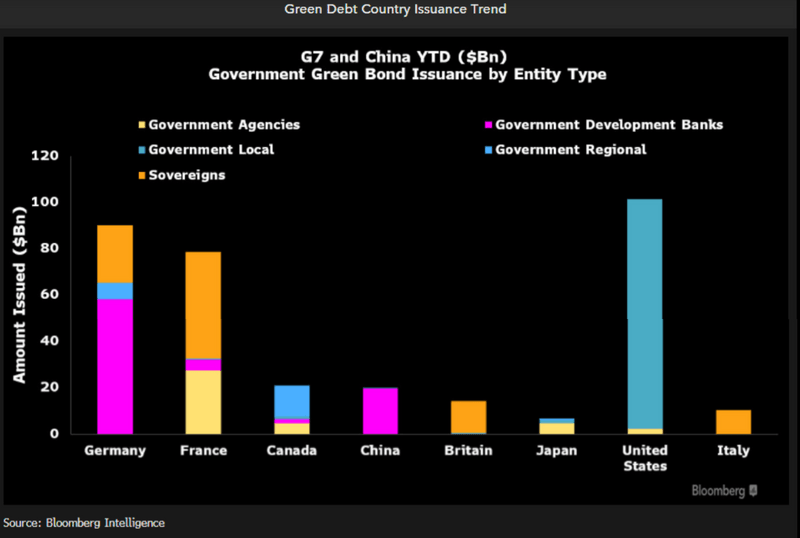

“There is a range of different issuers from financial institutions to state governments, universities, corporates, and triple A rated sovereign agencies like the Asian Development Bank, World Bank, and the Inter-American Development Bank.”

“For the sovereign agencies, donor countries guarantee them so that makes these bonds triple A rated, which is why they’re very safe to invest in.”

“The main way for retail investors to get involved is to invest into funds like the ones Pendal manages.”

“We manage two bond funds, and one of them has around 60% of its holdings in these types of impact bonds at any given time.”

“Without investing in such a fund, it’s very difficult for a retail investor to try and hold to the 40-50 bonds generally required to have that diversification.”

As a portfolio manager, how do you spot companies that are greenwashing?

“Greenwashing is a scourge.”

“The way in which we spot greenwashing is we have a rigorous process around looking at what the company is reporting, and comparing that with other databases.”

“And also having a whole bunch of in-house rules to prevent just going out on a whim and investing based on their last press release.”

“But the most important aspect is engagement.”

“We need to be happy with the underlying projects associated with the bond. We also need to be happy with the process in which they are selecting projects, and so that involves external audit as well.”

“But the fundamental thing is, we need to be satisfied with the credit quality and the ESG credentials of the the issuer.”

Two Sydney-based brothers have taken their sustainable Bitcoin mining startup all the way to the Nasdaq, making its debut last week.

Iris Energy (NASDAQ:IREN) was started by two ex-Macquarie bankers and brothers Will and Daniel Roberts, who raised $US215 million in the IPO round, valuing the Nasdaq stock at $US1.5 billion.

The company, which brands itself as a renewable energy miner, owns and mines BTC from its 30MW data centre project in Britisih Columbia, Canada.

The data centre sits next to large renewable energy plants that use hydroelectricity.

Iris said its operations aren’t affecting load on the the local grids because the data centres could be turned off during peak hours, and turned on again when electricity demand is low.

The data centres are also geographically flexible, allowing the company to locate operations in areas where there is excess generation and/or grid constraints.

Iris is already profitable, with US$6m EBITDA banked in the last quarter, but its stock price has sunk from US$28 to US$20 since listing.

Despite the lackluster stock price performance, the company has gained a huge amount of interest from investors for its ESG credentials.

Woodside Petroleum (ASX:WPL) and BHP (ASX:BHP) have signed off on one of Australia’s biggest resources projects in a decade, approving the US$12 billion Scarborough LNG project yesterday.

The announcement came as BHP and Woodside formalised their plans to merge BHP’s petroleum business with Woodside to create a $40 billion Australian oil and gas behemoth.

Meridian Energy (ASX:MEZ) has agreed to sell its Australian business to a consortium of Shell Energy Operations Pty Ltd – a wholly owned subsidiary of Shell and Infrastructure Capital Group (ICG) — for $729 million.

The deal will see Shell become the owner of the retail business Powershop Australia, while ICG is set to become the owner of the infrastructure assets (Mt Mercer and Mt Millar wind farms, Hume, Burrinjuck, and Keepit hydro power stations and development assets).

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article